Good morning. Here’s what’s happening:

Prices: Bitcoin and most other cryptos return to the red.

Insights: Metaverse ETFs are struggling to keep pace with gaming ETFs.

Technician’s take: BTC’s upside appears limited despite short-term support.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis. And sign up for First Mover,our daily newsletter putting the latest moves in crypto markets in context.

Prices

Bitcoin (BTC): $29,982 -3.4%

Ether (ETH): $2,030 -4.7%

Biggest Gainers

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Internet Computer | ICP | −9.4% | Computing |

| Filecoin | FIL | −8.3% | Computing |

| Cosmos | ATOM | −7.7% | Smart Contract Platform |

Bitcoin and other cryptos falter

That didn’t last long.

A day after bitcoin broke a week-long losing streak, the largest cryptocurrency by market cap and other major cryptos were in the red again on Monday.

Bitcoin was recently down over 3% over the previous 24 hours and has fallen seven consecutive weeks. Still, it spent much of the day near or above the psychologically important $30,000 level. “As far as the last 24 hours, we’ve seen a consolidation from six to eight weeks of sell-off,” 3iQ Digital Asset’s Head of Research Mark Connors told CoinDesk.

Bitcoin and other cryptos’ performances dovetailed with equity markets, which dropped slightly on Monday and have been tumbling since last fall as inflation and supply chain issues continued to surge and investors became more risk averse. The tech-heavy Nasdaq dropped more than a percentage point on Monday.

Such growing cautiousness fanned last week by the collapse of the terraUSD stablecoin (UST), and the luna token that supports it, rocked altcoins particularly hard over the past week. On Monday, AXS and AVAX were recently down 12% and 8%, respectively. SOL declined more than 6%.

Ether, the second-largest crypto by market cap, fell over 4.6%, although it held fast above $2,000.

“In equities, you’ve taken almost a year of returns off so [there was] a rapid resetting as the Fed hiked [interest rates] in the first week of May,” Connors said. “You’ve seen digital assets, bitcoin, ether and the rest of the altcoins fall. What’s happened is there’s been a stabilization. What people are assessing is whether the interest rate hike has been taken out sales. In our opinion, it hasn’t.

Trading volume rose from the lower levels to which it hewed for the first few months of the year, a sign of a potential, and at least temporary upswing. But few analysts are predicting a more permanent departure from the the current bear market. The coming weeks may be particularly hard on stablecoins even as Terraform Labs CEO Do Kwon released a “revival plan” to save the Terra network. Kwon proposed forking Terra into a new chain without UST.

Connors said that investors would likely see three to nine months of “choppy markets,” and that prices would likely drop, possibly with support in the $20,000 to $24,000 range. In this environment, he sees investors focusing more on Bitcoin and Ethereum. “Bitcoin dominance should and will happen when markets sell off,” Connors said. “People go to quality, but it seems that Ethereium is now building up as a number two quality asset in the ecosystem.”

Markets

S&P 500: 4,008 -0.3%

DJIA: 32,223 +0.08%

Nasdaq: 11,662 -1.2%

Gold: $1,824 +0.6%

Insights

Metaverse ETFs are struggling to keep pace with gaming ETFs

Sometimes a fancy new investment vehicle, most recently the metaverse, doesn’t perform as well on the market as last year’s model.

Metaverse exchange-traded funds (ETF) arrived last year shortly after the term entered our lexicon and became a favorite of venture capitalists. Because the metaverse is simply a mashup of gaming and crypto, these metaverse ETFs look a lot like gaming or eSports ETFs (the two terms are synonymous), which launched a few years ago.

They look like them because the metaverse is an ambiguous term; the shared online experience that is envisioned in Neil Stephenson’s science fiction novel “Snow Crash” already exists on many multiplayer gaming platforms. Metaverse tokens don’t yet have listed proxies, so metaverse ETFs compensate for that by putting in publicly listed crypto companies like Galaxy (GLX.TO) or Block (SQ), the former Square. And that’s where the problem starts.

