This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

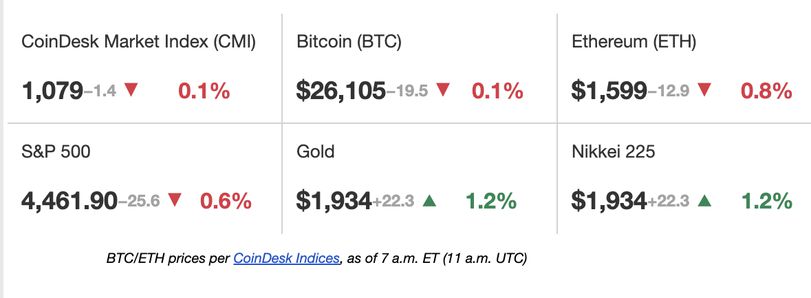

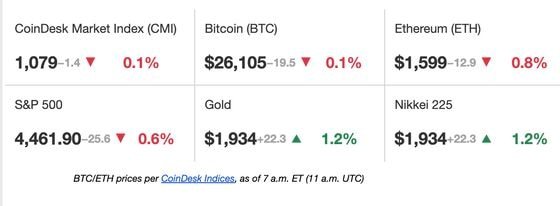

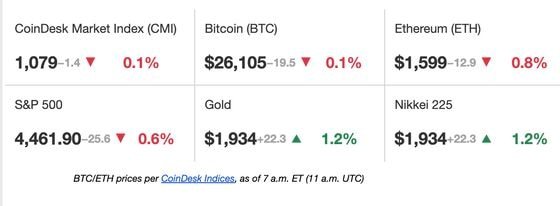

Latest Prices

Top Stories

Binance.US CEO Brian Shroder left the crypto exchange and the company eliminated one-third of its workforce, according to a spokesperson. It’s been a tough year for crypto exchanges in the U.S., with Binance.US feeling particular pressure. The Securities and Exchange Commission sued the company in June for allegedly violating securities laws, building on accusations from another American regulator. “The actions we are taking today provide Binance.US with more than seven years of financial runway and enable us to continue to serve our customers while we operate as a crypto-only exchange,” the company said in a statement. “The SEC’s aggressive attempts to cripple our industry and the resulting impacts on our business have real world consequences for American jobs and innovation, and this is an unfortunate example of that.”

Crypto derivatives exchange BitMEX started a prediction market that allows traders to bet on the outcome of real-world events. Prediction markets have been around for some time but have enjoyed a surge in popularity thanks to Polymarket. Polymarket, which was fined $1.4 million in January 2022 for unregistered swaps, offers bettors a plethora of contracts from the serious, such as the victor in the first Republican primary debate, to the absurd, like former President Obama’s sexuality, the chance of Russia using a nuclear weapon before the end of 2023, or the existence of aliens. BitMEX’s prediction market, which it’s calling its newest derivative product, is going for the former rather than the latter, starting with prediction contracts on the percentage recovery rate of FTX’s bankruptcy claims, the chance of approval for a Bitcoin Exchange Traded Fund on or before Oct. 17, and the chances of Sam Bankman-Fried ending up in jail.

Crypto exchange FTX amended its proposal to sell off billions in crypto assets as it seeks to assuage concerns raised by the U.S. Trustee, the bankruptcy branch of the Department of Justice. In the proposal filed Tuesday, FTX would still not have to issue advance public notice of transactions given their market-moving implications – as the prospect that a crypto player selling off as much as $100 million of assets a week has already chilled crypto prices. The U.S. Trustee originally objected to FTX’s plan, saying that any intention to sell bitcoin (BTC) or ether (ETH) should be flagged as widely as possible to give others an opportunity to object. In its compromise, FTX has agreed to keep the U.S. Trustee privately in the loop, alongside committees representing the exchange’s creditors.

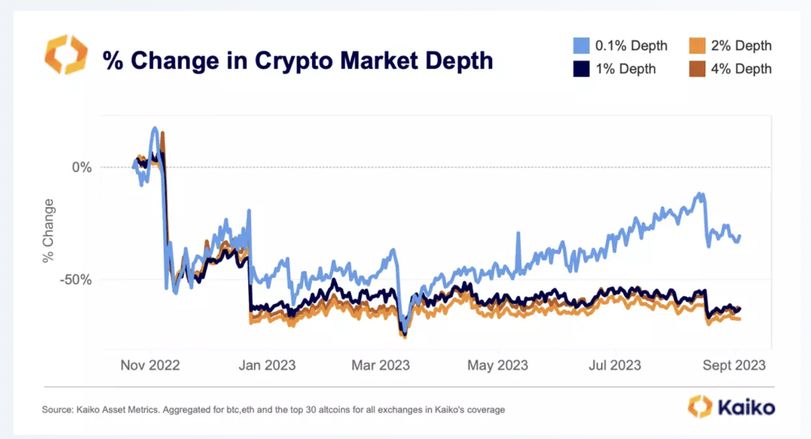

Chart of the Day