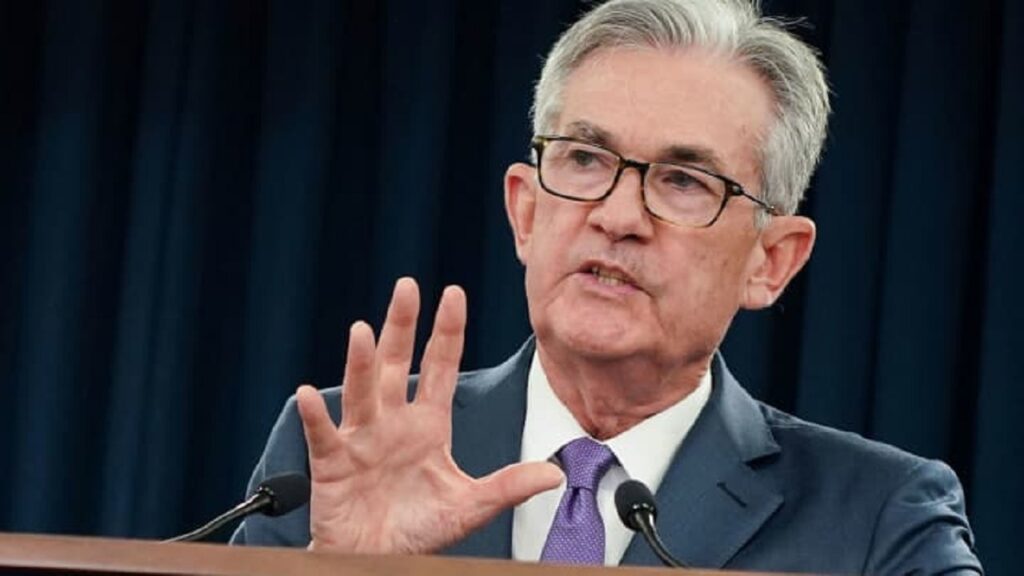

Fed Chairman Jerome Powell used the term ‘money’ for these altcoins in his speech today before the US House of Representatives Financial Services Committee. Powell’s admission contradicts the disdain for cryptocurrencies by others at the highest echelons of the federal government.

Jerome Powell : These altcoins are real money!

Federal Reserve Chairman Jerome Powell has openly acknowledged that stablecoins are a form of money. He made this bold confession Wednesday during his comments during the semi-annual meeting of the U.S. House of Representatives Financial Services Committee on monetary policy. Powell’s statements surprised many. Especially given the tough stance of his colleagues in government towards cryptocurrencies and stablecoins in particular. The Securities and Exchange Commission (SEC) is waging an escalating war against almost all cryptocurrencies. It classifies them as securities that must come under full SEC control.

“We see stablecoins as a form of money,” Powell said on Wednesday. This confession sparked astonishing reactions among crypto and finance commentators. In a regulatory environment where current and former SEC personnel routinely attack crypto as a fraud and pyramid scheme, Powell made an iconoclastic note. It contradicted recent statements by SEC chairman Gary Gensler and others. Last month, former SEC official John Reed Stark called stablecoin Tether the “mammoth house of cards.”

Largest stablecoins by market cap / Source: CoinMarketCap

Largest stablecoins by market cap / Source: CoinMarketCapPowell contradicts other US officials

Stark, the former chief of the SEC’s Internet Enforcement division, said he believes the stablecoin could be “the next domino to fall.” Powell was quick to characterize his confession. He openly said that the crypto market will never usurp the role of his own agency, the Fed, in setting interest rates and other financial policies. He balanced his confession about the stablecoin by saying that the Fed will always be “the main source of confidence behind money.” In this context, Powell made the following statement:

Stablecoins essentially borrow this trust from the underlying issuer, and in most cases they are dollar stablecoins. So they really borrow that trust.

The Fed Chairman called these altcoins special forms of currency. Powell added that these currencies could lose value if their reserves do not contain enough high-quality assets. Powell suggested that regulation can and should come into play here.

Stablecoins as a hedge

cryptocoin.com As we report, Jerome Powell’s comments have at least implicitly acknowledged the value of crypto as a hedge against volatility and rising inflation. Powell put his words in the context of statements that describe inflation as a serious and chronic problem. In this regard, the Fed Chairman underlined the following:

The Fed’s monetary policy actions are driven by our mandate to promote maximum employment and stable prices for the American people. My colleagues and I are acutely aware that high inflation creates difficulties by eroding purchasing power.

This is especially true for those who find it difficult to meet their basic needs. Jerome Powell drew attention to basic needs such as housing, food and transportation. In addition, Powell said he and his colleagues share their commitment to reducing inflation. He noted that currently the target rate is 2%. Powell used the following statements in his speech:

We have increased our policy rate by five percentage points since the beginning of last year. We see the effects of our tightening policy and demand in the sectors of the economy that are most sensitive to interest rates. The economy faces headwinds from tighter credit conditions for households and businesses…These are likely to put pressure on economic activity, hiring and inflation. The extent of these effects remains unclear.

So the committee’s decision to keep the federal funds rate between 5% and 5.25% today is likely a short-term measure. Given macro trends, Powell said new increases are on the way in the near future. “Almost all committee participants think it would be appropriate to raise interest rates a little bit more by the end of the year,” Powell said.