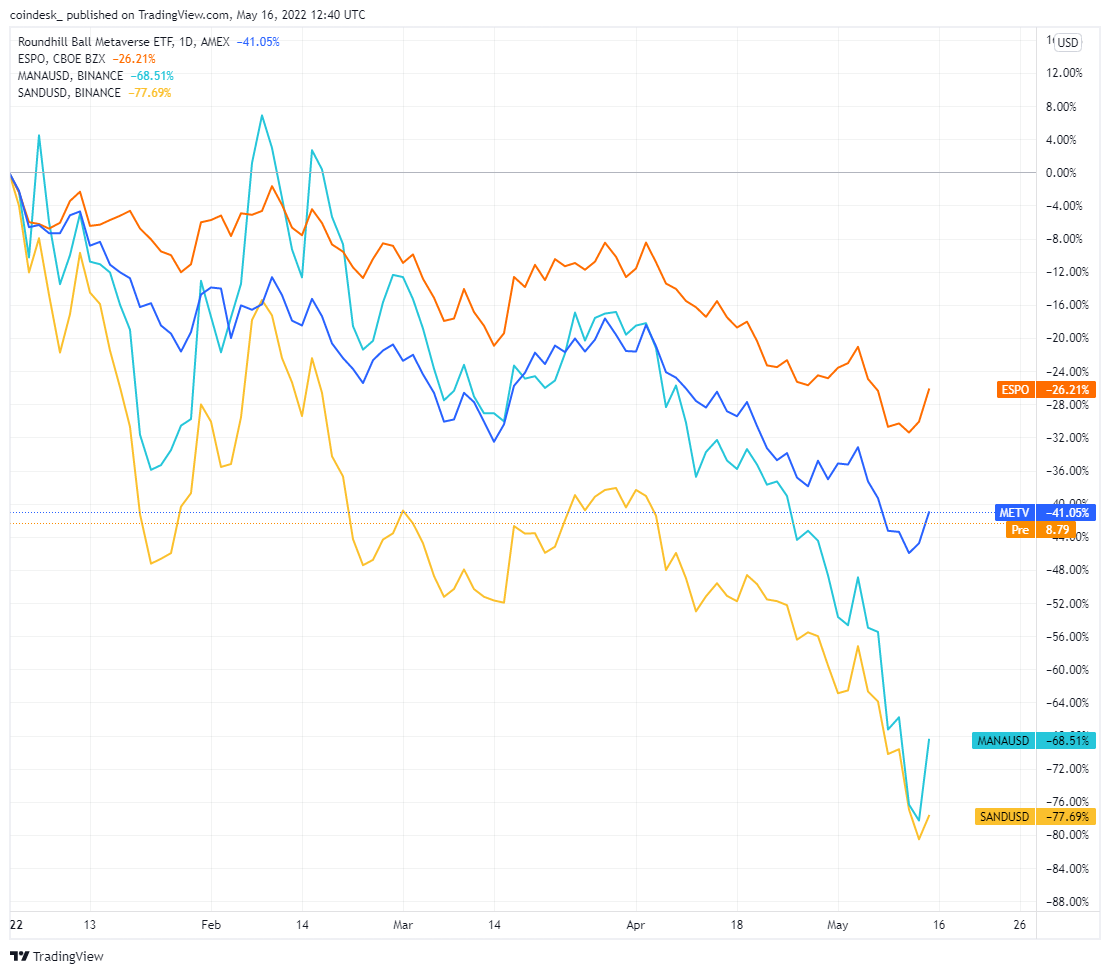

Roundhill Ball Metaverse ETF (TradingView)

That association with crypto means that METV, a metaverse ETF from Roundhill, is significantly underperforming ESPO, a gaming/eSports ETF from VanEck.

Gaming tech heavyweights, like GPU designer Nvidia (NVDS) or game engine developer Unity, are in both baskets and haven’t performed well on-year but the inclusion of the likes of Galaxy Digital – down over 60% year-to-date and planning a stock buyback [link] – really sinks the metaverse ETF.

Of course, this metaverse ETF is outperforming the metaverse tokens themselves: The Sandbox’s eponymous token (SAND) is down nearly 77% and Decentraland’s MANA is at 68% mainly because both have struggled to attract a player base that reflects their valuation.

There’s an irony here. The metaverse, which is a way to sell crypto-plus-gaming as a re-branded product, is doing better on the market than plain vanilla gaming itself.

Maybe crypto doesn’t belong in everything?

Technician’s take

Bitcoin Struggles at $27K-$30K Support Zone; Resistance at $35K

Bitcoin daily chart shows support/resistance. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin (BTC) is stabilizing around the $30,000 price level after last week’s sell-off. The cryptocurrency must remain above the $27,000-$30,000 support zone this week in order to generate a positive short-term momentum signal.

BTC was down by as much as 3% over the past 24 hours.

The relative strength index (RSI) on the daily chart is rising from oversold levels, which could keep buyers active at support. The RSI is also oversold on the weekly chart, although negative momentum could cap upside moves in price.

Immediate resistance is seen at $33,000 and $35,000, which is where a breakdown in price occurred earlier this month. That suggests a large number of sell orders could limit a relief rally over the next two weeks.

