As Chainlink (LINK) continues to drop the critical local resistance level since mid-2022, traders are waiting for the next rally. Filecoin (FIL) price trend is probably still bullish and the upward move is expected to resume soon. The price action of Optimism (OP) and Phantom (FTM) tokens has been quite similar since the last quarter of 2022.

Will the next LINK rally break the 10-month record?

There is speculation that Chainlink (LINK) has long since come out of the local resistance zone with the entry of whales. While most altcoins have gained significant value since early 2023, LINK price has yet to see a real bullish scenario. The altcoin has been sitting below the local resistance zone for 10 months. Recent momentum in trading volume and whale accumulation gives hope for finally a breakout. In an interesting development earlier in the week, Chainlink whales made massive transfers, moving assets that had been dead for about eight months. Whale action is often a great signal for potential upward price action in the short term.

Despite significant rebounds in the crypto market, Chainlink continues to sidetrack with little plus. Therefore, a short rally for LINK could possibly break it past the resistance level followed by a significant price increase. Popular crypto analyst Michaël van de Poppe expects the LINK upward curve to continue and reach the $10 level. Compared to the LINK price three months ago, LINK has grown in value by about 15%. During the same period, the Bitcoin price increased by more than 50%, sending bullish signals to push altcoin prices.

Price is currently still stuck in a 300-day accumulation range.

I'm expecting this to start resolving to the upside sooner rather than later.

Depending on your risk appetite, this probably is one of the safest $ALTS out there at the moment. pic.twitter.com/2wqJobefjV

— Lenny (@TraderLenny) February 23, 2023

Filecoin (FIL) price looks set for another spike

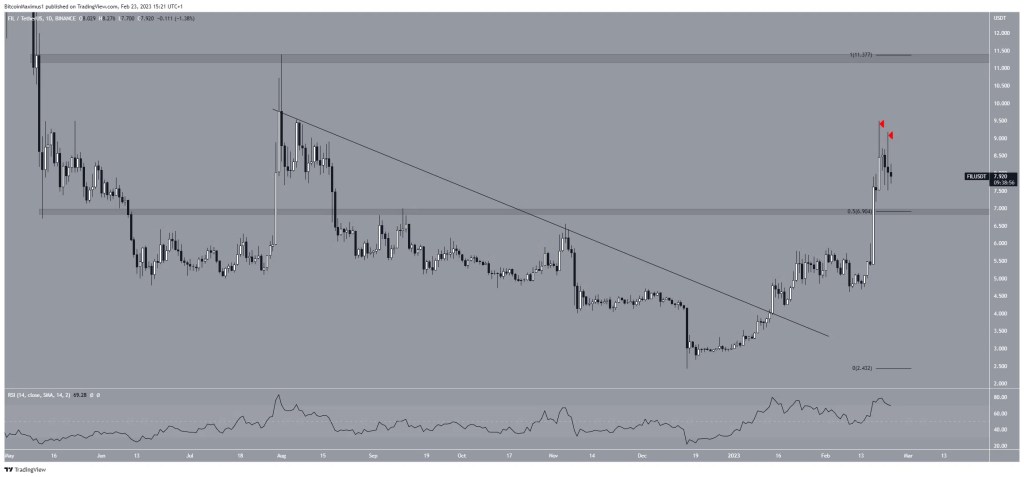

According to crypto analyst Valdrin Tahiri, the Filecoin (FIL) price trend is probably still bullish and the upward move is expected to resume soon. Filecoin price has increased since it dropped to $2.41 on Dec. 16. The up move hits as high as $9.50 on February 19, 2023. However, the price created two long upper wicks (red icon), most recently in February. 21. It has since fallen.

During the previous rise, Filecoin price broke out of a descending resistance line and then retraced the $6.90 horizontal resistance area, which was the 0.5 Fib retracement resistance level of the entire previous decline. The region is now expected to support it. While the daily RSI is overbought, it has yet to form any bearish divergence. Therefore, it is necessary to look at the lower timeframes to determine whether Filecoin price will rally towards the next resistance at $11.35 or drop to $6.90.

