Good morning. Here’s what’s happening:

Prices: Bitcoin, ether and other major cryptocurrencies swung upward despite ongoing concerns about FTX fallout and macroeconomic uncertainties.

Insights: Grayscale’s other digital asset trusts don’t have as much institutional interest as GBTC, which trades a serious discount but is still being scooped up by Cathie Wood’s ARK.

Prices

Bitcoin Climbs Toward $17K, Despite Investor Unease

By James Rubin

Bitcoin continued its surge from Monday, despite ongoing investor unease over FTX fallout, central bank monetary hawkishness and the potential impact of mass protests in China over the country’s harsh covid restrictions.

The largest cryptocurrency by market capitalization was recently trading over $16,979, up nearly 4.5% during the previous 24 hours and its highest point in about two weeks. BTC has shown remarkable resilience, holding largely above $16,000 in the nearly month since crypto exchange FTX started to implode after a CoinDesk story about irregularities in its balance sheet.

“People are nervous now,” John Peurifoy, co-founder and CEO of crypto brokerage firm Floating Point Group. “They’re nervous about where the contagion goes, what counter-parties they’re working with. Can they put money in different places? Are they going to lose it? So people are cautious.”

Ether fared even better, recently climbing more than 7.5% to $1,272, its highest level since the second week of November. Other major cryptos assumed various hues of green, most of them dark with UNI, the token of the smart contracts-based Uniswap platform, and SUSHI, the token of the decentralized exchange SushiSwap, each recently rising over 7%. The popular meme coin DOGE continued its momentum, rising 6% to trade at about $.10.7 cents. DOGE has jumped roughly 50% over the past week.

U.S. equity indexes closed mixed amid rising macroeconomic uncertainties with the the tech-heavy Nasdaq and S&P 500 closing down down 0.5% and 0.1%, respectively, but the Dow Jones Industrial Average trading flat. On Tuesday the Chinese government ratcheted up its efforts to quell the Covid-related demonstrations, sending police to protest hubs and increasing online censorship.

And markets will be listening nervously on Wednesday to remarks by U.S. Federal Reserve Chair Jerome Powell, who is scheduled to speak at the Hutchins Center on Fiscal and Monetary Policy on Wednesday. Fed officials have recently suggested an openness to more dovish interest rate hikes, even while reiterating their commitment to lowering inflation through monetary tightening. Meanwhile, they will also be eyeing Congressional efforts to head off a rail strike that could send prices upward, reversing recent progress. The Consumer Price Index dipped to 7.7% in October, lower than consensus projections and down from 8.2% the previous month.

Floating Point Group’s Peurifoy was circumspect about predicting how low bitcoin’s price would reach in the current bearish environment. “How many more pieces will fall?” he asked. “How many people will have to sell crypto to get liquidity? People are holding back selling if they don’t need to, but at the same time, some people are having to because of economic situations.”

“We’re at this pause period. I call it the doldrums.”

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Ethereum | ETH | +7.6% | Smart Contract Platform |

| Dogecoin | DOGE | +6.0% | Currency |

| Polkadot | DOT | +5.8% | Smart Contract Platform |

Biggest Losers

Insights

Grayscale’s digital asset trusts, such as GBTC and ETHE, are trading at a serious discount

By Sam Reynolds

Grayscale is best known for its Grayscale Bitcoin Trust (GBTC), but it also operates a whole suite of digital asset-based trusts.

Grayscale is owned by Digital Currency Group, which is also CoinDesk’s parent company.

When discussing GBTC, the words ‘discount’ and ‘record’ often come in the same sentence.

GBTC trades at a significant discount because there’s no redemption function for the trust. Meanwhile, bitcoin ETFs listed on the Toronto Stock Exchange is where the liquidity is going. The ‘Hotel California’ nature of GBTC was supposed to be solved by converting the trust into a bitcoin ETF, but the Securities and Exchange Commission (SEC) has continued to block it, which has led to a lawsuit.

So far this year, the GBTC discount has blown past its previous records given the broader FTX market contagion, and is now trading at a negative 40%.

