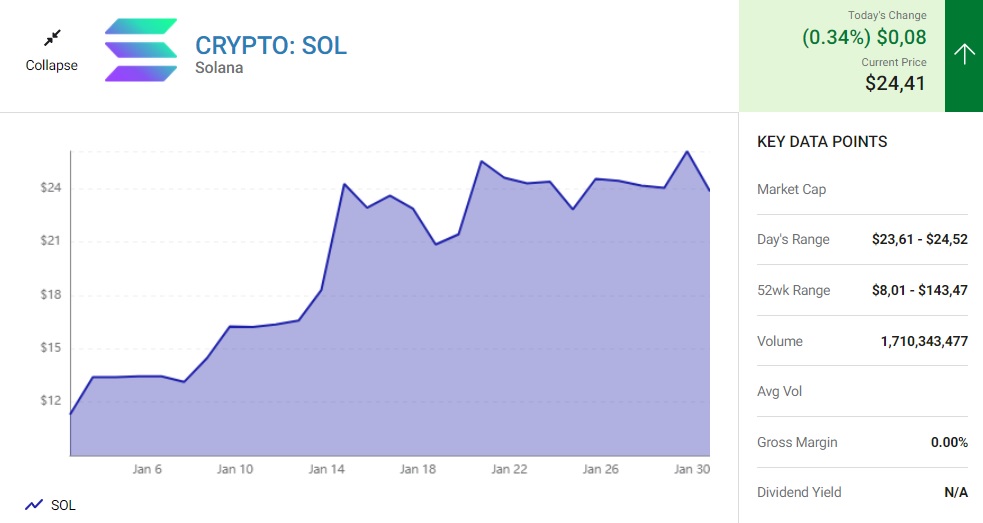

Solana has become one of the prominent altcoin projects in the crypto market with a mind-boggling 143% increase in January. According to crypto expert Dominic Basulto, Solana’s fundamentals are showing signs of recovery, giving investors hope that this rally can be sustainable. The expert also talks about a number of innovative projects by Solana that could help increase its price going forward.

Solana apparently left the FTX crash behind

This is good news for investors hoping for a good 2023. A surprising success story so far in 2023 was Solana (SOL), the crypto most affected by the collapse of FTX (FTT). cryptocoin.com As you follow, in 2022 Solana dropped more than 94% making it one of the worst performing altcoin projects of the year. However, the altcoin price has already increased by 143% this year. Solana appears to be on an unstoppable run as she makes up for losses from FTX.

The question on many investors’ minds is, of course, how much higher Solana can go. Before the FTX crash, Solana was trading around $34. Therefore, a 40% higher move from its current $24 price is definitely possible. Let’s take a closer look at what needs to go right for this to happen.

What are the foundations of the altcoin project?

Currently, most of the price action on Solana seems to be based on investor psychology rather than the underlying fundamentals of Solana Blockchain. Quite simply, the market overreacted negatively after the FTX crash, now the market may be overreacting positively as investors realize that rumors of Solana’s death may have been greatly exaggerated.

Fortunately, crypto research firm Messari has released a new report called ‘State of Solana 2022 Q4’. As such, it’s possible to peek under the hood and see what’s really going on in Solana. One of the key takeaways from the report is that Solana Blockchain’s network health, if anything, is improving. Average daily trading volume actually increased during the quarter. This refutes any suggestion that people are leaving Solana in droves. Also, even with this additional throughput, transaction processing speed (measured as transactions per second or TPS) actually increased.

However, things get a little trickier once you start looking into key market niches like Non-Fungible Tokens (NFTs). This is where Solana was strongest before the FTX collapse. As such, it remains an area where investors remain focused for signs of Solana’s recovery. The bad news is that the total number of new NFTs minted on Solana Blockchain is down 65% from the previous quarter. In addition, key metrics such as NFT secondary sales volume (down 19%) and number of unique NFT buyers (down 49%) also fell significantly.

The good news is, if you like to call it that, Solana has managed to maintain its market position as the No. 2 player behind Ethereum (ETH 0.87%) in the NFT market, despite all the chaos unfolding in the wider crypto market. As Messari details in his report, it’s important to consider Solana’s relative position vis-à-vis its competitors at a time when the entire NFT market is showing signs of weakness. Solana’s NFT secondary sales volume may have dropped, but it was still almost 10 times that of its next closest competitor.

Where can altcoin be the market leader?

Solana needs to do more than maintain the status quo to continue her current run. That is, it needs to be the market leader in some niche of the crypto world. It looks like Solana is trying to do exactly that. The coin has a number of initiatives that could help it rise much higher than its current price of $24 for 2023.

Solana, for example, is taking new steps to increase overall network efficiency and throughput. NFT is taking new steps to enforce the copyrights of its creators. This could make Solana Blockchain much more attractive to new creators looking to print NFTs. It is launching a new mobile startup called Solana Mobile, which will include a crypto phone and crypto-friendly mobile apps. Web3 goes deeper in areas such as game finance (GameFi) and decentralized physical infrastructure networks (DePIN). And finally, Solana is launching a new initiative that will make it much more interoperable than the Ethereum Blockchain.

SOL buy?

It will be interesting to see if these initiatives will help increase Solana’s numbers. I am confident Solana can continue to improve its network resilience and performance figures. This is an area that investors are beginning to question, given all the disruptions to Solana Blockchain over the past year. So, I think Solana has addressed this issue directly. I am also confident that Solana can maintain its position as the No. 2 player in the NFT market. Showing strength in these two areas may be enough to bring Solana back to the $34 level it was trading before the FTX debacle.

When you add in everything else like the new GameFi and mobile startups, that’s what can really move Solana’s needle. Therefore, I am bullish on Solana both short and long term.

The opinions and estimates in the article are those of the experts and are not investment advice. We recommend that you do your own research before investing.