-

Price Point: Both bitcoin and ether trade flat after Ethereum successfully completed its much anticipated Merge earlier Thursday. Ether futures market discount evaporates after the Merge.

-

Market Moves: Ether’s one- and three-month implied volatility gauges have come off sharply from Tuesday’s high as Ethereum’s high-anticipated technological change of how its blockchain verifies transactions went smooth early today.

-

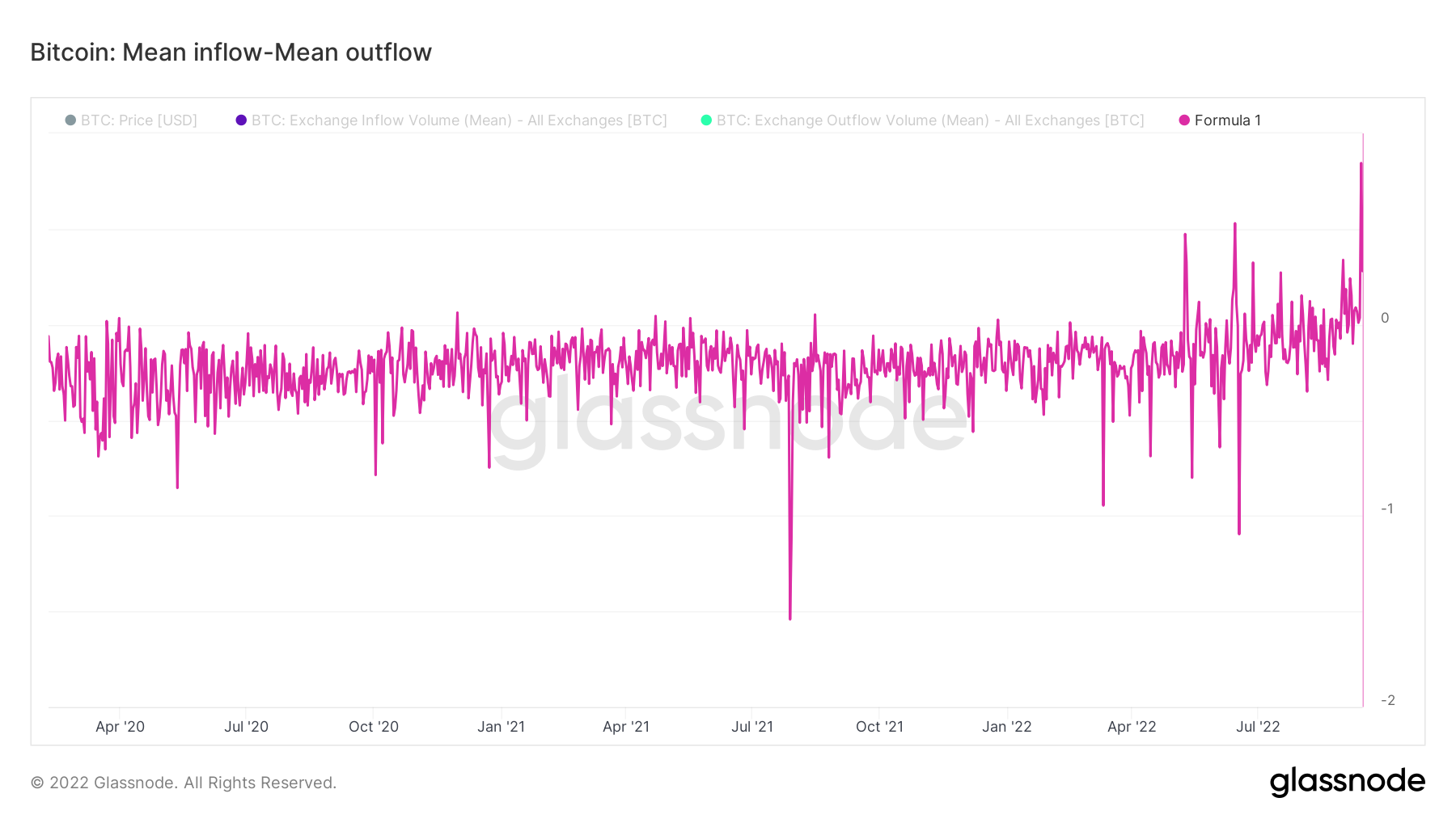

Chart of the Day: Bitcoin’s mean net inflows surge to a six-year high.

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Price Point

Ethereum’s historic change of the way it processes transactions went live early Thursday without any hiccup, disappointing traders positioned for a spurt in volatility.

The so-called Merge, marking the network’s shift to a more energy-efficient “proof-of-stake,” happened at 6:43 UTC, following which ether (ETH) witnessed a short-lived spike from $1,600 to $1,655. At press time, bitcoin (BTC) and ether were trading flat on the day.

“Happy Merge Day. Historic day in Crypto as the Merge completes successfully and somewhat uneventfully, which is a testament to ETH Devs,” over-the-counter institution-focused tech platform Paradigm said in its Telegram broadcast, taking note of subdued price action and a drop in ether’s implied volatility or expectations for price turbulence.

