This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

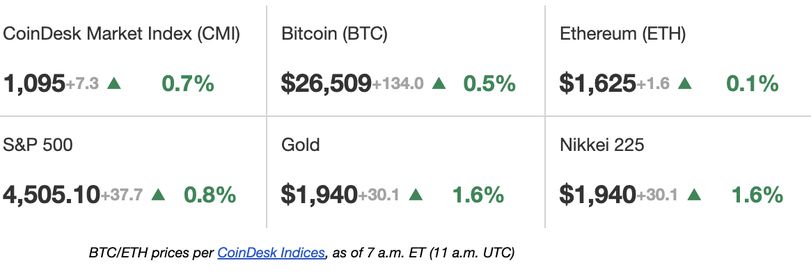

Latest Prices

Top Stories

As bitcoin (BTC) moves higher, the recently shorted alternative cryptocurrencies like Solana’s SOL may see leverage liquidations and exaggerated price rallies. Since Monday’s brief move below crucial support at $25,000, bitcoin has risen over 6% to trade near $26,600, CoinDesk data show. Upbeat China August retail sales and factory output data released early Friday revived risk sentiment in financial markets, clearing the way for continued price gains in the leading cryptocurrencies. Bitcoin cash (BCH) led advancers, adding 8% over the past 24 hours. Maker DAO’s MKR followed with a rise of 5%. XRP, Ether (ETH), SOL, Tron’s TRX and dogecoin (DOGE) are all tracking bitcoin higher, as usual. The altcoin bounce comes days after traders sold these tokens, pricing in the possibility of defunct exchange FTX securing approval from the bankruptcy court to sell assets from its multibillion dollar cryptocurrency holdings. The recovery puts altcoin bears, who took leveraged bets on SOL and other tokens declining because of potential sales by FTX creditors, at risk of liquidation.

Binance.US has been accused of not cooperating in a probe by the Securities and Exchange Commission, which has said the company’s staking, clearing and brokerage services violate federal securities law, court filings unsealed Thursday show. Federal U.S. regulators worry the crypto exchange’s use of Ceffu, a custody service offered by Binance’s international arm, violates a deal intended to stop assets being squirreled overseas. Binance.US’ holding company, known as BAM, has provided “only approximately 220 documents … many that consist of unintelligible screenshots and documents without dates or signatures,” the SEC said, of the evidence-gathering process known as discovery. The company also lost two more high-level executives not long after the departure of CEO Brian Shroder. Head of Legal Krishna Juvvadi and Chief Risk Officer Sidney Majalya are leaving the company, the Wall Street Journal reported, citing people familiar with the departures. Juvvadi was hired in May last year, and Majalya was appointed in December 2021.

Deutsche Bank is working with Taurus, a Swiss startup specializing in cryptocurrency safekeeping, to establish digital asset custody and tokenization services, the companies said on Thursday. Germany’s biggest lender, Deutsche Bank, said in June it had applied for a crypto custody license from the country’s financial watchdog, BaFin. The bank’s publicly known crypto custody ambitions stretch back to early 2021, when details about a digital asset custody prototype appeared in a report by the World Economic Forum. Germany’s roll-out of rules for firms to custody crypto assets and, more broadly, Europe’s proposed regime for Markets in Crypto-Assets regulation (MiCA) are providing traditional finance firms with the clarity needed to explore the digital assets industry.

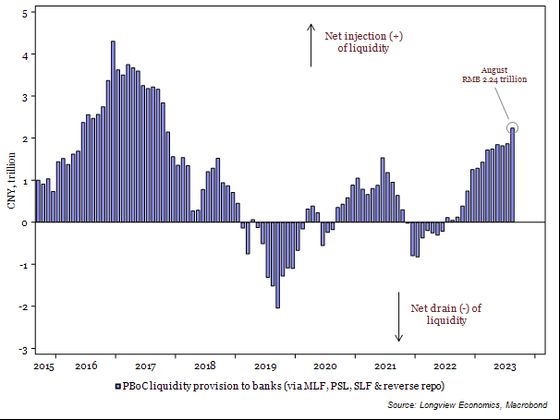

Chart of the Day