This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Price Point

Bitcoin (BTC) remained at the $20,000 level on Thursday as U.S. stock futures traded down, suggesting U.S. markets could stumble for a second day in a row after a two-day winning streak. The dollar eased slightly after posting solid gains overnight.

Bitcoin has been trading in a $600 range over the last few days, bouncing above and below the $20,000 mark with little direction.

Ether (ETH), the second-largest cryptocurrency by market value, gained 1% over the last 24 hours. Other altcoins posting gains included Uniswap’s UNI, up 4%, and XRP, up 3%. Ethereum classic and Chainlink’s LINK also made small gains.

In the news, crypto lender Celsius Network’s top three executives withdrew $56.1 million in cryptocurrency between May and June, shortly before the company suspended withdrawals and filed for bankruptcy, new court records show.

Former CEO Alex Mashinsky, former Chief Strategy Officer Daniel Leon and Chief Technology Officer Nuke Goldstein pulled bitcoin, ether, USDC and CEL holdings from their custody accounts in May before the company suspended all customer withdrawals.

In other news, GoldenTree Asset Management has invested $5.3 million in the Sushi governance token, the firm said in a Sushi forum announcement on Wednesday.

Finally, PowerTrade, a crypto exchange focused on derivatives, announced it is rolling out a request-for-quote (RFQ) model for the options market, which it says will cater to institutional investors by mirroring a widely used practice in traditional finance.

CoinDesk Market Index

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Ravencoin | RVN | +5.85% | Currency |

| Ribbon Finance | RBN | +5.06% | DeFi |

| Polymath | POLY | +4.11% | DeFi |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| MetisDAO | METIS | -7.75% | Smart Contract Platform |

| Celsius | CEL | -5.95% | Currency |

| COTI | COTI | -4.77% | Currency |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk Market Index (CMI) is a broad-based index designed to measure the market capitalization weighted performance of the digital asset market subject to minimum trading and exchange eligibility requirements.

Chart of the Day

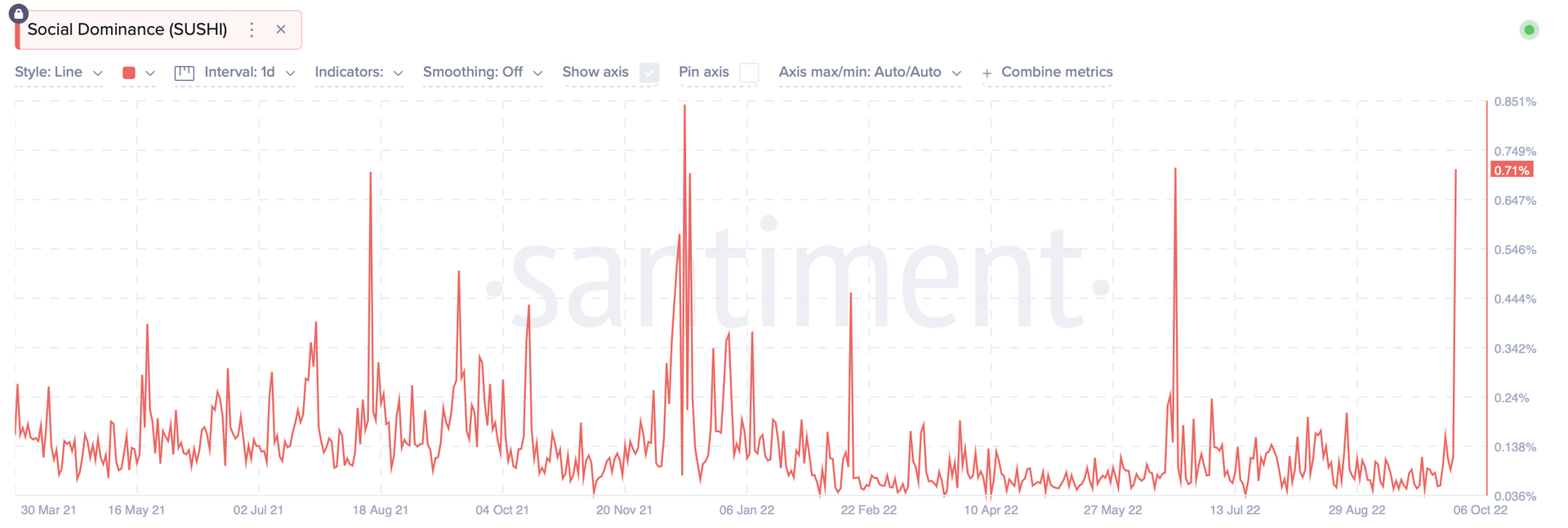

Sushi’s Social Dominance Hits Highest Level Since June

By Omkar Godbole

This chart shows ratio of discussions related to the decentralized exchange Sushi’s SUSHI token vs. all crypto topics. (Santiment)

-

GoldenTree’s disclosure of $5.3 million stake in Sushi has galvanized investor interest in the cryptocurrency.

-

Increased social-media chatter often leads to price volatility.

-

SUSHI has gained 14% in the past 24 hours.