Filecoin daily chart / Source: TradingView

Filecoin daily chart / Source: TradingViewFilecoin (FIL) Price Has Room for Growth

The number of waves on the six-hour time frame supports the possibility of FIL price rising towards the $11.35 resistance area. If the count is correct, it indicates that the price is currently in the third wave of a five-wave upward move (black). The third wave is prolonged and the lower wave number is shown in red. Putting a 1:1.61 ratio (black) on waves 1 and 3 leads to a high near $10. Later, a correction may come before the final increase.

A drop to $6.90 will not invalidate this number as this will still be considered part of a correction. However, a close below $6.90 will invalidate it. In this case, Filecoin price is expected to decline towards the $4.50 region.

Filecoin six hour chart / Source: TradingView

Filecoin six hour chart / Source: TradingViewAs a result, the most likely Filecoin price prediction is an increase towards $11.35. While there could be a drop to $6.90 before this pump, a bullish bias is seen unless the price closes below $6.90. If it does, the bullish thesis will be invalidated and Filecoin could drop to $4.50.

DeFi and dApp development of Phantom and Optimism

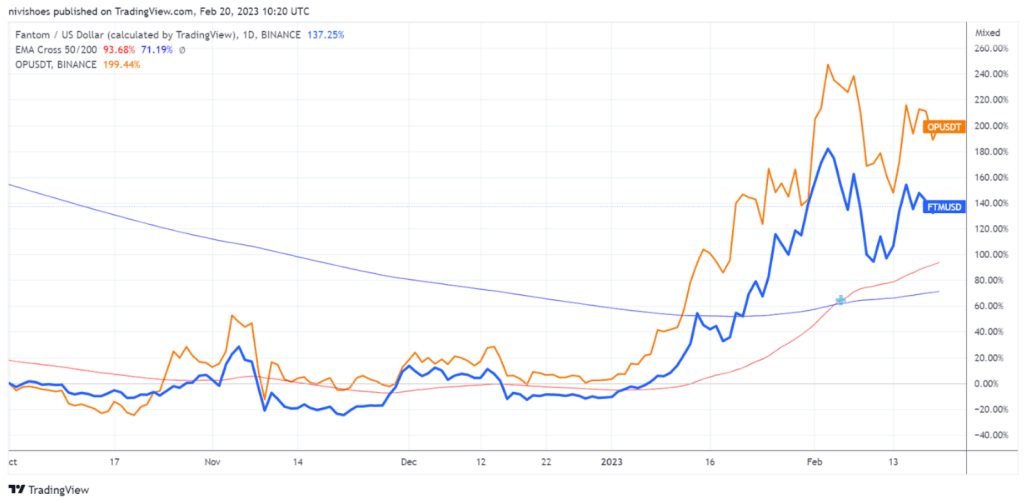

According to crypto analyst Nivesh Rustgi, despite similar price movements, the Phantom and Optimism ecosystems are moving in opposite directions, and this is reflected in the price of each token. The price action of Optimism (OP) and Phantom FTM tokens has been quite similar since the last quarter of 2022. The difference is that volatility is slightly higher for OP, which is up 240% year-over-year compared to 180% gains. Seen on FTM.

Since Q4 of 2022, the Phantom Foundation has made several improvements that have triggered an upward trend in the token price. But while Fantom’s ecosystem has remained primitive, its competitors have expanded to support new use cases. Optimism, on the other hand, demonstrated strong community and decentralized application (dApp) development thanks to the loyalty of Ethereum developers and the Optimism Foundation’s effective strategy in aligning token incentives with governance.

OP/USD (orange) and FTM/USD (blue) price chart / Source: TradingView

OP/USD (orange) and FTM/USD (blue) price chart / Source: TradingViewPhantom’s ecosystem development stops

