This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

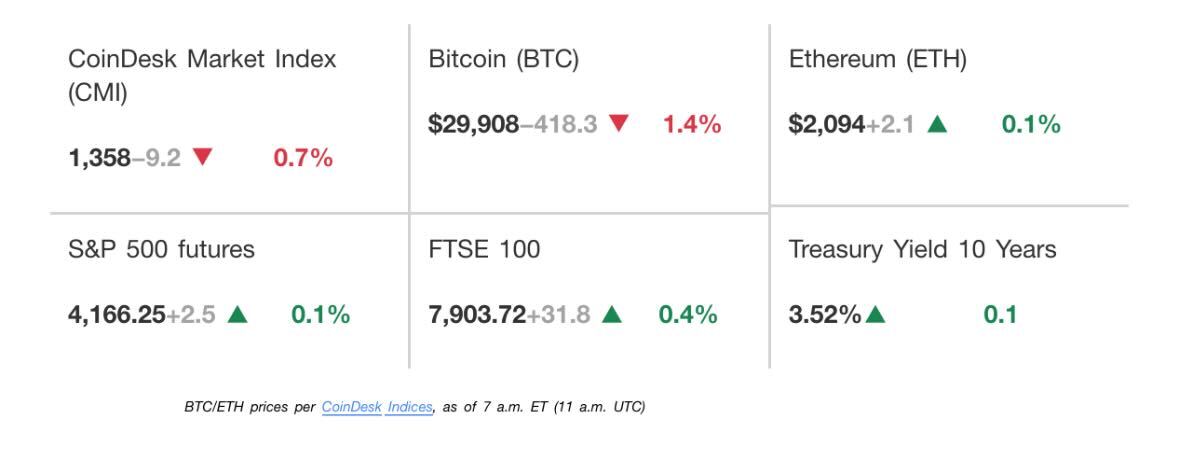

Latest Prices

Top Stories

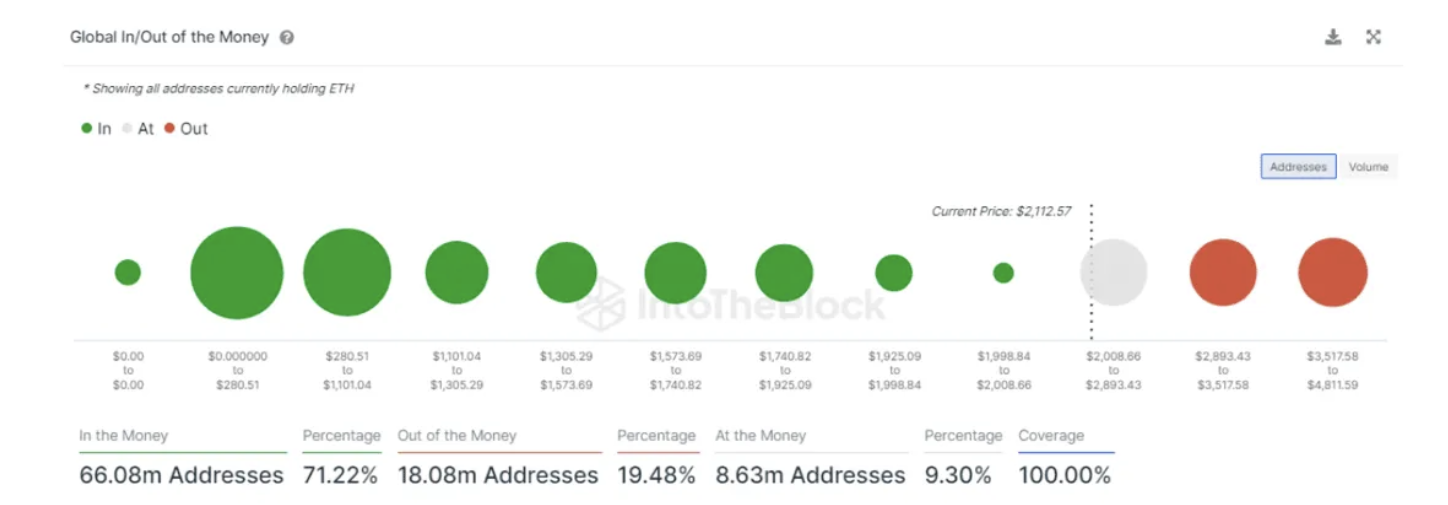

Ether is holding above $2,000 after it reached an 11-month high on Sunday of $2,141. The cryptocurrency’s upward movement comes after the Ethereum blockchain’s Shanghai software upgrade last week, although Simon Peters, an analyst at investment firm eToro, wrote in a morning note that the reaction to the upgrade was largely muted and that ether’s price jump was more of a response to macroeconomic conditions. Bitcoin, the world’s largest cryptocurrency by market value, lost 2% in the past 24 hours to fall below $30,000. Layer 1 network Avalanche’s AVAX led gains on Monday, up 7% in the past 24 hours. Last week, financial institutions T. Rowe Price, WisdomTree, Wellington Management and Cumberland joined Avalanche’s “subnet” called “Spruce” to make trade execution and settlements more efficient.

Basketball legend Shaquille O’Neal has been served in a class-action lawsuit against FTX founder Sam Bankman-Fried, a law firm for the plaintiffs tweeted on Sunday. “Plaintiffs in the billion $ FTX class action case just served @SHAQ outside his house,” a law firm led by Adam Moskowitz tweeted. Dubbed “Shaqtoshi” in an FTX commercial, O’Neal is one of several celebrities, including “Shark Tank” host Kevin O’Leary, football star Tom Brady and basketball player Steph Curry, who are facing a class-action lawsuit for promoting a “fraudulent scheme.” When crypto exchange FTX had collapsed O’Neal had said “I was just a paid spokesperson for a commercial.”

Bitcoin is closely following its early 2019 surge and its price could peak at around $45,000 next month, according to Vetle Lunde, a senior analyst at K33 Research. The cryptocurrency has soared 80% this year, beating traditional risky assets, including the tech-heavy Nasdaq index, by a wide margin. The rally comes after a 12-month decline when prices fell 76% and bottomed out in November 2022. The drop and subsequent recovery are analogous to the pattern seen in the 2018-19 bear market in terms of length and trajectory, according to Lunde. “Bottoms in both cycles lasted for approximately 370 days. And the peak-to-trough return after 510 days of both cycles reached 60%,” Lunde said in a note sent to clients last week. “In 2018, the bear market rally topped 556 days after the 2017 peak, on June 29, 2019, with a 34% drawdown from the peak.”

Chart of the Day

(IntoTheBlock)

Recommended for you:

- Amber Group’s Ex-U.S. CEO Raazi Joins EDG, a Digital-Asset Structured Product Firm

- AXA Investment Managers Gains French Crypto Registration

- An Ode to LocalBitcoins (and a Lesson About Maintaining Bitcoin’s Public Goods)

- Join the Most Important Conversation in Crypto and Web3 in Austin, Texas April 26-28

Trending Posts