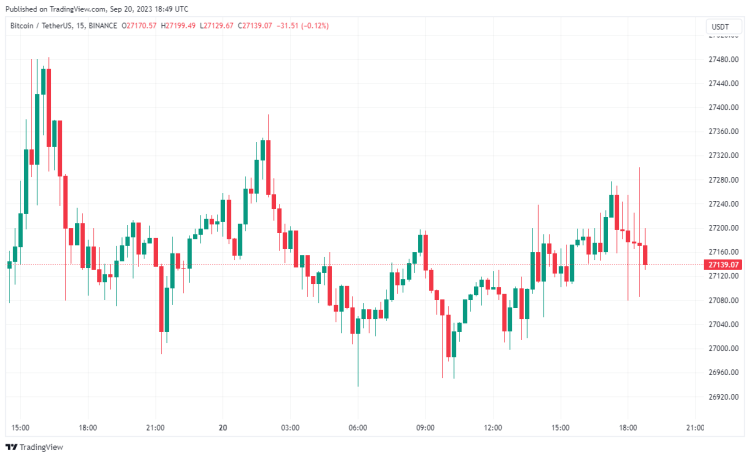

The US Federal Reserve’s Federal Open Market Committee (FOMC) left interest rates steady at 5.25-5.50 percent on Wednesday, as expected. Following this decision, the price of Bitcoin (BTC) stabilized at $ 27,200.

How did Bitcoin price react after the FED decision?

The FOMC’s interest rate decision was awaited with great curiosity by the markets. Following the decision, Bitcoin price did not show any major changes and stabilized at $27,200. The FED plans to keep interest rates between 4.9-5.6 percent for next year. This is a higher rate than the estimate of 4.3 percent in June. It also revised its economic growth expectation for this year to 2.1 percent, compared to 1 percent in June.

FED President speaks

cryptokoin.com As we reported, Jerome Powell is currently answering questions. His prominent statements at the time of writing are as follows:

“As the FOMC, we are determined to increase inflation to 2%. We still have a long way to go in this process, but the majority of policy makers believe that a new interest rate increase would be appropriate. We acted quickly on interest rate increases last year. “This year we have a chance to move slower and wait for the data.”

Stating that inflation is well above the target and causing serious problems, the President said: “We are determined to achieve and maintain a sufficiently restrictive policy to reduce inflation to 2% over time. “Long-term inflation expectations are well balanced.”

Stating that a unanimous decision was taken at the meeting to maintain the current policy stance, Powell said, “The current policy stance is restrictive. FOMC will continue to make decisions meeting by meeting. “We are ready to raise interest rates further if appropriate,” he said.

Pointing out that the FED’s high interest policy puts pressure on business investments, Powell continued: “The FED has come a long way, but the full effects have not yet been felt. Nominal wage growth showed some signs of easing.”

FED President: “Consumer spending is quite strong. “Rebalancing in the labor market is expected to continue,” he said, adding: “FED forecasts are not a plan, policy will be adjusted depending on the situation. The fact that we decided to keep the policy rate constant does not mean that we have reached the policy stance we wanted or not. “We want to see convincing evidence that we have reached the appropriate level.”

What’s next for BTC?

Crypto and macro analyst Noelle Acheson stated that the interest rate projection for 2024 is a huge signal. “This is higher than I expected,” Acheson said. The market was hoping that interest rate cuts would occur sooner. However, the FED took this possibility off the table.”

Bitcoin investors and followers are carefully waiting for the press conference that FED President Jerome Powell will hold at 2.30 today. Powell is expected to give more details about the interest rate decision and future policies.

Interest rate hike expected at November FOMC meeting

The FOMC observed that inflation in the economy remained high and the unemployment rate remained low. Overall, Fed staff has said it prioritizes reducing inflation to its 2% target over time. The CME FedWatch Tool, which measures market sentiment regarding the possibility of a Fed rate decision, currently shows a 36.3% chance of raising the interest rate to a range of 5.50-5.75% at the November FOMC meeting.