Bitcoin (BTC), the world’s biggest cryptocurrency by market value and a macro asset that closely tracks the U.S. dollar liquidity metrics, has seen a resurgence this year, with prices rising 70% since Jan. 1.

The rally may run into a temporary roadblock if Federal Reserve (Fed) chairman Jerome Powell refrains from signaling a highly-anticipated pause to the tightening cycle on Wednesday, according to some observers.

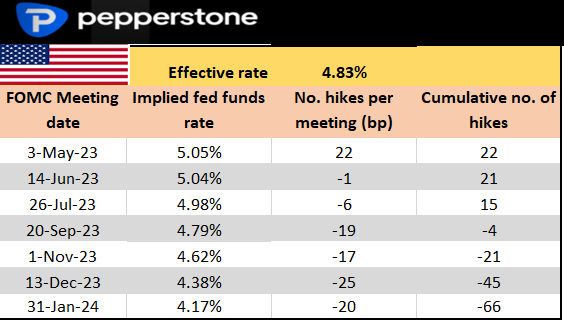

The Fed will announce its interest rate decision on Wednesday at 14:00 ET (18:00 UTC). Half an hour later, Powell will speak at the post-meeting press conference. The Fed funds futures show traders expect the central bank to raise rates one final time by 25 basis points to the 5%-5.25% range, ending the so-called tightening cycle that roiled cryptocurrencies last year. Further, traders are pricing rate cuts starting in July.

Dovish expectations have strengthened as multiple uncertainties have recently risen in the form of the debt ceiling, recession fears, crisis at regional banks and bearish speculative fervor in banking stocks.

The aggressive pricing of pause and rate cuts means Powell needs to confirm the same during his presser, or else the Treasury yields and the U.S. dollar (USD) may bounce. An uptick in yields and the dollar has historically been bearish for bitcoin.

“As the market is expecting a pause after this hike, we’ll be looking for the sentence on ‘additional policy firming may be appropriate’ to be removed from the statement, replaced by more open-ended language leaving the door open for either more rate hikes or a pause, i.e., data-dependency,” Dick Lo, the founder and CEO of quant-driven crypto trading firm TDX Strategies, told CoinDesk.

“We expect that Chair Powell may shy away from being definitive when it comes to a pause which may disappoint the market,” Lo added.

Markets have seen a classic risk-on action since October 2022, mainly anticipating a dovish Fed pivot. The dollar index, which gauges the greenback’s value against major fiat currencies, has declined by over 14% since early October. Meanwhile, Wall Street’s tech-heavy Nasdaq index and bitcoin have rallied 25% and 50% over the same period.

Thus, the lack of conviction from Powell in signaling the pivot may disappoint markets, as Lo warned, triggering a recovery in the greenback.

Chris Weston, head of research at foreign-exchange brokerage Pepperstone, voiced a similar opinion on Twitter.

“Sure, bank equity has been hit – but with nothing priced for June and cuts starting in July, if the Fed offers a lazy tightening bias (data dependent), it feels the risk [is] skewed on the hawkish side,” Weston said.

Traders see the Fed cutting rates from July. (Pepperstone/Fed funds futures) (Pepperstone/Fed funds futures)

Weston said that the pre-Fed dovish pricing is similar to the setup seen before the Reserve Bank of Australia’s recent rate decision. The RBA on Monday lifted rates by 25 basis points and warned of more tightening ahead, contradicting expectations for a continued pause and eventual easing later this year. The hawkish surprise saw the Aussie dollar surge across the board.

According to Weston, the post-meeting bounce in yields and the dollar, if any, could add to banking sector woes and will likely be short-lived. Bitcoin has performed positively during the recent banking turmoil, strengthening its safe-haven appeal.

“I would assume this initial move [higher in USD] would be short-lived as any decent spike in bond yields would see bank equity take another leg lower and traders would simply reapply USD and crude shorts and buy gold and JPY as a hedge,” Weston noted.

Some observers, however, do not foresee a sustained dollar rally, irrespective of what Powell says at the post-meeting press conference.

“The U.S. dollar is unlikely to rally here as the expectations for an eventual dovish pivot by the Fed will be kept alive – no matter if the Fed hikes again or signals another hike,” Markus Thielen, head of research and strategy at crypto services provider Matrixport said.

Recommended for you:

- Blur Reportedly Finds Loophole in OpenSea’s Blocklist as Marketplace War Escalates

- Winklevoss Twins Lent Their Crypto Platform Gemini $100M: Bloomberg

- Diana Biggs: Building Early-Stage Ventures in Web3

“The stress is the banking sector is deflationary and energy costs have declined materially. The Fed is also seeing progress in their request for a higher unemployment rate and this should provide comfort that rate hikes are coming to an end. Bitcoin is likely to rally on a dovish pivot,” Thielen added.