And GBTC is just one of the trusts offered by Grayscale.

Many other digital asset trusts that have a significant AUM face the same predicament as GBTC.

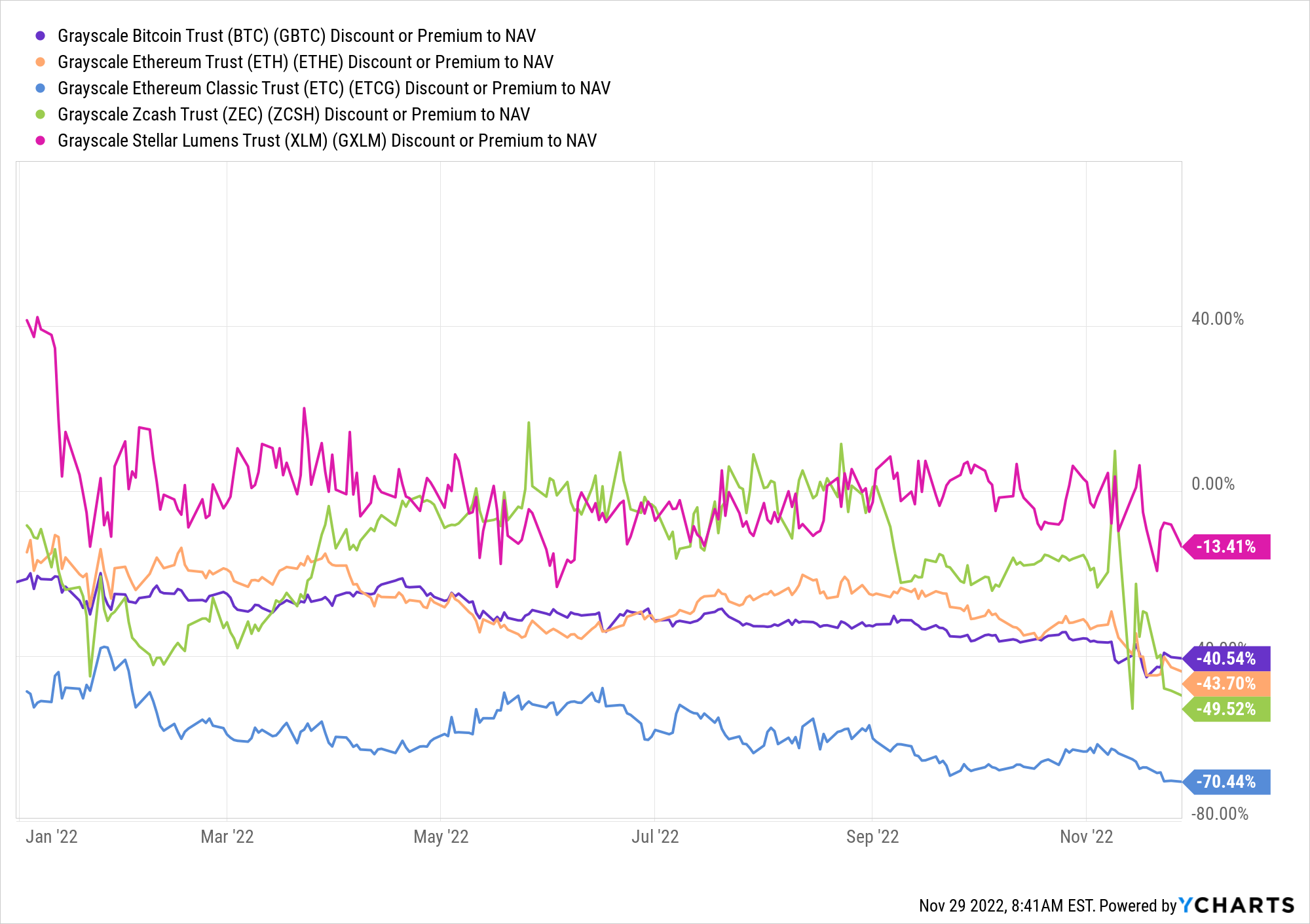

(Ycharts)

Data compiled by YCharts shows that Grayscale’s Ethereum Classic Trust is trading at a 43.7% discount, while its ZCash trust trades at just under a 49% discount.

