Former BitMEX CEO and market analyst Arthur Hayes has set the date for the next Bitcoin bull in his latest statements.

Arthur Hayes gave Bitcoin investors a year

The famous forecaster shared his predictions for the next bull market on his Youtube channel ‘What Bitcoin Did’ yesterday. Hayes says investors will have to wait until 2023 ends.

“I don’t think we’re going to hit $70,000 this year. I think next year, when we overcome this resistance, we will reach the top later. Then there will be 2025, 2026 and then Armageddon.” Hayes here points to Bitcoin’s halving event in 2024. BTC price often moves around these cycles.

Meanwhile, Hayes’ prominent statement was that we’ll see Armageddon after 2024. As for his comment on Armageddon, he explained that he was talking more of a social change, like a major war. He pointed to quantitative relaxation and social discontent as two factors that would lead to such an event.

Hayes says, “It doesn’t have to be so simple. We just have this situation. “There’s too much money, there’s no trust, and there are people trying to make a living,” he said. He added that in this scenario, Bitcoin will also fall.

US debt ceiling debate continues

Hayes says that the issue of the US debt ceiling will be resolved after the usual round-trips. But he argued that financial disruption events usually occur in the fall, arguing that its timing could cause market fluctuations. According to their description:

There are trillions of dollars in debt with the banking crisis and the federal government having to finance themselves. Basically 3/4 of this year. You’re putting together a powder keg of a situation that will explode in Q4, and if so why I think it could ultimately be pretty good for Bitcoin. It will be quite volatile up and down.

As for Hayes’ own investment strategy during this period, he noted that Maelstrom has been playing some games with ETH staking and has been closely examining the emergence of NFTs in Bitcoin, known as Ordinals.

Bitcoin investor confidence falls

CryptoQuant analyst Tomáš Hančar published an analysis on May 25 revealing that currency deposit transaction numbers broke a 6-year low earlier this month. According to the analyst, the likely reason behind this was the effects of November’s collapsed FTX.

Another CryptoQuant analyst, Gigisulivan, has published an analysis suggesting that the price of BTC could drop further. He used the spent output age groups metric to indicate an increase in activity in the 3-5 year olds in recent weeks. The metric was at its highest level since early January when it preceded a stronger move in the following weeks.

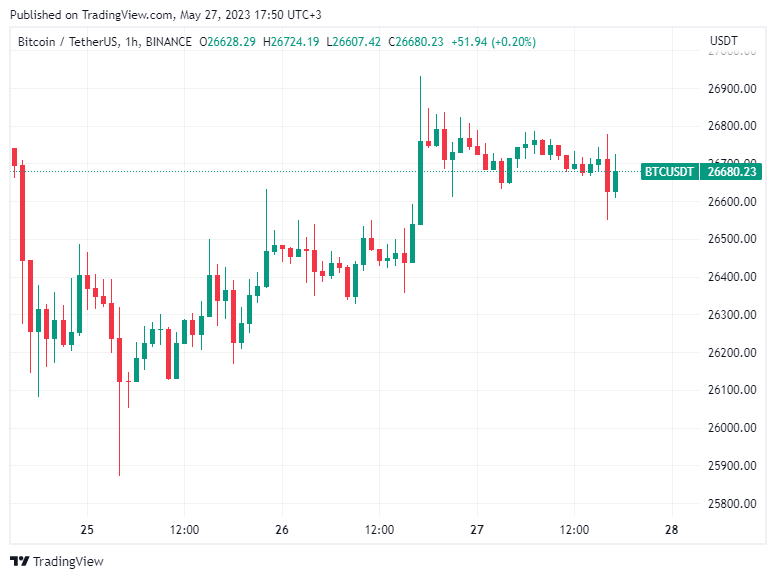

According to Gigisulivan, this is an early warning signal for more downtrends as BTC drops below $27,000.

cryptocoin.comAs we covered in their analysis, other analysts agree on a pessimistic future.