Good morning, and welcome to First Mover. I’m Lyllah Ledesma, here to take you through the latest in crypto markets, news and insights.

-

Price Point: Both bitcoin and Twitter shares are trading down Monday Morning. More news unfolds from 3AC’s court documents and traders think BTC could push back further in the short-term.

-

Market Moves: Omkar Godbole reports an on-chain indicator is suggesting bitcoin could be undervalued. Similar readings have marked bear market bottoms in the past.

Price point

Bitcoin (BTC) was down 3.6% over the last 24-hours after trading in a range between $20,000-$21,000 over the weekend.

The world’s largest cryptocurrency by market capitalization began to show signs of resilience last week as it briefly traded above $22,000, registering its highest valuation since mid-June.

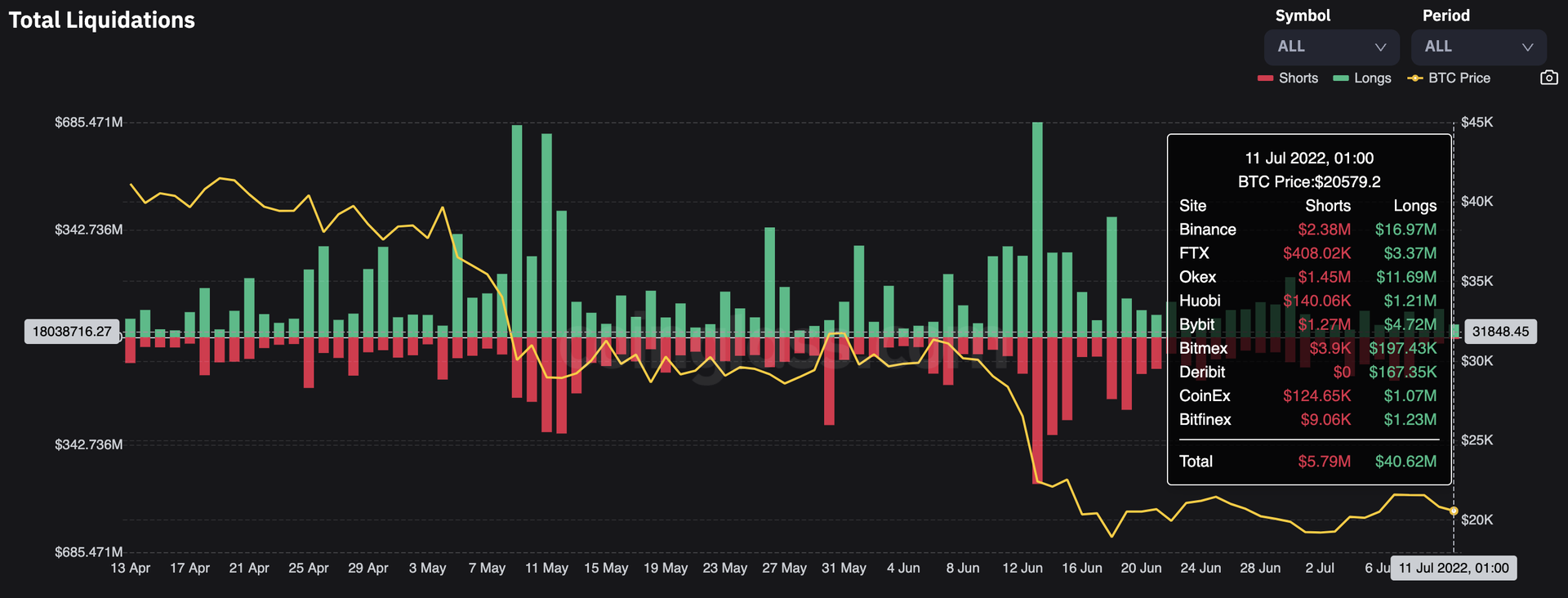

Bitcoin liquidations are showing longs to be substantially higher than shorts over the last 24-hours, data from Coinglass shows.

BTC Total Liquidations (CoinGlass)

Shorts totaled to $5.79 million and longs to $40.62 million.

“This could trigger sell orders at any time of the day,” said Laurent Kssis, head of Europe at Hashdex.

“We could test $20,000 before pushing back,” added Kssis.

Ether (ETH) is down 3% on the day, at $1,142. The only altcoins trading in the green Monday morning were privacy token Monero and Tezos which were up by 5% and 3% respectively.

Meanwhile,Twitter (TWTR) shares slipped in pre-market trading after Elon Musk decided to scrap his planned $42 billion takeover of the social media platform with fears that legal action could ensue.