Stock futures pointed to a second day of calmer trading as investors weighed in recent indications that the Federal Reserve will have to take tougher action to combat inflation than many had hoped.

“I still think we have not seen the bottom in crypto markets. After the higher-than-expected inflation numbers, the terminal rate has been adjusted from previous 3.5% to 4%, which means that there is still a long way to go in interest rate hikes,” said Pablo Jódar, an independent crypto analyst.

“Obviously, this is not good for growth stocks nor crypto, as higher interest rates reduce demand for risky assets. We need to see a meaningful change in inflation data to see a reversal in market tendency.”

Ethereum Classic and Lido DAO were trading up 5.7% on the day.

Ether futures market discount evaporatesafter the Merge

CoinDesk’s Omkar Godbole reported that the month-long ether futures market anomaly that stemmed predominantly from traders looking to profit from Ethereum’s technological change, the Merge, has reversed.

Ether futures have almost caught up with the cryptocurrency’s underlying spot price following the historic overhaul of the way Ethereum verifies transactions.

The annualized rolling discount in one-month bitcoin futures listed on Deribit, the world’s largest crypto options exchange, narrowed to 0.3% from 17.66% before the changeover, which went live at 6:43 UTC, according to data provided by Skew.

Ether moves to centralized exchanges

A large amount of ether was moved to centralized exchanges ahead of the Merge.

Cryptocurrency lender deposited 450,000 ETH worth $720 million to leading digital assets exchange Binance late Wednesday, according to data tweeted by Nansen’s CEO Alex Svanevik. While crypto exchange Bitfinex received 288,442 ETH worth $490 million.

The cumulative inflow of $1.2 billion is supposedly the largest in six months. The total number of ETH held in centralized exchange wallets has jumped to a two-month high of 25.34 million.

CoinDesk Market Index

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Polymath | POLY | +5.77% | DeFi |

| Cosmos | ATOM | +4.16% | Smart Contract Platform |

| Lido DAO | LDO | +3.95% | DeFi |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Ravencoin | RVN | -18.16% | Currency |

| Compound | COMP | -11.47% | DeFi |

| Terra Luna Classic | LUNA | -8.33% | Smart Contract Platform |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk Market Index (CMI) is a broad-based index designed to measure the market capitalization weighted performance of the digital asset market subject to minimum trading and exchange eligibility requirements.

Market Moves

Ether’s Implied Volatility Slides as Merge Goes Smooth

By Omkar Godbole

Ether’s one- and three-month implied volatility (IV) gauges have come off sharply from Tuesday’s high as Ethereum’s high-anticipated technological change of how its blockchain verifies transactions went smooth early today.

“The large volatility event did not happen and once the first block was finalized for the proof-of-stake chain, IVs started to come off,” Markus Thielen, chief investment officer at BritishVirgin Islands-based IDEG Asset Management, said.

“The ease of short-term risk aversion has caused the IV of short tenor options to drop significantly, Griffin Ardern, a volatility trader from crypto asset management firm Blofin, said.

Ahead of Ethereum’s so-called Merge, some traders were worried that the upgrade may run into last minute problems, injecting volatility into markets. So traders had bought short-term puts or options offering protection from price drops, Thielen told CoinDesk.

However, once the Merge went smooth, ether held steady and the puts bought in anticipation of volatility began bleeding money, forcing traders to square off their positions.

That led to a drop in the implied volatility. A rise in demand for options lifts IV and vice versa.

Chart of The Day

Bitcoin’s Mean Net Inflows Surge to a Six-Year High

By Omkar Godbole

Bitcoin mean inflow-mean outflow (Glassnode)

-

The spread between the mean amount of BTC per transaction sent to the exchange and the mean amount withdrawn from the exchange rose to 0.84 early this week, hitting the highest in six years, according to data sourced from Glassnode.

-

The data indicates investors depositing lot of coins on centralized exchanges is increasing.

-

Exchange inflows are often taken to represent investor intention to sell.

Latest Headlines

-

Thailand’s SEC Bans Crypto Firms From Offering Staking and Lending Service: The regulator recently filed a police report against Zipmex after the exchange froze withdrawals in July.

-

The Ethereum Merge Is Done. Did It Work?: The historic upgrade casts aside the miners who had previously driven the blockchain, with promises of massive environmental benefits.

-

Bernstein: Strong Institutional Adoption of Ether Expected Following the Merge: The new economic model under the Merge combined with token burn could lead to negative token emission during periods of high demand, the report said.

-

South Korea Looks to Invalidate Terra Co-Founder Do Kwon’s Passport, Local Media Reports:The CEO of Terra along with five others were issued with an arrest warrant on Wednesday.

-

Crypto Exchange Coinbase Enlists Broadridge Financial to Improve Liquidity: Coinbase will use Broadbridge’s NYFIX order-routing network.

-

Ether Futures Market Discount Evaporates After the Merge: The negative spread between futures and spot prices has narrowed from $20 to almost zero following the Merge.