Nassim Nicholas Taleb, author of Black Swan, Antifragile, Skin in the Game, has identified a weak point that makes Bitcoin and altcoins fragile.

Black Swan author identifies weakest spot in Bitcoin market

Nicholas Taleb expressed his concerns about the cryptocurrency market on Twitter today. Taleb pointed to the “broken bell” effect, which threatens to collapse as the market’s biggest weakness. Currently, the total value of the crypto market is $1.23 trillion, according to CoinGecko. However, Taleb argues that even if market participants only sell between 1% and 4%, this will cause the market’s value to drop by 50%.

Taleb warns that in this case, other cryptocurrencies may lose value when Bitcoin falls.

Cryptos are "worth" $1.5 T. But try to sell 1% to 4% of that and the value would go down by half.

— Nassim Nicholas Taleb (@nntaleb) May 6, 2023

Despite Bitcoin showing bullish signs, investors remain bearish

Bitcoin’s rising price has sparked a great deal of speculation among the crypto community. While some traders are skeptical about rising BTC prices, some data indicates that it will rise even more.

According to Delphi Digital, the 75% increase that Bitcoin has witnessed in the last few months is an indication that global markets have entered a new liquidity cycle. A new global liquidity cycle denotes a period of significant increase in the availability of money and credit in the global financial system.

This is due to factors such as central bank policies, government stimulus programs and increased investor confidence. If the market enters the new global liquidity cycle, this will have a potentially positive impact on BTC. This is because increased liquidity and credit availability boosts demand for BTC, supporting the price increase.

Positive signals for BTC bulls

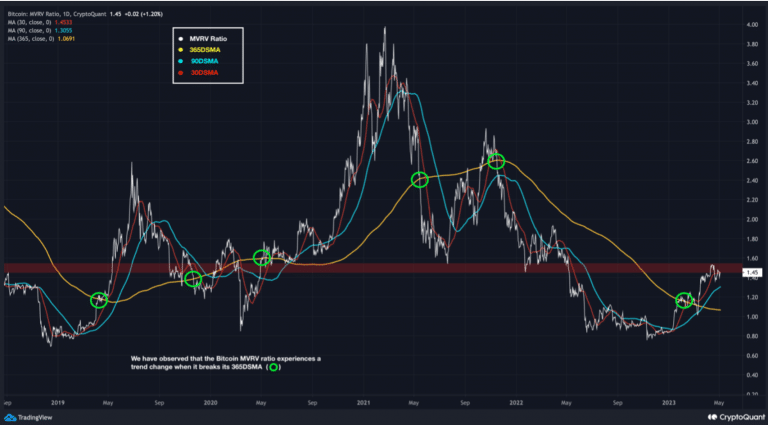

A positive indicator for BTC was the MVRV rate. According to data provided by CryptoQuant, there is a possibility for BTC to enter another bull run. In January 2023, the MVRV rate for Bitcoin broke the 1.5 level, which marked the start of the bull market. The MVRV rate currently fluctuates between 1.55 and 1.45. However, major investors are watching the data closely to buy Bitcoin at a discount during the dips.

The analysis also showed that 365DSMA should be considered. The MVRV ratio breaks it to signal a trend change. If Bitcoin’s MVRV rate breaks 1.5 again, it will likely slide to a range of values between 1.8 and 2, i.e. if the BTC price reaches $30,000.

cryptocoin.com As you follow, BTC price is currently consolidating below $29,000. According to Demirors, CoinShares’ chief strategy officer, its price will depend on these two catalysts.