Further, the recent underperformance of alternative cryptos (altcoins) relative to bitcoin suggests a lower appetite for risk among crypto traders. Typically, alts decline by more than bitcoin during down markets because of their higher risk profile. The broader risk-off environment could keep BTC’s short-term downtrend intact.

Important events

Cosmos Gateway Conference

Permissionless DeFi Conference

9:30 a.m. HKT/SGT(1:30 a.m. UTC): Reserve Bank of Australia minutes

8:30 p.m. HKT/SGT(12:30 p.m. UTC): U.S. retail sales (MoM/April)

CoinDesk TV

In case you missed it, here is the most recent episode of “First Mover” on CoinDesk TV:

OKX Exec on UST and Luna Crash, Bitcoin Outlook After 7 Straight Weeks of Losses

As investors continued to digest the disastrous fall of Terra’s luna (LUNA) and stablecoin UST, OKX Director of Financial Markets Lennix Lai joined “First Mover” to explain how it handled the crash and to share his thoughts on what may happen in the industry and markets next. Plus, Charles Allen of BTCS Inc. provided market analysis and Chen Arad of Solidus Labs examined the crypto crash.

Headlines

Kwon Proposes Forking Terra, Nixing UST Stablecoin in ‘Revival Plan 2’: “$UST peg failure is Terra’s DAO hack moment,” the Terraform Labs CEO wrote, “a chance to rise up anew from the ashes.”

The Collapse of UST and LUNA Was Devastating, but There Is Still Hope for Crypto: When a prominent stablecoin and the token that backs it failed, the broader ecosystem certainly was dealt a blow, but ultimately it is surviving.

LFG Reserves Dwindle to Just 313 Bitcoins From 80K After UST Crash: The announcement comes after criticism of the Luna Foundation Guard’s “lack of transparency.”

Indian Central Bank Says Cryptos Could Lead to “Dollarization” of Economy: Report:RBI officials said cryptocurrencies could undermine the central bank’s capacity to regulate flow of money.

Japan’s Nomura Said to Launch Crypto Unit With DeFi and NFTs on Menu: Report: The Japanese investment bank carried out its first cryptocurrency derivatives trades last week.

Nigeria’s SEC Affirms All Digital Assets Are Securities in New Rulebook: Rules look to clarify crypto’s role in the economy by providing a regulatory framework.

Longer reads

Satoshi’s Mission, LUNA, UST and Where Crypto Went Wrong: In 2009, Satoshi Nakamoto encoded a mission statement for the industry in Bitcoin’s first block. Essentially, crypto should first do no harm.

Today’s crypto explainer: Bitcoin Mining Difficulty: Everything You Need to Know

Other voices: A Crypto Emperor’s Vision: No Pants, His Rules

Said and heard

“China’s economy descended deeper into a COVID-19-induced doldrums last month, raising questions about whether Beijing’s planned stimulus measures can prevent a prolonged downturn.” (The Wall Street Journal) … “Terraform Labs, the organization that built the system, supposedly deployed about $3 billion worth of bitcoin, paused the blockchain, flooded the market with UST’s sister token LUNA and tried to pay out arbitrageurs taking advantage of the volatile situation in an effort to rescue its network. Those expensive gambles failed, and even Do Kwon’s, UST’s principal architect, said the network as it once was can’t be salvaged. Terra is working on something of a repayment plan for “small” token holders. All of this raises two very important questions for the industry: Are all “algos,” or algorithmic stablecoins, dead on arrival? And should there be regulation in place to prevent a similar disaster?” (CoinDesk columnist Daniel Kuhn) … Soaring valuations and booming [initial public offerings] made startups seem like a safe bet, inspiring hundreds of new venture funds. Now, the party seems to be suddenly ending – and downsizing may signal even worse times ahead. Since January, nearly 50 startups have made significant layoffs, according to data collected by Layoffs.fyi. Among them are companies like Robinhood [HOOD] and Peloton [PTON], which after huge growth during the pandemic now face the realities of a less buoyant economy, and less cash on hand. Startups like Cameo have had to reverse the spending sprees of the last two years.” (Wired)

Save a Seat Now

BTC$30,044.46

BTC$30,044.46

3.37%

ETH$2,031.99

ETH$2,031.99

4.69%

XRP$0.424490

XRP$0.424490

4.43%

SOL$54.47

SOL$54.47

6.45%

CRO$0.194382

CRO$0.194382

3.14%

View All Prices

Sign up for Market Wrap, our daily newsletter explaining what happened today in crypto markets – and why.