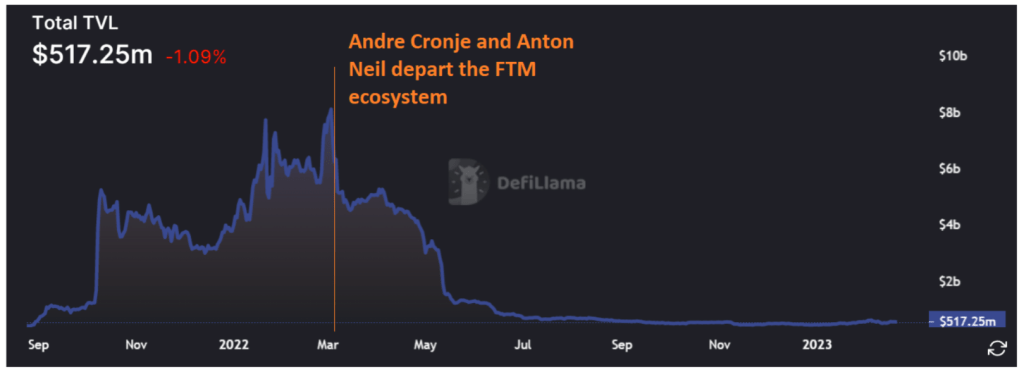

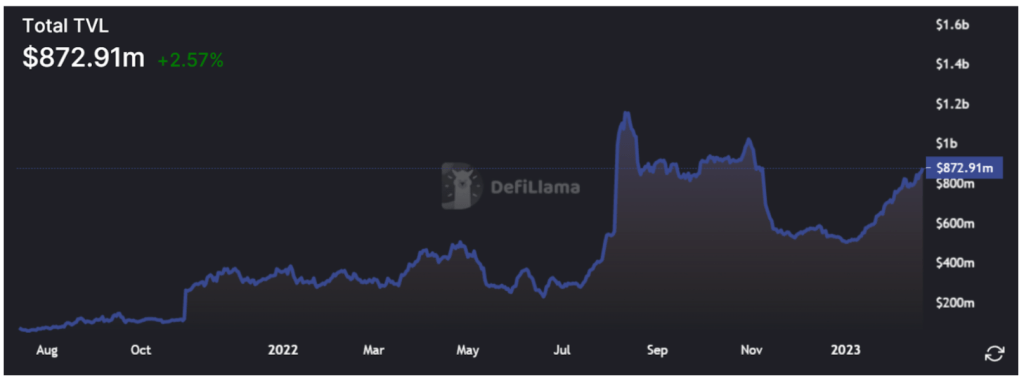

The phantom ecosystem was hit negatively by the departure of leading DeFi architect Andre Cronje in early 2022. The ecosystem development of the blockchain stalled after Cronje left. At the same time, Phantom’s competitors such as Polygon, Cosmos, Arbitrum and Optimism continued to host various popular applications. Cronje rejoined the Phantom development efforts in November 2022, but by then it seems too late. The lack of sustainable returns in the bear market restricted the flow of liquidity to Fantom.

