This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Binance is targeting $1 billion for a previously announced recovery fund for distressed crypto assets, CEO Changpeng “CZ” Zhao said in an interview with Bloomberg TV Thursday. The fund will be open to contributions from other industry players. “If that’s not enough we can allocate more,” CZ said, according to the news outlet.

CZ also confirmed in the Bloomberg interview, that Binance’s U.S. arm will be making a fresh bid for crypto lender Voyager now that FTX is unable to follow through with acquiring it. Following Voyager’s bankruptcy, FTX emerged as the frontrunner to acquire the lender, with Binance’s bid said to be held back by concerns it would represent a national security concern for the U.S. government.

The Securities Commission of The Bahamas is firing back at collapsed crypto exchange FTX’s accusations that the nation had directed unauthorized access to transfer assets off the platform after it filed for bankruptcy protection in the U.S. In a Wednesday notice, the regulator called the allegations “intemperate and inaccurate.”

Chart of the Day

-

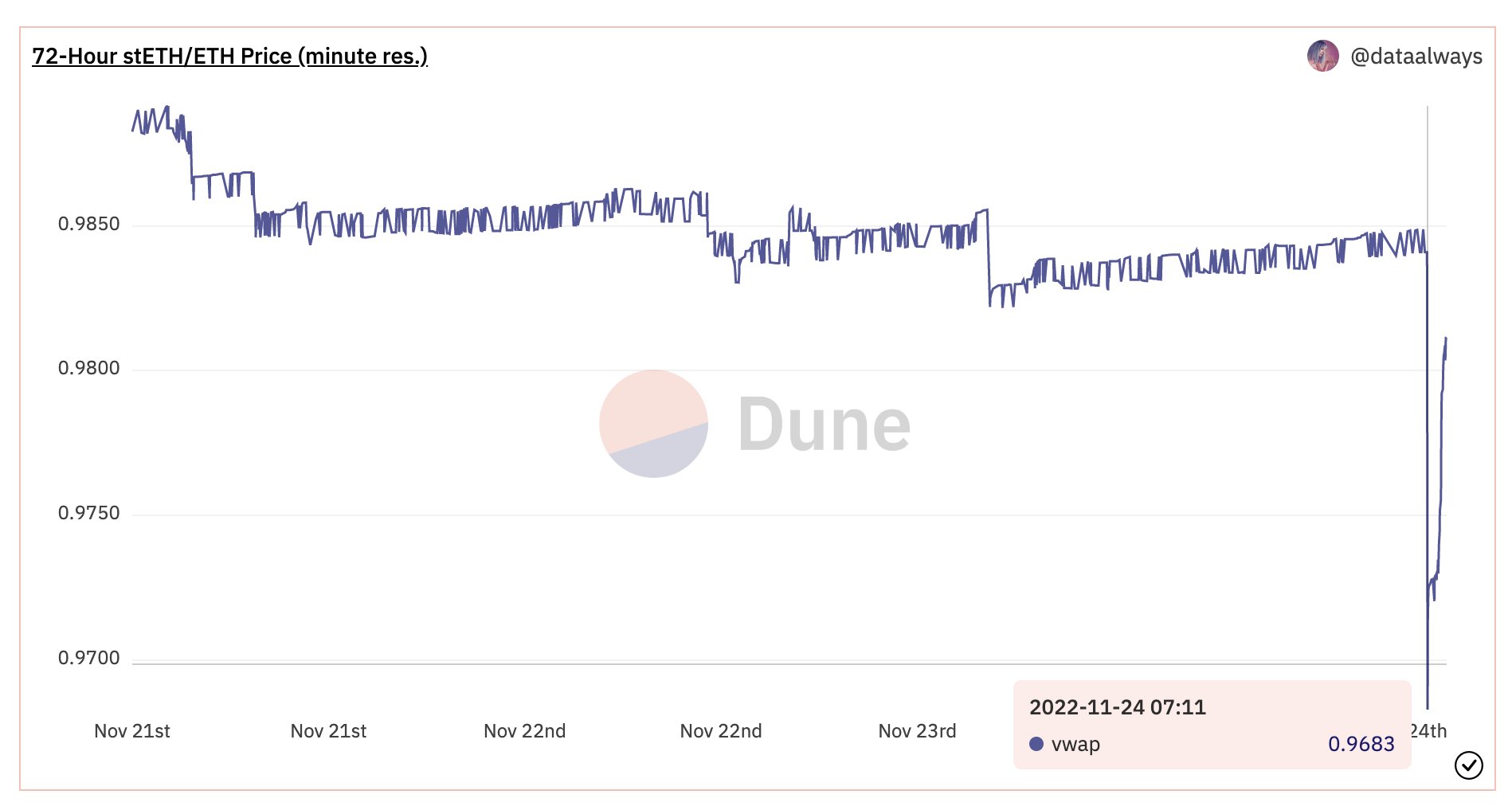

The chart shows the price of liquid-staking protocol Lido’s staked ether (stETH) token fell to 0.97 ETH early Thursday.

-

According to blockchain sleuth Lookonchain, the de-pegging happened after a whale removed over 84,00 ETH from decentralized exchange Curve’s stETH-ETH liquidity pool.

-

Historically, stETH’s deviation from ETH price has coincided with market uncertainty.

-

The previous episodes of de-pegging saw smart money snap up stETH at a discount and eventually sell at par.

Trending Posts

-

Crypto Exchange Bybit Announces $100M Fund to Support Institutional Clients

-

Crypto Market Analysis: Commitment of Traders Report Shows Asset Managers Trimming Long Positions

-

Ethereum Software Firm ConsenSys Reveals It Collects User Data