This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

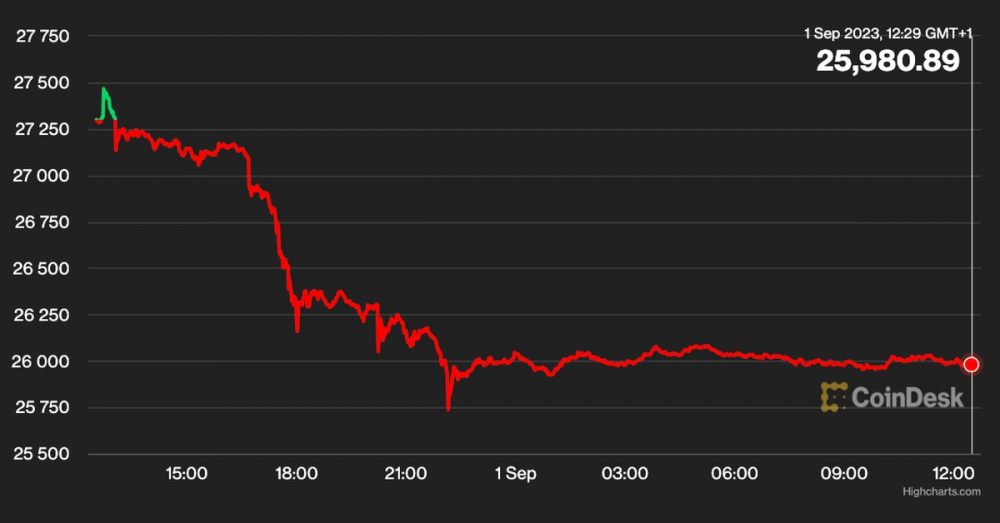

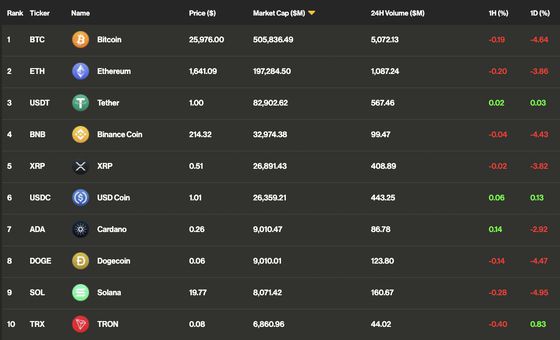

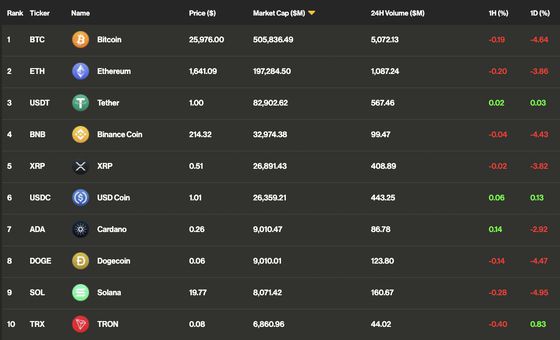

Latest Prices

Top Stories

The U.S. Securities and Exchange Commission (SEC) delayed until October a decision on all spot bitcoin exchange-traded fund (ETF) applications submitted by firms including BlackRock, WisdomTree, Invesco Galaxy, Wise Origin, VanEck, Bitwise and Valkyrie Digital Assets, according to agency filings on Thursday. The SEC began reviewing the latest slate of applications from both crypto-heavy and traditional finance firms last month. The applicants hope to launch the first spot bitcoin ETF, which advocates have argued will allow for greater retail investment in the bitcoin market while saving investors the trouble of setting up a wallet or having to buy the cryptocurrency directly.

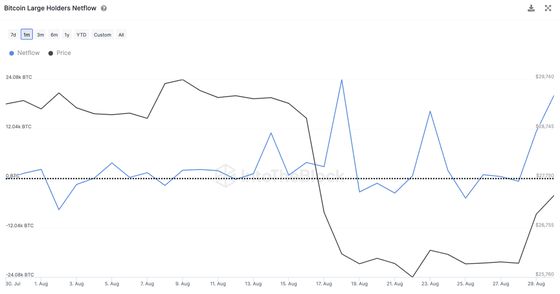

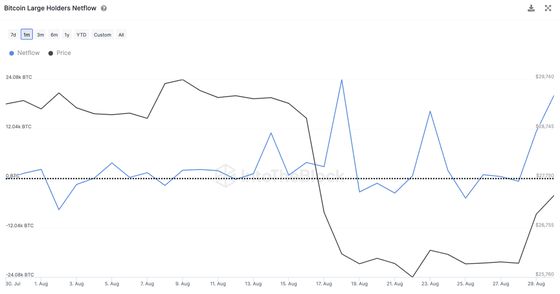

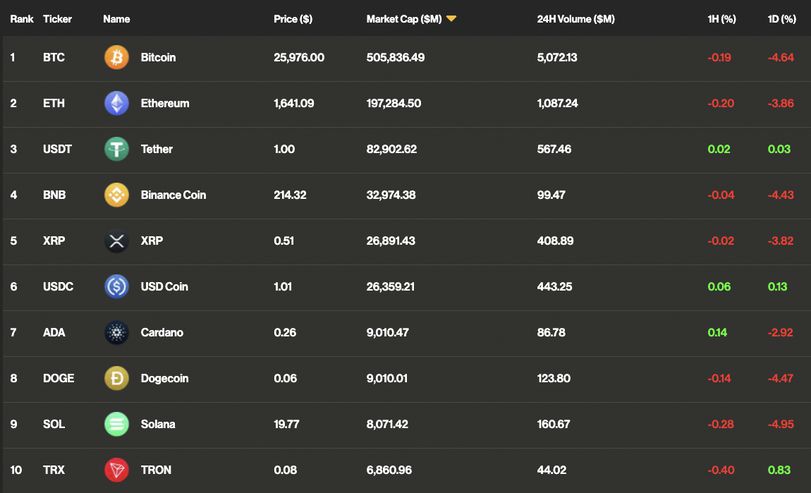

Bitcoin and major tokens gave back all weekly gains as the SEC delayed key ETF decisions that were expected on Friday, damping traders’ hopes of a long-term recovery. The largest cryptocurrency fell under $26,000. In the past 24 hours, majors solana (SOL) and litecoin (LTC) dropped as much as 5.5% while ether (ETH) lost 3.7%. Bitcoin cash (BCH) slid 7.7%. Only tron (TRX) and toncoin (TON) were in the green on Friday, up over 1% each.

A New York court classified popular cryptocurrencies ether and bitcoin as “commodities” while dismissing a proposed class action lawsuit against leading decentralized crypto exchange Uniswap in a Wednesday filing. The lawsuit – filed in April 2022 by a group of investors against Uniswap and its creator Hayden Adams – alleged the DeFi platform violated U.S. securities laws by failing to register as an exchange or broker-dealer, offering and soliciting securities on an unregistered exchange. The suit sought to hold Uniswap accountable for investors losing money to “scam tokens” issued and traded on the protocol. The tokens cited in the suit include Ethereum (ERC-20) tokens EthereumMax (EMAX), Bezoge (BEZOGE) and Alphawolf Finance (AWF). But Wednesday’s ruling to scrap the suit before it goes to trial stated the true defendants of the case were the issuers of the tokens in question, not Uniswap. While SEC Chief Gary Gensler has so far shied away from calling ETH a security, Judge Katherine Polk Failla of the Southern District of New York directly called it a commodity and declined to “stretch the federal securities laws to cover the conduct alleged,” in the case against Uniswap.

Chart of the Day