Bitcoin price is already falling due to the bear market and the collapse of companies like FTX. In addition, the price of the Bitcoin trust fund on Grayscale dropped to $8,400. That is, it is trading almost $11,000 below its current price. Here are the details…

Bitcoin price, $8,400 on Grayscale

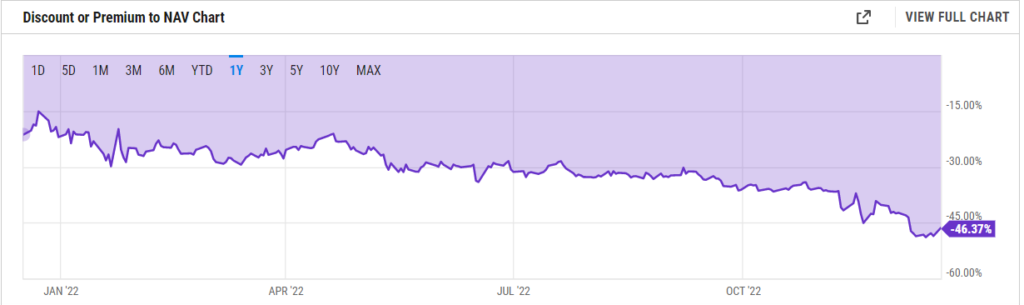

Grayscale Bitcoin Trust (GBTC), one of the largest trusts in the market, has fallen to a record low. In terms of NAV, the 50 percent discount is a new record we’ve never seen before. According to Ycharts, the NAV discount had reached 48 percent at one point two days ago. So in the current situation, Grayscale has made it the cheapest way to expose yourself to Bitcoin and some other assets. Such a strong devaluation of a fund’s shares can be considered an investment opportunity for those who want to invest in BTC for the long term, but it also has some serious downsides.

Investors tend to use arbitrage opportunities in the market immediately after they appear. Therefore, such a large discount is not used without some serious concerns. For example, according to Blockchain analysis firm Glassnode, it’s not currently the best arbitrage opportunity in the market as funding inflows to the company haven’t improved. The terms of the fund require investors to hold their shares for a certain period of time after the purchase. Therefore, the reluctance of investors to take risks through Glassnode is understandable. This creates unnecessary risks, which is the last thing you need in a volatile cryptocurrency market.

Discounts to net asset value are not uncommon for trusts like Grayscale. However, this ratio usually remains below 10 percent. Even abnormal volatility in the market should not strain a normal trust to the extent we currently see in GBTC. Grayscale is actively trying to convert the Bitcoin trust into an ETF to combat current market conditions. Currently, Grayscale’s discount is 46.37%, while Bitcoin is trading at $16,837.

Statement from Grayscale CEO

Meanwhile, cryptocoin.com As we reported, with the Grayscale Bitcoin Trust (GBTC) making deeper discounts day by day, the firm’s CEO is considering new options for how to support investors if the trust cannot be converted into a Bitcoin ETF. Grayscale’s flagship fund offers more traditional investors an easy way to gain exposure to Bitcoin without having to buy or hold Bitcoin themselves. In June, Grayscale filed a lawsuit against the SEC after the regulator again rejected its spot Bitcoin ETF application.

Sonnenshein confirmed that the firm is committed to getting its application approved and turning the troubled Bitcoin trust into a spot ETF. The SEC still has not approved any spot Bitcoin ETFs in the US, only Bitcoin futures ETFs that depend on bets on the future price of Bitcoin rather than the current price.

Meanwhile, Grayscale is now considering whether to make a tender offer for 20% of the outstanding shares of Grayscale Bitcoin Trust (GBTC). To make such an offer would require Grayscale to amend the GBTC trust agreement, which currently does not allow repurchase of GBTC. This will require shareholder approval. In addition, the SEC will need to remove “certain requirements” for the implementation of tender offers.