Over Time Phantom TVL / Source: DefiLlama

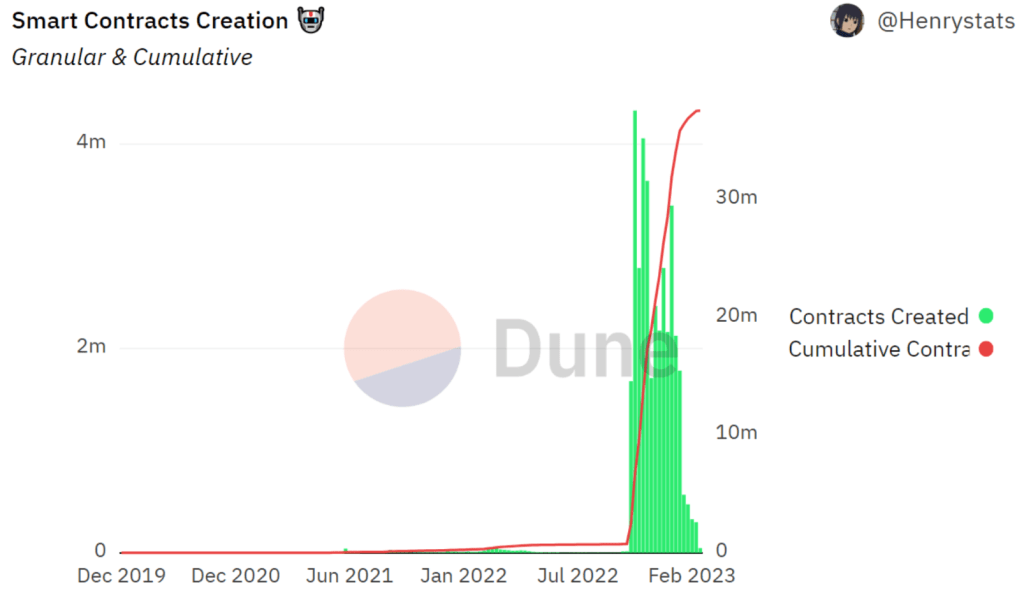

Over Time Phantom TVL / Source: DefiLlamaThe phantom community also aimed to improve the quality of decentralized applications on Blockchain through an ecosystem development fund built by reducing the share of burnt fees from 20% to 5% in December. While the number of smart contracts created on Fantom has increased significantly since the third quarter of 2022, the quality of dApps still needs to be improved compared to its competitors.

Number of smart contracts created in Fantom / Source: Dune

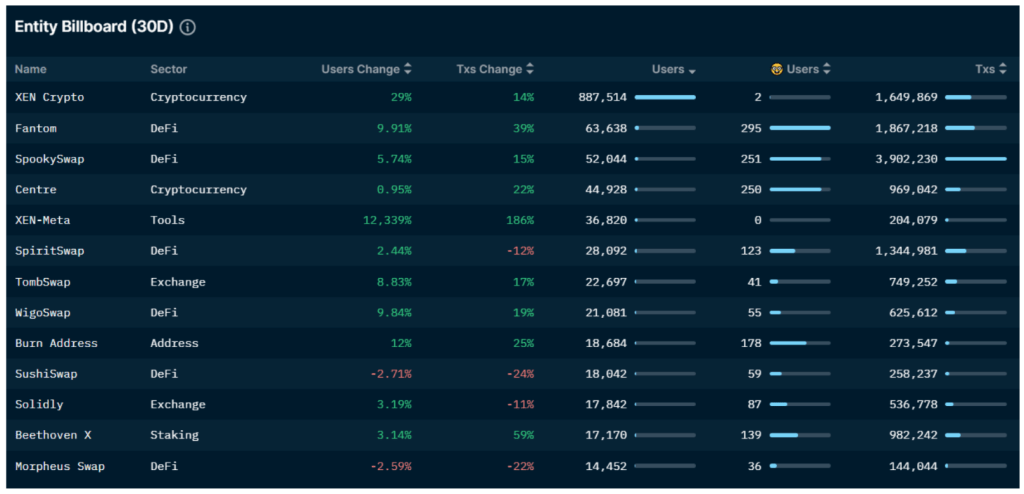

Number of smart contracts created in Fantom / Source: DuneNansen’s 30-day activity board shows that the best dApp activity on Fantom is limited to simple swaps. This is discouraging as other activities such as derivatives trading, social media platforms and NFT trading are successful on competing Blockchains like Arbitrum, Polygon and Optimism.

From January 20, 2023 to February 20, 2023, the most used dApps on Fantom is XEN Crypto, a free Ponzi scheme-like application. The app first appeared on Ethereum in October 2022 with great excitement in the first few days of its launch. However, the hype subsided after the mint became unprofitable as many users flooded the platform.

