This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

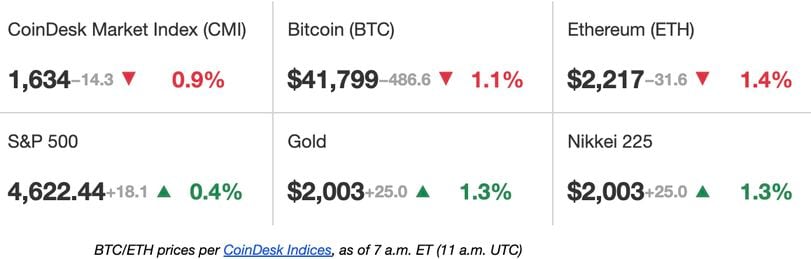

Latest Prices

Top Stories

Binance, the world’s largest cryptocurrency exchange by market volume, has seen its spot market share gradually decline over the year as the company faced an array of charges from regulators that eventually claimed its founder and CEO, Changpeng “CZ” Zhao. According to numbers provided by CCData, Binance’s market share so far in December was just 30.1% versus 55% at the start of the year. From January to September, the exchange’s monthly spot volumes declined by over 70% to $114 billion. CCData notes that the trading volumes have been increasing since September even as its market share continues to slide.

El Salvador’s long-planned Bitcoin bonds have inched closer to reality after apparently receiving regulatory approval for an early 2024 issuance, the country’s Bitcoin-focused office posted on Tuesday. The bonds are set to be offered on Bitfinex Securities, a regulated division of crypto exchange Bitfinex. “The Volcano Bond has just received regulatory approval from the Digital Assets Commission (CNAD),” El Salvador’s National Bitcoin Office posted from its account on X. “We anticipate the bond will be issued during the first quarter of 2024.”

Cathie Wood’s ARK Invest sold around $12.85 million worth of Grayscale Bitcoin Trust (GBTC) shares from its Next Generation Internet (ARKW) exchange-traded fund (ETF) on Monday, the biggest sale in more than a year. The offload of 395,945 GBTC shares from ARKW leaves the fund with about $112.7 million worth of GBTC, a weighting of 6.95%. ARK aims for no individual holding in its ETFs to exceed a 10% weighting of the fund’s total market value. Digital asset manager Grayscale’s bitcoin (BTC) investment vehicle dropped 8.6% to $32.46 on Monday, reflecting the 5.8% decline in the value of the largest cryptocurrency by market value.

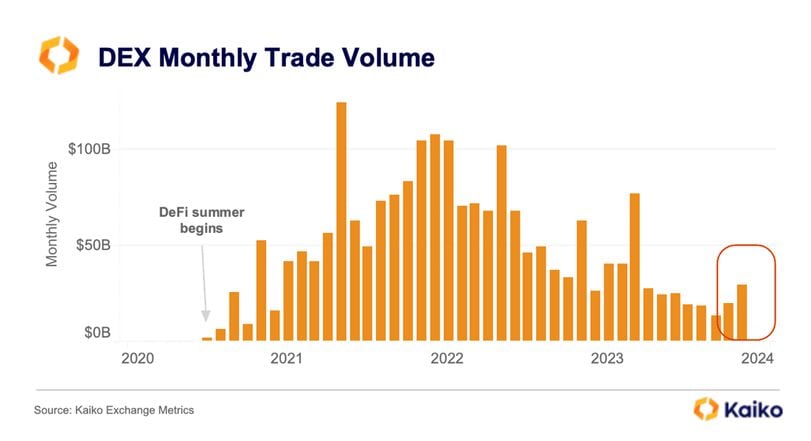

Chart of the Day

– Omkar Godbole