On June 14, discussions of altcoin Celsius continued to fill media headlines. The news on June 14 included the platform’s CEL token making huge gains after what appeared to be a stock market glitch or short-term nuisance. CEL price rose from $0.18 to $1.55 in a spike. It then fell back to $0.60 within the same one-hour candle.

Altcoin Celsius sells Dai (DAI): Escape from bankruptcy?

Currently, analysts are worried about the cause of the explosive price breakout. Some cite Celsius’ repayment of some of its debts, while others cite a possible error in the FTX exchange as the reason for the short squeeze. As Kriptokoin.com previously reported, Celsius is struggling to pay off a number of debts. It is possible that some investors may see this as a sign that the platform can survive the current turmoil.

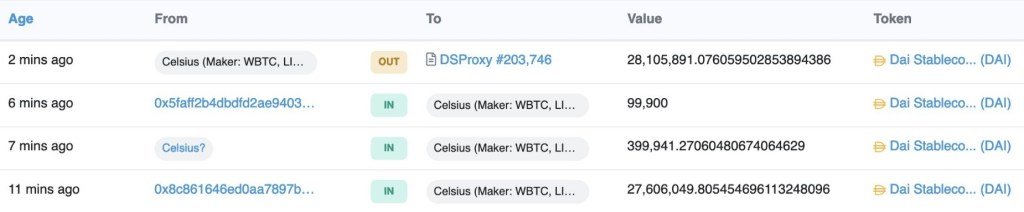

Twitter analyst Hsaka stated that on chain data was recently deposited with $28 million in Dai (DAI) into a Celsius-controlled wallet. He said he’s since shown it was sent to a separate address he identified as the debt repayment address. Analysts believe Celsius’s strategy is to lower the liquidation price on the MakerDAO vaults it holds and ultimately avoid bankruptcy.

UI issues in FTX

The initiation of debt repayment helped give Celsius more confidence. However, several crypto traders reported having problems trying to buy and sell tokens on the FTX exchange. Several replies to the tweet confirmed user difficulties when trying to sell CELs on FTX. Twitter user Karl Larsen said they could “fill short positions at just 0.87-0.95.”

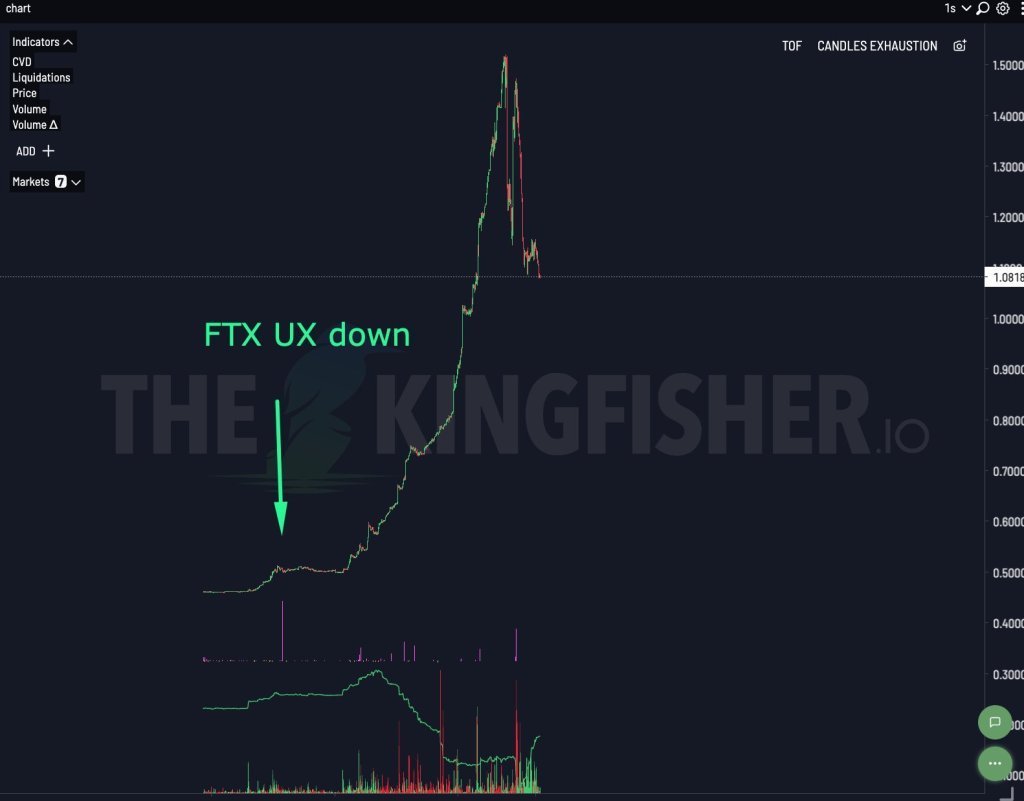

The possibility that UI challenges in FTX may have played a role in the rapid rise of CEL, by analytics provider TheKingFisher, who published the graph below highlighting when the UI declines relative to when the CEL price rises. was also noted. According to TheKingfisher, when UX fell, “most traders were unable to hedge. He could not close [or] reduce his positions.” Therefore, it shows what happened in FTX as manipulations to liquidate users.

Just another short squeeze?

Some analysts say the price breakout is nothing more than an old-fashioned short-term squeeze, as Saleem Lala points out. We’ll see what happens with the price of CEL moving forward. The most likely culprit appears to be a gradual purge. This is because such events are relatively common during strong market volatility. For example, Chain (XCN) token suffered a similar event on June 14 as its price dropped 95 percent due to gradual liquidations.

Bigger play was to liquidate $CEL shorts on perps.

Funding was super high, over 2500% annualized, meaning lot of people were short.Prices didn't move much on the perps, meaning there weren't natural buys, but liquidations mostly as the mark price went up pic.twitter.com/GCeJNma6IF

— Saleem Lala (@saleemlala) June 14, 2022