This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

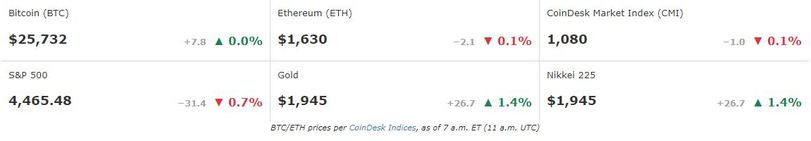

Latest Prices

(CoinDesk)

Top Stories

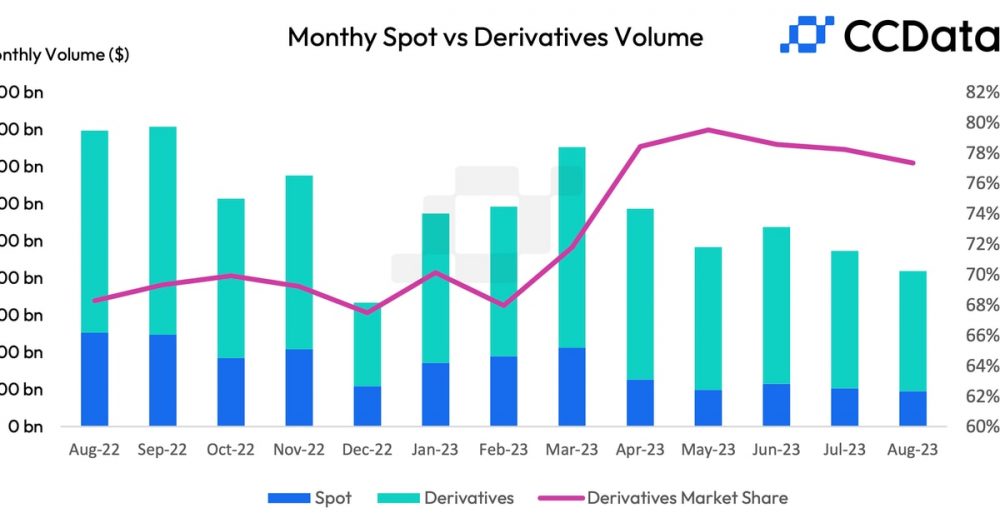

Crypto spot trading is at its lowest level since March 2019, according to digital assets data provider CCData, shedding some light on the soporific state of the market. Spot trading volume on centralized exchanges fell 7.78% to $475 billion in August, while volume in derivatives fell over 12% to $1.62 trillion, the second-lowest since 2021. An event such as Grayscale’s court victory over the SEC last week would have been expected to stoke a rally in crypto prices, but even this failed to spur traders into activity. “The low spot trading volume and the fluctuations in the open interest data suggest that the market is currently driven by speculation,” CCData said.

Major South Korean investment banking firm Mirae Asset Securities is working with the Polygon network to advance tokenization within finance. The Ethereum scaling network will serve as a technical consultant to the $500 billion asset manager, which is looking to create infrastructure to issue, exchange and distribute tokenized securities. Tokenization involves representing real-world assets such as bonds, equities and physical assets as digital tokens that can be traded on the blockchain, the theory being that this will make transacting them more efficient, transparent and liquid. Mirae would join other institutions such as Franklin Templeton in initiating tokenization projects on Polygon.

Cboe’s BZX exchange filed the paperwork on Wednesday to list spot ether (ETH) ETFs of Ark 21Shares and VanEck. Coinbase will act as the surveillance-sharing partner for both products, similar to its proposed role in a large number of spot bitcoin (BTC) ETFs. Once the SEC acknowledges the filings, it will have 240 days to return a decision, a period it usually allows to go the distance. If either fund is approved, it would be the first spot ether ETF to list in the U.S. and possibly the first such product for any crypto asset. It remains to be seen whether ether ETF applications will meet the same fate of ongoing delays and rejections by the SEC that have beset bitcoin products.

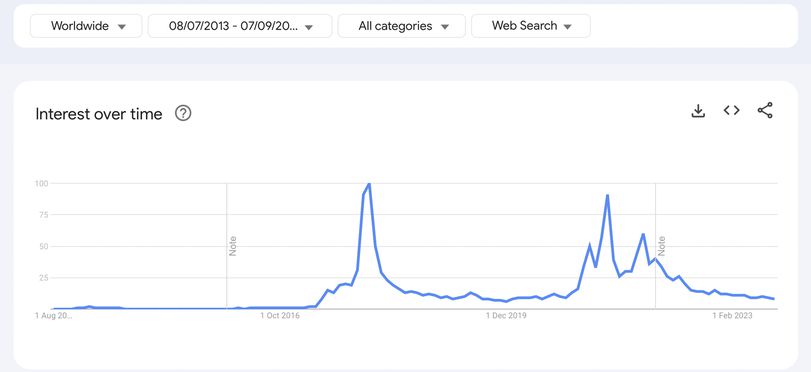

Chart of the Day

(Google Trends)