Battered bitcoin (BTC) bulls eagerly await the Federal Reserve (Fed) to move away from the ongoing liquidity tightening and offer a lifeline to risk assets. However, the so-called Fed pivot in favor of easing may not bring immediate relief to the crypto market.

That’s the message from the S&P 500’s historical data, which shows Wall Street’s equity index, a benchmark for risk assets worldwide, bottoms out several months after the Fed kicks off the easing cycle with an interest rate cut.

Bitcoin tends to move more or less with the sentiment on Wall Street. The Fed has raised rates by 300 basis points this year, wrecking havoc for risk assets.

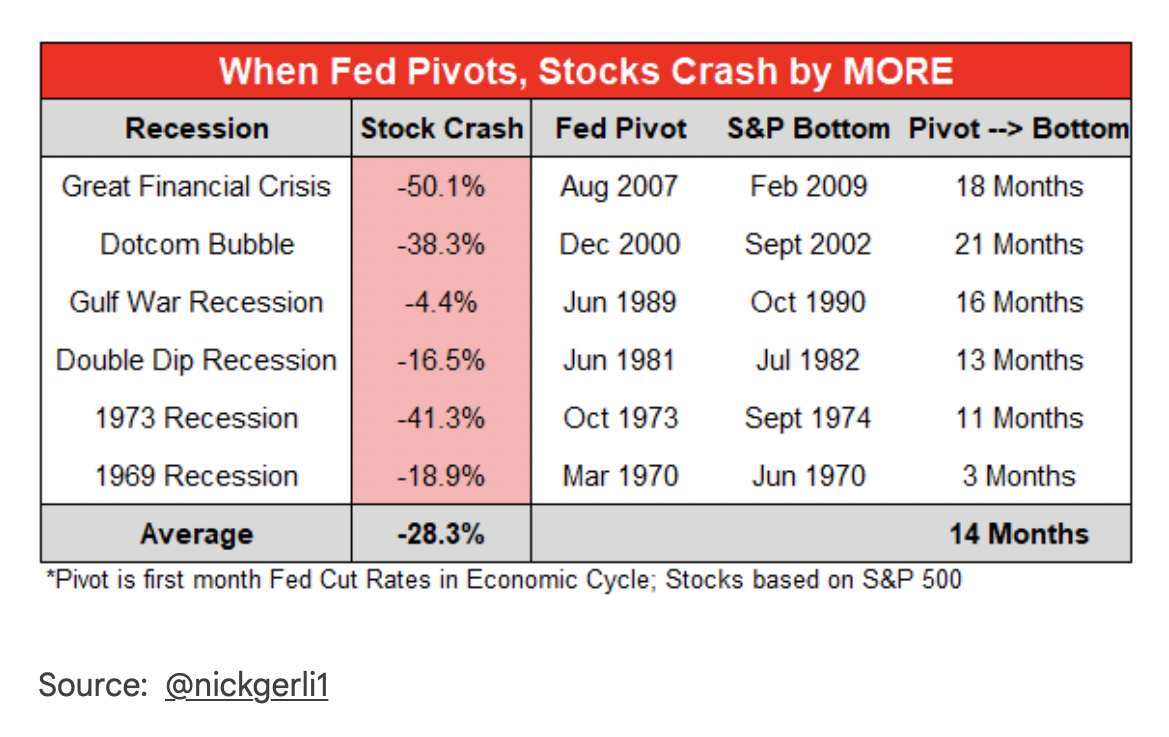

Stocks extend losses when the Fed pivots and find bottom several months later. (Nick Gerli/Reventure Consulting) (Nick Gerli)

The U.S. saw six economic recessions between 1969 and 2007.

In each case, stocks extended losses, falling by an average of 28%, after the Fed cut rates to stimulate the economy, according to data tweeted by Nick Gerli, CEO and founder of Reventure Consulting.

After the Fed pivot, the average time taken to bottom out was 14 months.

“Few are asking, ‘what happens if pivot?’ – perhaps a better question is: when sustainable bottom? In other words, this is not March 2020; a recessionary bear market takes longer to bottom; among other things, the economy needs to actually bottom for the market to bottom,” Callum Thomas, head of research and founder at Topdown Charts, wrote in the latest edition of Weekly S&P500 ChartStorm, commenting on data shared by Gerli.

“Just like Fed rate hikes take time to pile up and inflict economic damage, a pivot to easing will take time to filter through, too,” Thomas added.