Analysts of financial and investment consultancy company Fool have suggested that the 2 cryptocurrencies, which have lost their value in half, can quickly recoup their losses. Experts list the catalysts that strengthen long-term prospects.

Fool analysts expect these 2 cryptocurrency giants to recover quickly

Since the arrival of 2023, the crypto market has experienced a refreshing and much-needed revival in prices. Year-to-date, the market’s overall value has increased by more than 40%, once again reclaiming $1 trillion. But despite this rally, most cryptos are still significantly below their previous ATH levels.

In the rest of the article, let’s take a look at the 2 cryptocurrencies that Fool analysts trust in this environment, with their reasons.

The undisputed champion

Bitcoin, the top pick of Fool analysts, remains at the top of the market despite thousands of cryptocurrencies created since its launch in 2009. As of today, it still accounts for over 40% of all value in crypto, a sign that Bitcoin is still the crypto of choice for investors.

But Bitcoin remained under the influence of bankruptcy chains throughout 2022. Fortunately, there is reason to believe that Bitcoin may be ready for another bull and possibly spearhead the return of a bull market. While evaluating the past price of Bitcoin, it should be noted that there is about a year and a half left until the next halving cycle.

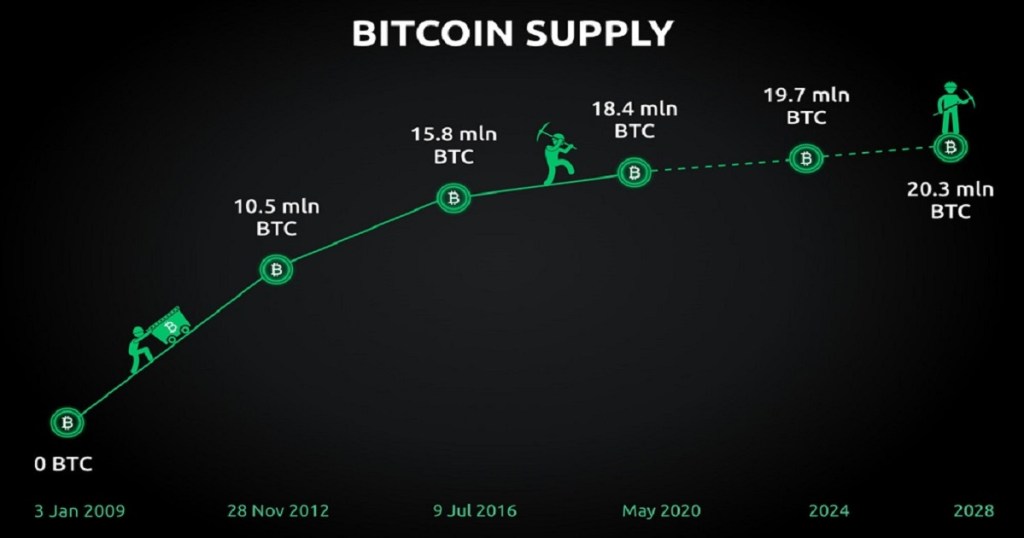

Halving cycles are a mechanism linked to the Bitcoin code that lowers the rate at which new cryptocurrencies enter circulation. Approximately every four years, the number of Bitcoins issued to miners is halved. In the early days of Bitcoin, the reward was 50 Bitcoins, but this has dropped to just 6.25 today as many halvings have passed since then.

The next halving is scheduled for May 2024, so we’re a little less than a year and a half away from this highly impactful event. Based on historical data, the price of Bitcoin appears to have bottomed out near this point in the halving cycle. From here, downside risk is typically lowest, while profit potential is highest.

Which is the next best crypto option?

The second most valuable cryptocurrency in the world, Ethereum has had its fair share of success since it was founded in 2015. Over the past eight years, the rise of Ethereum has paved the way for all new lucrative and booming sectors of cryptocurrencies like DeFi.

Unlike Bitcoin, which is resistant to major changes, Ethereum has a number of developers working to fine-tune its code and even implement new features. One of these new features came in the form of an upgrade known as the London hard fork. This upgrade introduced a new mechanism that would “burn” or permanently remove ether from circulation, effectively turning Ethereum into a deflationary asset.

Ethereum's London hard fork has activated at block 12,965,000 and EIP-1559 is now active.

LFG!!!

— Dhee.eth/nft 🦇🔊 (@DheerajShah_) August 5, 2021

Before the London hard fork, Ethereum’s inflation rate was over 3.5%. But since the implementation of the upgrade, the rate at which new ETHs circulate is actually negative. The number fluctuates with demand, but as of today, Ethereum has a deflation rate of -0.074%, meaning the overall supply of ETH is decreasing.

Falling supply supports Ethereum bulls

Due to the required implementation of Merge (another Ethereum upgrade released in September 2022) it took a while to materialize, but with the added deflationary pressure, the price of Ethereum will likely benefit as it is now subject to the dynamics of a truly limited supply and incrementally increasing. If a bull market returns and demand for Ethereum increases, new buyers will put incredible bullish pressure on the price, accompanied by the dwindling supply of ETH, according to Fool analysts. cryptocoin.comWe have included other research by Fool analysts in this article.