This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

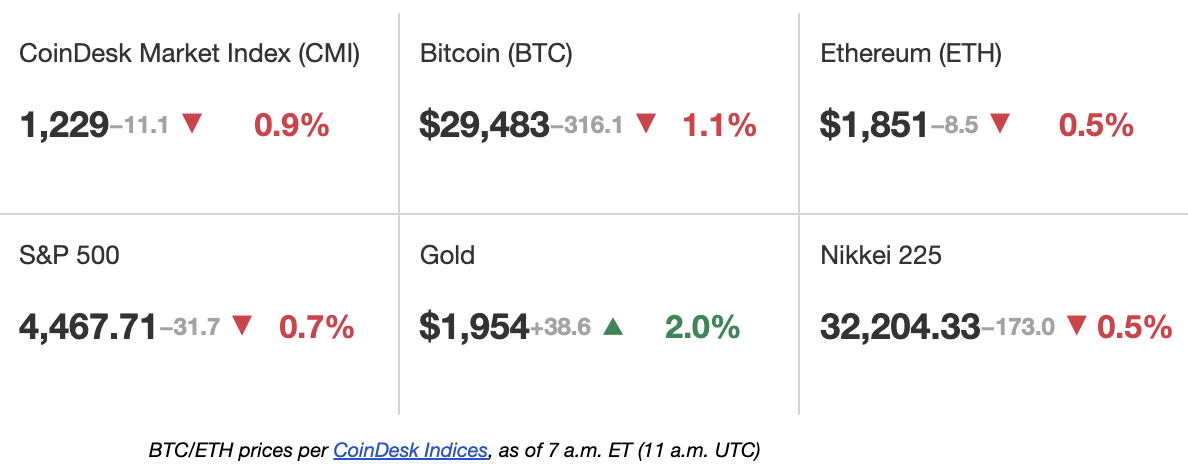

Latest Prices

Top Stories

Coinbase (COIN), the large publicly traded U.S. crypto exchange, said its new Base blockchain, a “layer 2 network,” has gone live, heralding the start of a new era of public companies running their own distributed networks. Base was already live for testing by developers, and it became open to the public at noon ET on Wednesday. The move could ultimately allow Coinbase to garner fees from running its own blockchain, in addition to a potentially even more lucrative stream of revenue from applications built atop it, executives say. Layer 2 networks are built atop base ones, relieving congestion on the underlying network. Base is built upon the Ethereum blockchain.

The U.S. Securities and Exchange Commission will file an “interlocutory appeal” of a judge’s ruling on Ripple’s programmatic sales of XRP, the regulator said in a court filing on Wednesday. The SEC said it was seeking to “leave to” appeal part of a recent decision while other parts of the SEC’s case proceed to trial. The regulator said approval of an appeal could prevent the SEC and government from needing two trials. The SEC sued Ripple in 2020 on grounds that it was selling an unregistered security. Last month, a federal judge ruled that Ripple’s programmatic sales — where it listed XRP on exchanges for anyone to purchase — weren’t securities transactions, whereas Ripple’s direct sales to institutional clients were.

Rep. Maxine Waters (D-Calif.) said Wednesday she’s “deeply concerned that payments giant PayPal (PYPL) is launching its own stablecoin without federal rules for stablecoins in place. Waters, the top Democrat on the House Financial Service Committee, noted that PayPal has 435 million customers around the world, more than the number of online accounts of all the largest banks combined. “Given PayPal’s size and reach, federal oversight and enforcement of its stablecoin operations is essential in order to guarantee consumer protections and alleviate financial stability concerns,” Waters wrote.

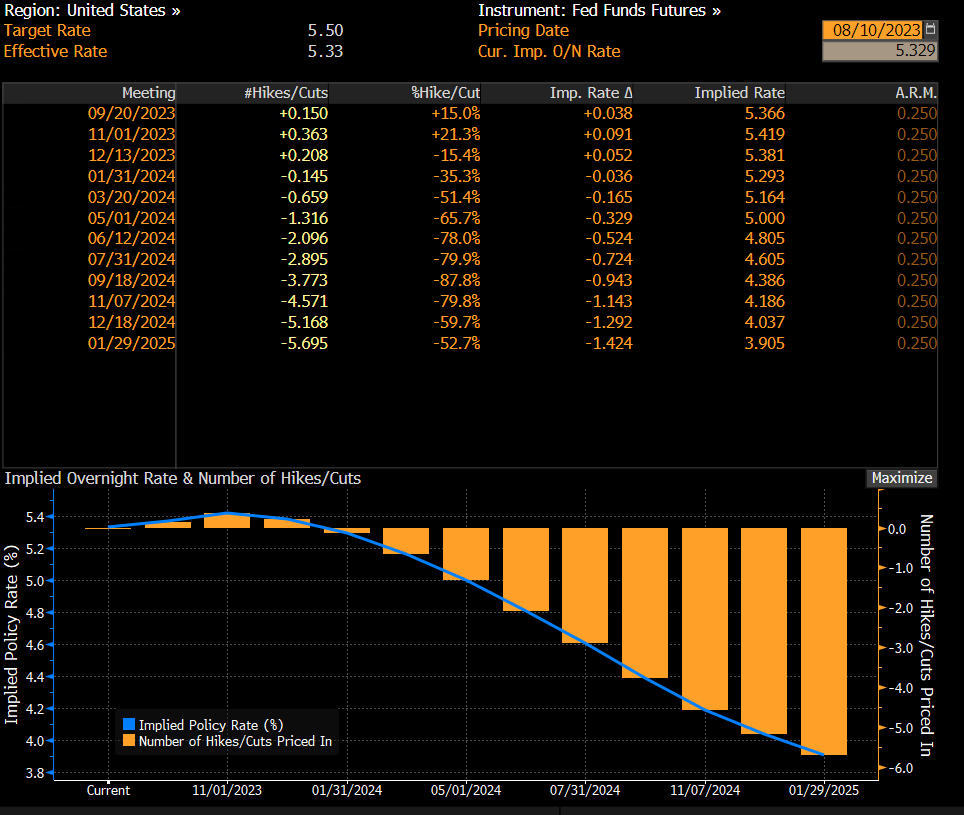

Chart of the Day

(Source: Lisa Abramowicz, Bloomberg)

– Omkar Godbole