This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Talk of a Genesis bankruptcy has sent bitcoin to fresh new lows. The troubled trading firm sought funding from Binance and Apollo Global Management, according to the Wall Street Journal. Binance, the world’s largest crypto exchange, declined to invest, citing potential conflicts of interest. A Genesis representative, however, told Bloomberg that “we have no plans to file bankruptcy imminently.”

The initial news sent bitcoin to a fresh two-year low of $15,480. Since then, the price has remained at about $15,650.(Genesis and CoinDesk share the same parent company, Digital Currency Group.)

Sam Bankman-Fried’s crumbling FTX empire held $1.2 billion in cash reserves as of Sunday, court documents show. That is far below the $3.1 billion it owes to its top 50 creditors. About $751 million of that is held in debtor entities, and the rest, $488 million, is in non-debtor entities, according to the document, which was filed on Monday. About $514 million is unrestricted cash, $260 million is custodial, and $465 million is restricted cash that is earmarked for specific purposes like loan repayments and can’t be used for general business purposes.

Coinbase shares have sunk to an all-time low. The U.S. crypto exchange went public in April 2021, and its shares have lost nearly 90% over the past year, with the FTX contagion causing the latest leg down. The stock dropped 10% to $40.62 on Monday, and it is down 39% in November. Coinbase’s shares traded at slightly over $400 last year on the day the company went public on Nasdaq.

Chart of the Day

-

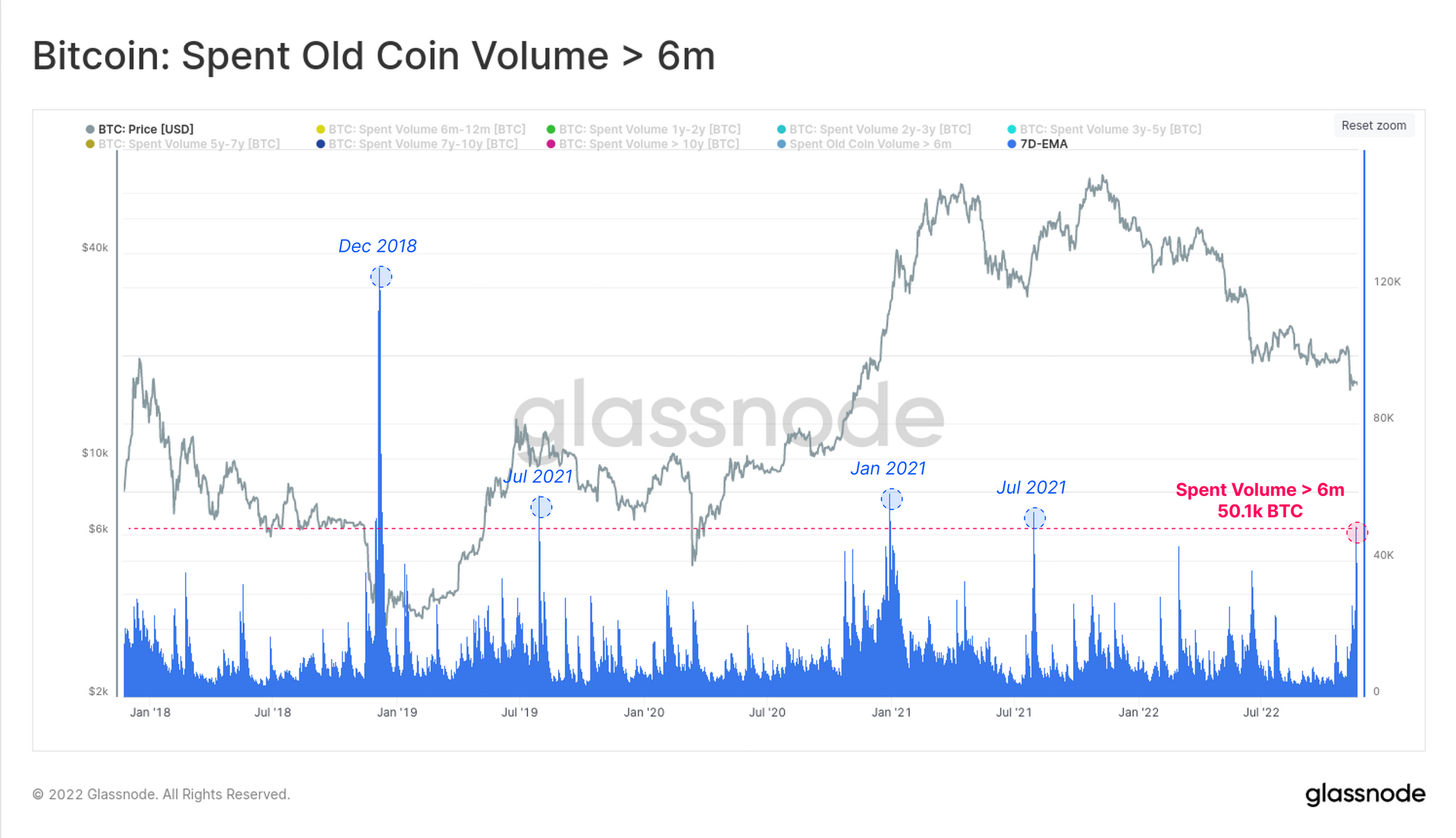

The chart above shows an increase in the volume of on-chain transfers of bitcoin that have been inactive for at least six months, a sign of long-term holders losing conviction, according to Glassnode.

-

A total of 254,000 BTC older than six months appears to have changed hands since the collapse of FTX.

Trending Posts

-

FTX Blowup Helped Enrich the Ethereum Validators Who Run the Blockchain

-

Crypto Market Analysis: Bitcoin and Ether Approaching Oversold Levels

-

FTX Must Pay Expenses Incurred by Bahamas Regulator for Holding the Exchange’s Digital Assets