Federal Reserve Vice President Michael Barr talks about the need to regulate stablecoins in the United States. These altcoins, the largest of which is Tether (USDT), are cryptocurrencies that are usually indexed to the dollar. The Fed is now pushing to bring these cryptocurrencies under regulation.

“ Stablecoins need to meet fundamental principles.”

cryptocoin.com As you follow from , stablecoins continue to remain in the spotlight of regulators. In a recent statement, Michael Barr, the Federal Reserve’s deputy chairman for supervision, spoke about stablecoins, Federal Reserve Digital Currencies (CBDCs), and some other aspects of the need for Federal oversight. According to Barr, these altcoins must meet the basic principles of payment systems in the US. The Federal Reserve has an important role as controller and payment operator.

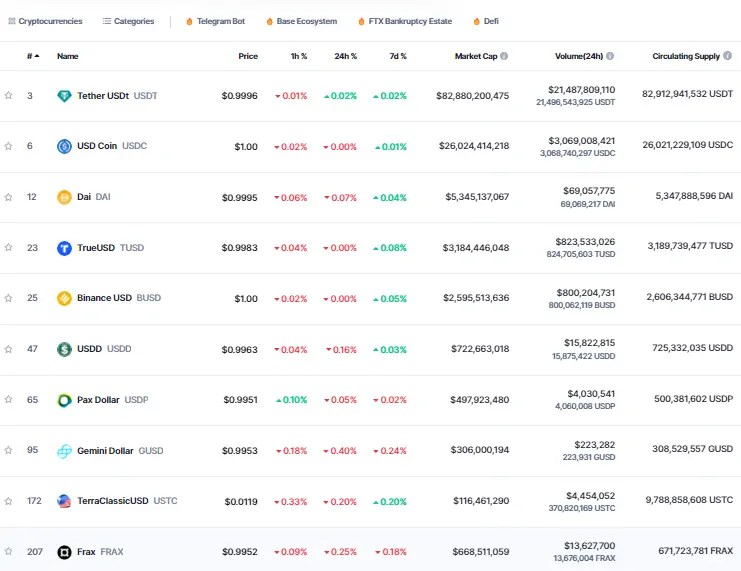

Top 10 stablecoins by market cap. Source: CoinMarketCap

Top 10 stablecoins by market cap. Source: CoinMarketCapIn his statement, Michael Barr talks about ongoing innovations in the financial industry. However, he emphasizes the importance of ensuring the continued security and efficiency of US payment systems. The Vice Chairman of the Federal Reserve also shares his views on the potential of CBDCs. In this vein, Barr cites the Fed’s active efforts to implement it for centrally tracked altcoins. However, he also makes it clear that the feds have yet to decide on the issuance of CBDCs. Issuing CBDCs will require support from the executive branch and congressional authority.

Fed Vice Chairman is concerned about these altcoins!

Speaking about stablecoins, Barr emphasizes that he remains concerned about these altcoins without strong Federal oversight. Michael Barr underlines the following points in his speech:

When an asset is pegged to a government-issued currency, it is a type of private money. When this asset is used as a means of payment and a store of value at the same time, it borrows the trust of the central bank.

These altcoins can pose significant risks!

According to Michael Barr, the Federal Reserve previously issued guidance on the process for Fed-supervised banks to request no objections before dealing in “dollar tokens.” The guidance calls for banks to have appropriate risk management systems and cybersecurity measures in place. It also aims to provide clarity for banks dealing with stablecoins. In this context, Barr makes the following statement:

If non-federally regulated stablecoins become a widespread means of payment and store of value, they could pose significant risks to financial stability, monetary policy, and the U.S. payment system.

Finally, Barr states that the Fed will continue to explore new technologies to improve payment systems. It also involves ongoing review of ledger technology, he says.