According to the financial firm, this metaverse coin wants to maintain the momentum it did in early 2023. However, according to the company, this is more difficult than it seems. cryptocoin.comWe have compiled the opinions of the finance company about metaverse coin for you.

This metaverse coin is on the decline

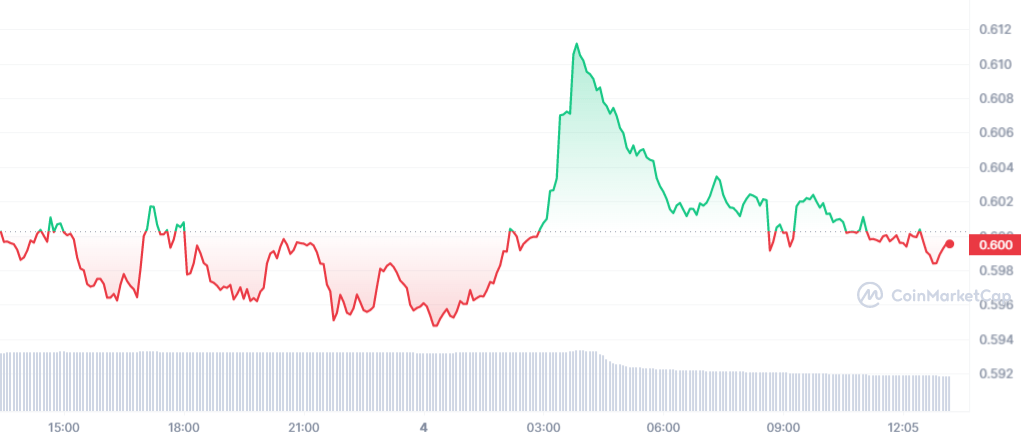

According to the finance firm, one of the surprising stories of the crypto market so far in 2023 has been the comeback of metaverse coins. In 2022, top metaverse coins have dropped by 90% or more. This year, however, such tokens have been among the market’s top performers. For example, in January Decentraland (MANA) took the lead with a stunning 152% gain.

However, Decentraland, which is currently trading around $0.59, now faces a reality. Its performance started declining in February and has dropped 13.4% in the last 30 days. As a result, risk-seeking crypto investors may decide to look elsewhere for upside potential, such as AI-related coins.

Momentum and metrics

When weighing this question, it’s important to distinguish between momentum and metrics. Momentum refers to investor sentiment and is much more affected by speculation, hype, and buzz. Metrics refer to real-world numbers and real-world performance. According to the company, the metaverse could be a $1 trillion market opportunity in the future.

The finance company is therefore concerned about Decentraland. Much of the coin’s big rally in 2023 seems to be based on momentum, not metrics. Currently, the Decentraland metaverse platform has only 10,000 core users, down from the peak with 50,000 daily active users in early 2022. This represents an 80% drop in activity.

Until Decentraland starts reclaiming a significant portion of these users or attracts an entirely new demographic to its own metaverse version, it will be difficult to see how the core metrics in Decentraland will change.

When you take into account all the new metaverse players, from new virtual worlds built on various blockchains to new game options for mobile devices, it’s hard to see how Decentraland will consolidate and improve its position, according to the finance company. For the token to break the $1 mark this year, it will need to appreciate in price by around 60%. As a rough estimate, this would mean a similar gain in daily active users or a similar gain in overall trading activity happening on the platform.

real world utility

One reason I’m skeptical about the possibility of such gains is that the Decentraland token has yet to generate any real-world benefits. It is still a management token for a certain small metaverse world.

This does not mean that it is not possible to find economic use cases for Decentraland. But many of these use cases require enormous amounts of time, attention, expense and may not be attractive to emerging metaverse entrepreneurs.

Decentraland analysis of the company

As a concept, the metaverse is compelling. There’s a good reason why big Silicon Valley tech players like Meta Platforms (META) are spending literally billions of dollars trying to bring their metaverse ambitions to fruition.

It’s understandable that Apple (AAPL) plans to enter the metaverse business this year with a new virtual reality (VR) headset. Eventually a company will figure out how to monetize the metaverse, make using it a core activity for mainstream consumers, and make huge profits in the process. For these reasons, the company is skeptical that Decentraland could see $1 in 2023.