This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Lawmakers in the European Union on Thursday voted 517-38 in favor of a new crypto licensing regime, Markets in Crypto Assets, popularly known as MiCA, with 18 abstentions, making it the first major jurisdiction in the world to introduce a comprehensive crypto law. The European Parliament also voted 529-29 in favor of a separate law known as the Transfer of Funds regulation, which requires crypto operators to identify their customers in a bid to halt money laundering, with 14 abstentions. The votes follow a Wednesday debate in which lawmakers largely supported plans to make crypto wallet providers and exchanges seek a license to operate across the bloc and require issuers of stablecoins tied to the value of other assets to maintain sufficient reserves.

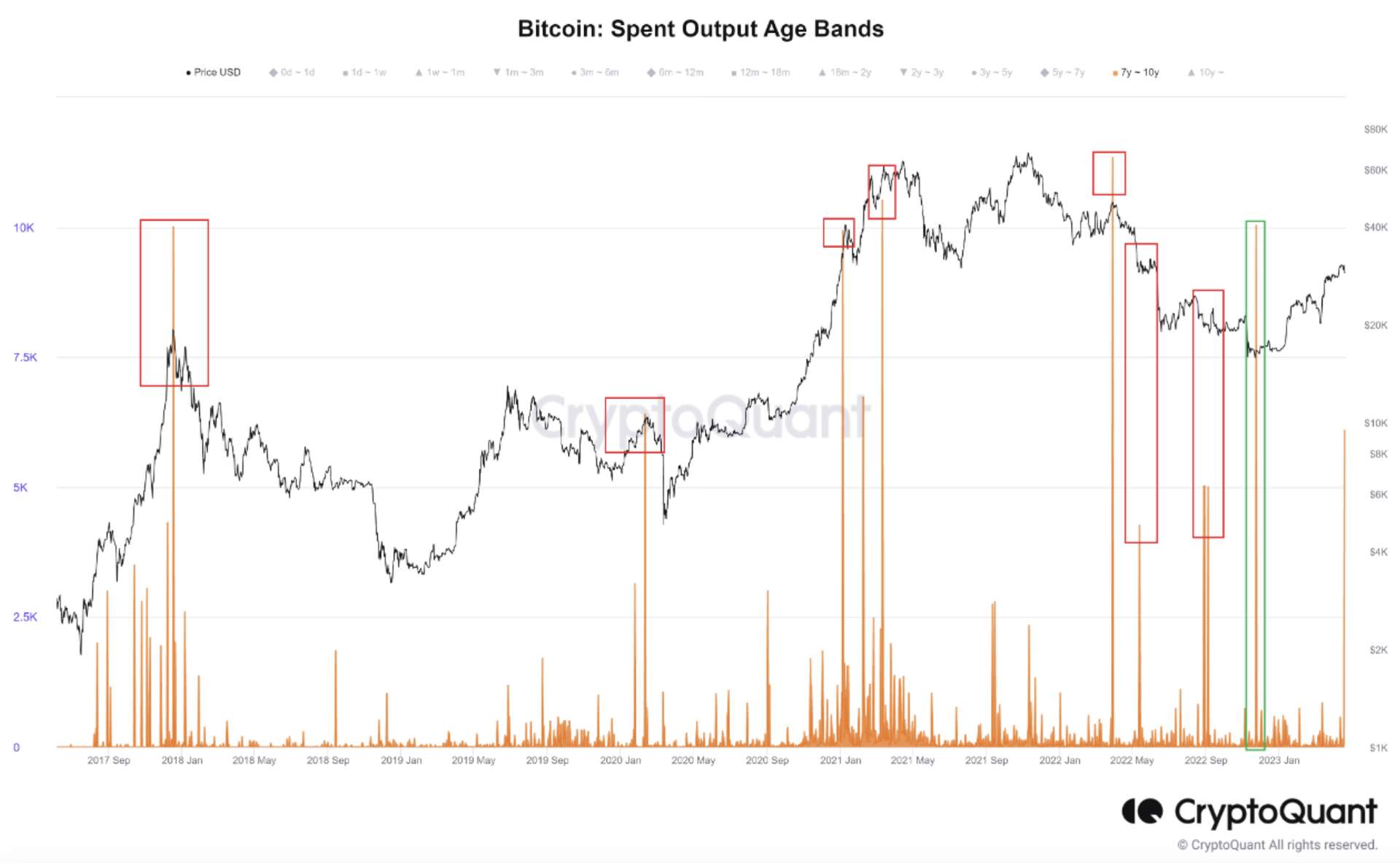

Bitcoin fell for a second straight day on Thursday, dropping to $28,500, a 10-day low. The world’s largest cryptocurrency declined 2% over the past 24 hours as traders across the globe moved away from risky assets. Bitcoin closed below its 20-day moving average on Wednesday, according to data from TradingView, a sign of weakness. The cryptocurrency has rallied this year, but Craig Erlam, an analyst at foreign-exchange trading firm Oanda, said in a morning note that the recovery may be running on fumes. Popular meme token, dogecoin (DOGE), was one of the few coins trading in the green Thursday, up 5% over the past 24 hours. Some supporters refer to April 20 as “DogeDay.”

The substantive parts of the Voyager Digital-Binance.US sale deal could be allowed to proceed even before a legal appeal is worked through, court filings made Wednesday suggest, as concerns rise that the buyer could pull out. The document says the U.S. government has now agreed that the bulk of Binance.US’ $1 billion deal to purchase assets of the bankrupt crypto lender can proceed, despite concerns that the fine print of the contract would pardon breaches of tax or securities law. The filing proposes that, until an appeal is settled, those contentious “exculpation provisions” should remain on hold, but not the remaining elements of the deal.

Chart of the Day

Recommended for you:

- Student Organizations Pull Their Weight in DeFi Protocol Governance

- Skyweaver Is a Great Blockchain Game, and an OK Regular Game

- Trump Digital Trading Card Project Mints NFTs for Winners of Prizes

- Join the Most Important Conversation in Crypto and Web3 in Austin, Texas April 26-28

Trending Posts