This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Bitcoin rose slightly on Thursday while the U.S. dollar slippedas investors showed an increased appetite for risk. Bitcoin was up 1% over the past 24 hours to about $28,500. It reached an intraday high of $29,100 but has since retreated a bit. Contracts on the tech-heavy Nasdaq 100 advanced 0.4% after a rally on Wednesday to enter into a bull market for the first time in nearly three years. Meanwhile, data from IntoTheBlock shows that bitcoin now has the highest “Sortino ratio” compared with traditional markets and ether. The metric measures the risk-adjusted performance of assets. A higher Sortino ratio suggests better risk-adjusted returns.

Crypto investors are fleeing Circle Internet Financial’s USD coin (USDC) stablecoin, with many of them switching to tether, another stablecoin, which has reached a 22-month high in market share. Net outflows from USDC have surpassed $10 billion since March 10 That’s when regulators shuttered Silicon Valley Bank, a firm Circle banked with. Circle, a payments firm, has weathered SVB’s collapse as USDC has re-established the U.S, dollar price peg it lost in the immediate aftermath of SVB’s failure, but the token has still dropped 23% from its one-time $43 billion market capitalization, according to crypto price tracker CoinGecko. USDC’s plunge comes as the stablecoin sector has been severely tested by problems in the banking industry and regulatory scrutiny. Crypto exchange Binance’s BUSD token has also plummeted, among other stablecoins.

OKX says it has identified $157 million in digital assets belonging to FTX and Alameda Research, and is turning them over to the bankruptcy estate for the two firms that both filed for bankruptcy in November. The exchange didn’t specify what digital assets it had identified. OKX said in a release it conducted investigations to identify any FTX-related transactions on its exchange, and upon discovering assets and accounts linked to FTX and Alameda Research, a trading firm that is affiliated with FTX, it moved to secure the assets and freeze the connected accounts. Shortly after the collapse of FTX, a hacker siphoned $600 million from the exchange’s wallets, leading to fears that FTX accounts on other exchanges were compromised.

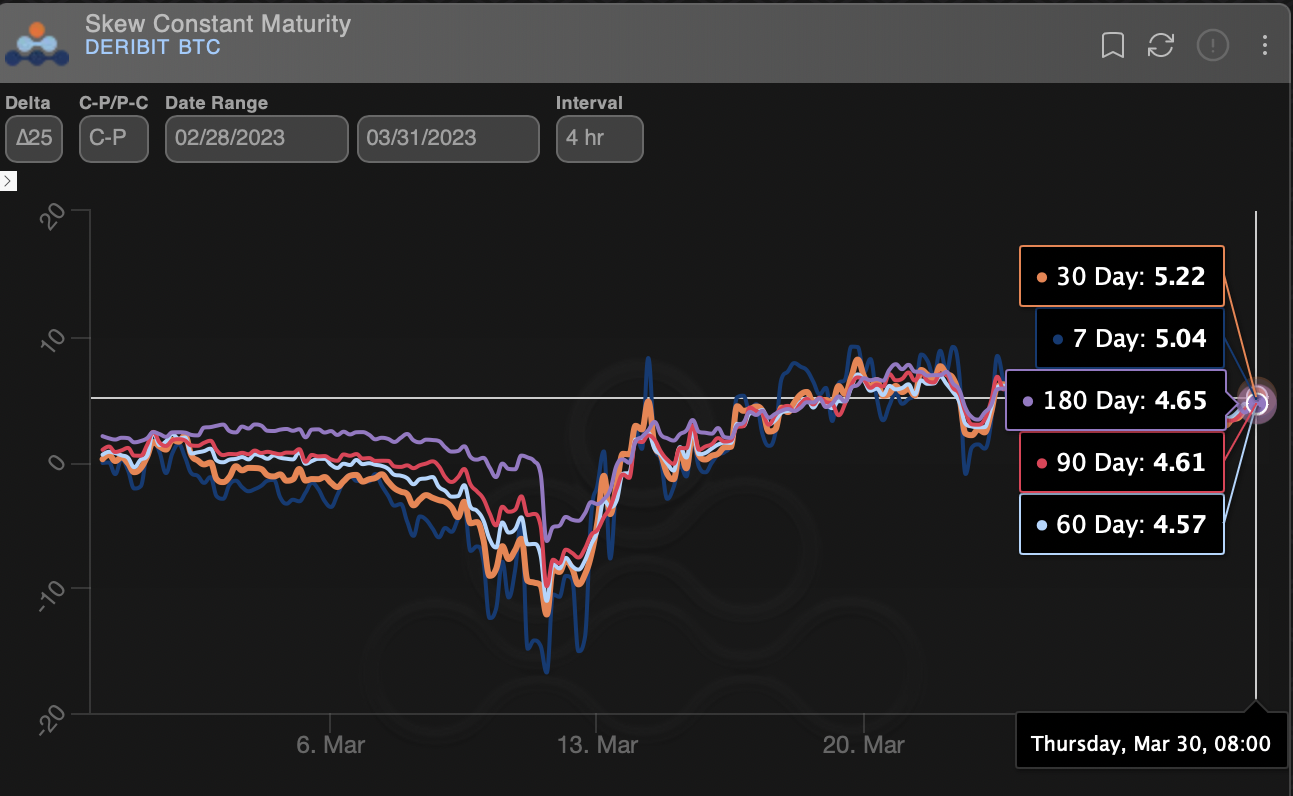

Chart of the Day

(Amberdata)

Recommended for you:

- Why NFTs Are So Appealing – And How Anyone Can Start Learning for Free

- SEC Is ‘Completely Out Of Control,’ Says a16z Crypto’s Head of Policy

- Kazakhstan to Press On With CBDC Development Until 2025

- Join the Most Important Conversation in Crypto and Web3 in Austin, Texas April 26-28

Trending Posts