Its Ethereum Classic trust, meanwhile, trades at a whopping 70% discount.

Of course, all these have the same problem: The shares can be traded on the open market after a long lockup period, but not redeemed for the underlying asset. Grayscale is one of the largest holders of GBTC, simply because DCG has allocated so much cash for buybacks.

“The Trust currently has no intention of seeking regulatory approval to operate an ongoing redemption program,” reads a 10Q filing for the ZCash trust. Similar language is found in a 10Q filing for the Ethereum Trust.

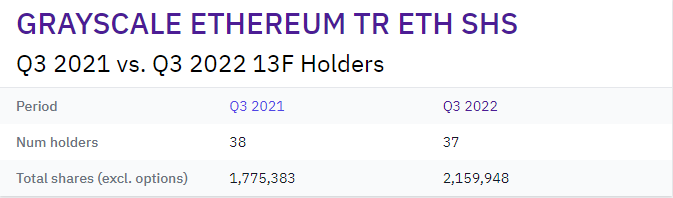

One other problem is these other trusts simply don’t have the institutional interest that GBTC has. According to data compiled by 13F.info, which tracks 13F filings by fund managers, GBTC is held by 61 fund managers, while ETHE is held by 37.

61 fund managers hold GBTC (13F.info)

37 fund managers hold ETHE (13F.info)

Cathie Wood’s ARK has still been buying GBTC, but its holdings of GBTC are down by 26% since the same quarter in 2021, according to 13F data, while its much smaller holdings of ETHE are down by 15% during the same time period. There certainly are others making buys, but the scale just isn’t there.

Grayscale’s other trusts are too small to be listed in 13F filings. The Litecoin trust has a significant premium, but there hasn’t yet been institutional interest in the product.

It’s tough to see how this can all turn around, considering the bear market and the SEC’s reluctance to offer a redemption scheme.

Important events.

8:30 a.m. HKT/SGT(00:30 UTC) Australia’s Monthly Consumer Price Index (YoY/Oct)

9:00 a.m. HKT/SGT(1:00 UTC) China’s NBS Manufacturing PMI (Nov)

9:30 p.m. HKT/SGT(13:30 UTC) United States’ Gross Domestic Product Annualized (Q3)

CoinDesk TV

In case you missed it, here is the most recent episode of “First Mover” on CoinDesk TV:

BlockFi to Make First Appearance in Bankruptcy Court; Bitcoin Bounces Above $16K

Cryptocurrency lender BlockFi, the latest casualty of the FTX collapse, was scheduled to make its first appearance in bankruptcy court after filing for Chapter 11 protection. Hodder Law Firm founder Sasha Hodder joined “First Mover” to discuss the legal proceedings. Bitcoin and ether prices were higher despite the BlockFi filing. Floating Point Group CEO John Peurifoy shared his crypto markets outlook. Plus, what other companies could be impacted by FTX’s fallout? Bernstein’s Gautam Chhugani joined the conversation.

Headlines

Sam Bankman-Fried Addresses Withdrawals, FTX Collapse in Newly Released Audio Interview: The FTX founder said he unpaused Bahamian FTX withdrawals to “appease” local customers and added his lawyers to the groups of people he said can “go f–k themselves.”

Coinbase Wallet to End Support for Bitcoin Cash, Ethereum Classic, Ripple’s XRP and Stellar’s XLM:The company took note of “low usage” as its reason for no longer supporting those tokens.

France, Luxembourg Test CBDC for 100M Euro Bond Issue: The Venus Initiative is the latest attempt to use digital representations of money for financial-market settlements.

India to Test Digital Rupee in 4 Cities With 4 Banks: The test, which will start on Thursday, will be extended to include another nine cities and four more lenders in a later phase.

DeFi Lender Compound Tightens Borrowing Limits After Aave Exploit Attempt: A passed proposal introduces borrowing caps for five cryptocurrencies and sets stricter loan limits for another five.