This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

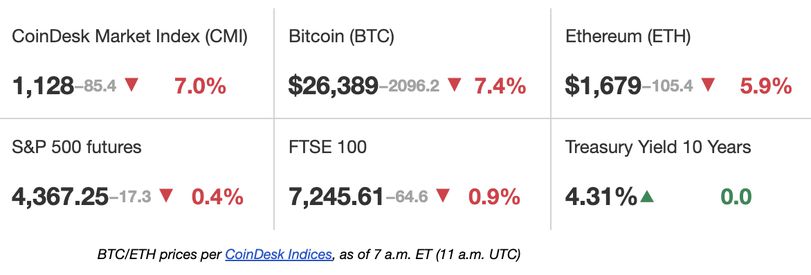

Latest Prices

Top Stories

Bitcoin (BTC) has dropped 7% over the past 24 hours, plunging to levels not seen since June as the digital-asset market witnessed one of the worst sell-offs this year. Crypto traders were hit with $1 billion worth of liquidations over the past 24 hours, according to Coinglass data. The world’s largest cryptocurrency by market value was trading at around $26,400 at the time of writing, but briefly fell to $25,234 on Thursday. Altcoins performed slightly better with ether (ETH) losing 6% over the same time period and Solana’s SOL losing around 5%. Traders say market structure and liquidations were a likely reason for the sudden drop instead of a singular fundamental catalyst. “We’ve seen BTC OI ramp up in position, with a bias to shorts,” said Decentral Park Capital trader Lewis Harland, in a message to CoinDesk. “The break below $28,500 led to material volumes of longs being liquidated. This has been combined with spot selling ahead of the date (likely anticipating further delays).”

Creditors of bankrupt crypto firm Celsius will hold a vote on the lender’s plan to sell assets to the Fahrenheit consortium, after a judge on Thursday approved disclosures that suggested creditors can expect to recover 67%-85% of holdings. Approval marks one of the final steps on Celsius’ year-long march out of bankruptcy and the return of funds to customers, in a period which has seen widespread disruption in crypto markets and the arrest of former Chief Executive Officer Alex Mashinsky on fraud charges, which he has denied.

Securities regulators are poised to approve ether futures ETFs for the U.S., Bloomberg reported on Thursday. Several firms have applied to list these exchange-traded funds, which would hold derivatives contracts tied to ether – rather than ether itself. But they need the U.S. Securities and Exchange Commission’s blessing, something Bloomberg said might be imminent. There are already U.S. ETFs that hold crypto derivatives: bitcoin futures ETFs. The industry is anxiously awaiting word on whether ETFs that hold bitcoin itself, not derivatives, might also get approval. Wall Street giants like BlackRock are seeking to create those, too.

Chart of the day

– Omkar Godbole