Top Phantom dApps by usage in the last 30 days / Source: Nansen

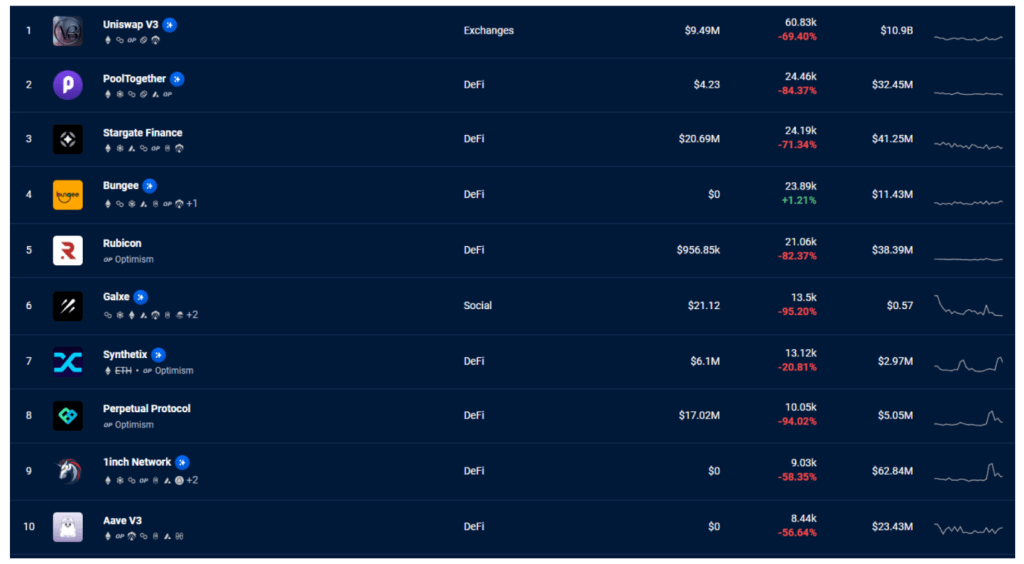

Top Phantom dApps by usage in the last 30 days / Source: NansenOptimism developers find success with new use cases

At the same time, Optimism has successfully attracted liquidity and activity to its ecosystem after launching the OP token and accompanying airdrop campaigns. In April 2022, the Optimism team announced that there would be an ‘airdrop season’ and launched an Optimism Quest campaign. The Layer-2 network has seen increased use by users to collect NFTs. This will most likely make them eligible for airdrop. Missions ended in January 2023, followed by a sharp drop in activity. However, DeFi liquidity remained sticky.

Total liquidity on Optimism / Source: DefiLlama

Total liquidity on Optimism / Source: DefiLlamaAlso, the activity related to Optimism is quite diverse. The list of most used decentralized apps on Optimism includes yield platform Pool Together, derivatives platforms Synthetix and Perpetual Protocol, and leading lending platform Aave. Optimism also hosts Mirror, a decentralized blogging platform that allows content writers to publish their articles as NFTs. The platform gained significant usage with 2.7 million clicks on its website.

Top Optimism dApps by usage in the last 30 days / Source: Nansen

Top Optimism dApps by usage in the last 30 days / Source: NansenOn February 24, the largest US exchange Coinbase announced the layer-2 Blockchain, which uses the same technological design as Optimism. The announcement added that the exchange is working closely with Optimism Collective with a vision to connect blockchains built on the same technological stack, known collectively as the Optimism ecosystem. This could possibly be the start of a big step forward for Optimism if other businesses join and increase Optimism’s liquidity and activity by following Coinbase.

Comparison of FTM and OP tokens

One downside to the OP is that it’s just a governance token and doesn’t entitle users to real returns on gas fees. OP supply will increase by 2% per annum with investor and team unlocking from April 2023. However, the Optimism team encouraged participation in governance, which improves the governance of the protocol and also aligns the incentives with the intended use, i.e. higher voter turnout.

Optimism’s governance has proven more efficient at promoting decentralization than competitors such as Uniswap (UNI) and Compound (COMP). The ecosystem of the Layer-2 network is also expanding, supporting a variety of applications. Optimism will also benefit from Arbitrum’s native token launch, which could possibly power the tier-2 token narrative and raise the OP price.

For Phantom, despite implementing a write feature in its protocol, the actual payoff for the platform is still negative. Blockchain’s fees and liquidity must be significantly improved to increase the value of FTM. Otherwise, it risks being irrelevant next to many other layer-1 protocols on the market. Technically, FTM could see more upside moves while holding the support above $0.38 and targeting the $0.95 support and resistance area. However, a drop below $0.38 could lead to a drop to $0.19.

FTM weekly chart / Source: TradingView

FTM weekly chart / Source: TradingViewFor the OP, its price broke above its previous high of $2.30, which will now act as a support for further upside as it experiences a price discovery. On the other hand, a break below this level could cause the price of the token to drop to $1.30.