A new research report from South Korean cryptocurrency exchange Korbit analyzes when the Bitcoin bear market will reverse. According to the forecasts of the experts, the bulls will be on the scene again in the medium term.

South Korean experts pointed to this date for the Bitcoin bull

A new study has suggested that the total value of the crypto market will grow from around $800 billion to $1.5 trillion next year. Experts claim that it will whet its appetite for the Bitcoin and altcoin market in the “first half of next year”. They suggested that “stabilizing” inflation figures as the catalyst for this rally would attract investors back to the market.

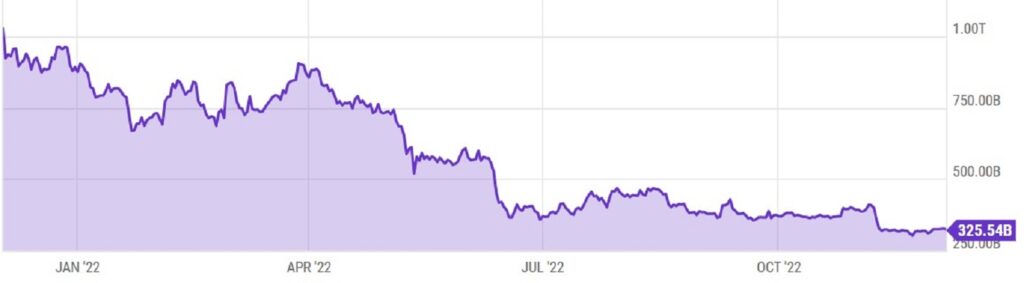

The bull predictions came from a new research report from South Korean cryptocurrency exchange Korbit. The study titled “2023 Cryptoasset Market Prospect Report” analyzes how the market will peak again next year. Currently, Bitcoin’s market cap is down over 65% from a year ago. But experts remain optimistic about the recovery.

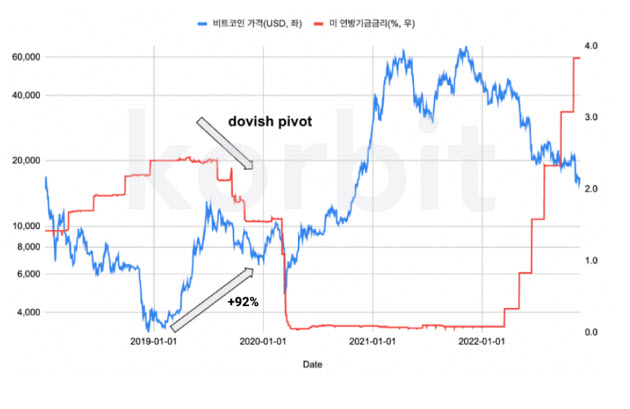

Korbit researchers have suggested that central banks like the Fed are “strengthening their aversion to risky markets.” However, they showed signs that the Fed will step back from its 2022 policies next year. Researchers also expect 2023 to be similar to 2019. This was a time when the crypto market started to gradually recover after the icy crypto winter of 2018. One of the report’s lead researchers says:

Investors generally think that the 2018 crypto crash continues into 2019. But actually the Bitcoin price recovery in 2019 reached 92%.

Fed will play an active role in the bull

Korbit researchers noted that in early 2019, the Fed’s policies stopped the central bank from raising a series of interest rates. This led to a “pigeon axis” in Bitcoin prices in September of the same year. According to experts, the Fed’s reluctance to actually raise interest rates could lead to a similar rally next year.

Researchers also include the following projections for 2023:

- Adoption will increase. Mainstream firms will begin to examine not only BTC options, but also Ethereum (ETH) adoption proposals.

- Synergy between stablecoins, DeFi industry and traditional financial institutions will increase

- Tether (USDT), USD Coin (USDC) and BUSD “will compete fiercely for supremacy” as stablecoins compete to become “the next dollar”

Pay attention to these developments that may cause “volatility” in 2023.

cryptocoin.com As you follow, 2022 saw high profile bankruptcies like Terra and FTX. While Terra remains relatively submerged, the effects of FTX are expected to remain on the market for a long time. Accordingly, Korbit analysts say that the following developments will have an impact on volatility in the new year.

- New regulations implemented globally following the FTX collapse

- New concerns about centralized exchanges again due to FTX drop and fallout

- Ruling on the legal battle between the U.S. Securities and Exchange Commission (SEC) and Ripple

- The success or failure of American progressive crypto regulation spearheaded by Wyoming Senator Cynthia Lummis