TWTR shares on the New York Stock Exchange were down 6.55% trading at 34.40 at the time of writing.

Following the Three Arrows Capital (3AC) debacle, the hedge fund recently got an emergency hearing as founders were failing to ‘cooperate’.

In court documents filed late Friday in New York, lawyers acting on behalf of the creditors said that the founders of the fund “have not yet begun to cooperate with the [proceeding] in any meaningful manner.”

Creditors said that the fund’s remaining assets could be “transferred or otherwise disposed of” before creditors get their share. But first, creditors are requesting the court to compel Three Arrows’ founders to list out the fund’s assets.

Terra developers migrate to Polygon

In other news, more than 48 projects previously on the Terra network have begun migrating to Polygon almost two months after the Terra ecosystem collapsed following the implosion of terraUSD (UST).

Over $20 million had been earmarked to help projects making the move.

Elsewhere, the Financial Stability Board (FSB), an international body that monitors financial systems and proposes rules with the goal of preventing financial crises, plans to present recommendations for regulating crypto in October, according to a Monday statement.

The FSB said it will propose recommendations for stablecoin regulation and submit a report on recommended rules for other crypto assets to the G-20.

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Polygon | MATIC | +2.7% | Smart Contract Platform |

| Cosmos | ATOM | +2.3% | Smart Contract Platform |

| Chainlink | LINK | +0.6% | Computing |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Dogecoin | DOGE | −3.8% | Currency |

| Loopring | LRC | −3.7% | Smart Contract Platform |

| Cardano | ADA | −3.3% | Smart Contract Platform |

Market moves

By Omkar Godble

Bitcoin in ‘Accumulation’ Phase, Onchain Indicators Suggest

It’s time to start stacking bitcoin again. That’s the message from indicators tracking tokens sold by miners and comparing the cryptocurrency’s market value to its fair value.

The Puell Multiple, calculated by dividing the daily issuance of bitcoins in U.S. dollar terms by the 365-day average of the value, has dropped into a “green zone” below 0.5, indicating the newly minted coins are undervalued relative to the yearly average.

In other words, the current profitability of those responsible for minting coins is relatively low. In the past, that’s indicated a perfect opportunity to build long-term exposure to the cryptocurrency.

“Entering the green zone is a good time to average in, and for those more conservative, you can also wait for confirmation with a move out of the accumulation zone,” analysts at Blockware Intelligence said in a newsletter published on Sunday.

The daily issuance refers to coins added to the ecosystem by miners, who receive them as rewards for verifying a new block of bitcoin transactions. Recently, many miners have reduced their crypto holdings to stay afloat as the value of the reward has fallen.

Undervalued readings on the Puell Multiple have marked previous bear market bottoms.

“The Puell Multiple has reached a territory consistent with market bottoms in the past (below 0.5 and even touching levels below 0.4 a few weeks ago),” said Julio Moreno, a senior analyst at South Korea-based blockchain data from CryptoQuant.

Read the full story here: Bitcoin in ‘Accumulation’ Phase, Onchain Indicators Suggest.

Latest headlines

-

CoinFlex Begins Arbitration Against $84M Delinquent Customer; FLEX Holders in FocusThe company said it was speaking with depositors looking to help the business by “rolling some of their deposits into equity.”

-

KuCoin Denies Layoff Rumors, Says It’s Hiring 300 Staff“We are continuing to do everything to increase the productivity and motivation of our employees,” CEO Johnny Lyu said.

-

ING Bank Spins Off Its Cryptocurrency Custody Platform to GMEX GroupCrypto platform Pyctor will continue to work with the bank and collaborate through ING’s digital assets team.

-

Celsius Pivots Toward Paying Off Aave, Compound Debt, With $950M Collateral as PrizeThe troubled crypto lender Celsius started to make good on the $258 million debt on the decentralized lending protocols Aave and Compound – possibly in an attempt to reclaim collateral it had posted as guarantees. The transactions come just a day after Celsius used a debt-paydown to reclaim collateral on Maker.

-

Global Financial Watchdog FSB to Propose Crypto Regulations in October.The Financial Stability Board said it will propose recommendations for stablecoin regulation and submit a report on recommended rules for other crypto assets to the G-20.

-

Bitcoin Will Make a Comeback, Rockefeller International Chairman Says“We need the excesses to get weeded out,” Ruchir Sharma told CoinDesk TV.

This web version of today’s First Mover newsletter was produced by Sage D. Young.