A widely followed cadre of analysts, including experts like Cantering Clark and Smart Contracter, has mixed thoughts about Fetch.ai (FET), which has cooled its rally it launched in January.

Fetch.ai (FET) led the first trend of 2023

Artificial intelligence project Fetch.ai lost $0.45 support today after its rally since January. But the AI coin trend remains strong and there are analysts who expect FET to pick up momentum and quickly make up for its recent losses. The data shows that the FET/USD pair has stayed up 70% over the past 30 days.

What are analysts saying about FET amid ongoing AI trend?

AI-related cryptocurrencies have outperformed their rivals in recent weeks, especially after global tech giants Microsoft and Google poured resources into the industry backed by massive hype around OpenAI’s Chat GPT.

So, could the bulls have lost their appetite for the AI coin market? According to crypto analyst and trader Cantering Clark, this is highly unlikely. In particular, the analyst says FET may yet see a new foothold as AI remains one of the hottest trends in the market:

I’m not sure the AI bull is over completely. The FET doesn’t appear to be in the dissipation phase, but rather ready for another run towards the highs at the minimum. Personally, of all crypto trends, artificial intelligence was the most attractive.

https://twitter.com/CanteringClark/status/1630958522392272897

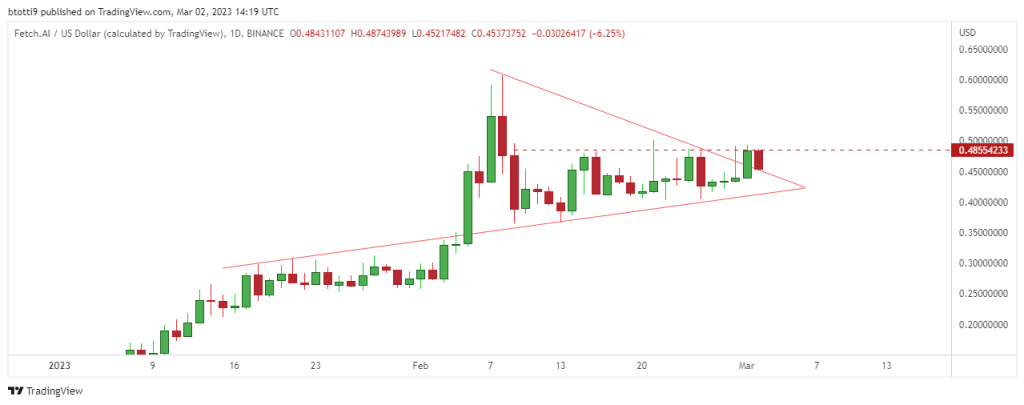

FET is preparing to break a triangle formation on the daily chart to the upside. The bulls still faced stiff resistance just above $0.48. While there is the possibility of a distribution move, another analyst, Altcoin Sherpa, also thinks the uptrend is the more likely trajectory:

The FET doesn’t look to me like it’s in the distribution phase right now. Maybe if BTC plays well, it can continue to rise.

96% of Fetch.ai (FET) investors are in profit

The data also shows that over 96% of FET investors are making substantial profits after recent gains as more people want to buy FETs. Having so many addresses that make a profit can lead to potential selling pressure, while IntoTheBlock’s entry/exit metric shows that around 99% are long-term investors. Only 1% of investors who bought FETs were in the last 1-12 months.

Meanwhile, on-chain analytics platform Santiment also shared data for Fetch.ai showing that whale activity has increased recently. According to Santiment’s cautionary analysis, “Cardano, Maker and Fetch shined in 2023. Especially considering the FET, which has increased 5 times since January 1st. But these 3 cryptos are seeing huge spikes in whale activity, so we can expect big fluctuations.”

🐳 #Cardano, #Maker, and #Fetch have all had their moments to shine in 2023. $FET in particular, which has 5x'd since January 1st. But these 3 assets in particular have all seen steep increases in whale activity, and you can expect major swings from here. https://t.co/aLMD7PMdZ1 pic.twitter.com/LTjrHdfTWy

— Santiment (@santimentfeed) March 2, 2023

On the downside, if the sentiment in the broader market turns negative, the bears could target the critical support area around $0.38 and even push the price down to $0.29. Smart Contracter, a crypto analyst known for his accurate predictions, argues that this will be the case.

Smart Contracter expects sharp drop in FET price

The hit crypto analyst says FET can now cool off the rally it has been running since January and slide back to its local tops. cryptocoin.comIn the current technical analysis we have reported as Smart Contracter, FET expects a decrease of nearly 50% in price.