Binance CEO Changpeng Zhao urges investors to control their emotions as extreme fears grip the BTC and altcoin market.

Changpeng Zhao remains bullish for BTC and altcoin market after big crash

In a recent tweet, CZ claimed that the drop will be nothing but a correction in a few years tried to alleviate the concerns of investors. Earlier today, he posted the following on his Twitter account:

It may be a first and painful first for you, but not a first for Bitcoin. Now it just looks flat. This (now) will look flat in a few years as well.

The video highlights the trajectory of Bitcoin price since 2014…

It might be the first time and painful for you, but it's not the first time for #bitcoin. It just looks flat now. This (now) will look flat in a few years too. pic.twitter.com/ehIHOREknE

— CZ 🔶 Binance (@cz_binance) May 10, 2022

The world’s richest crypto boss, whose net worth is estimated at $17.7 billion, reminded that Bitcoin has endured many major crashes in the past. CZ also urges investors to control their emotions. Those who succumb to panic may consider reducing their positions if they are unable to deal with too much risk.

Bitcoin price dropped below $30,000 for the first time since July 2021

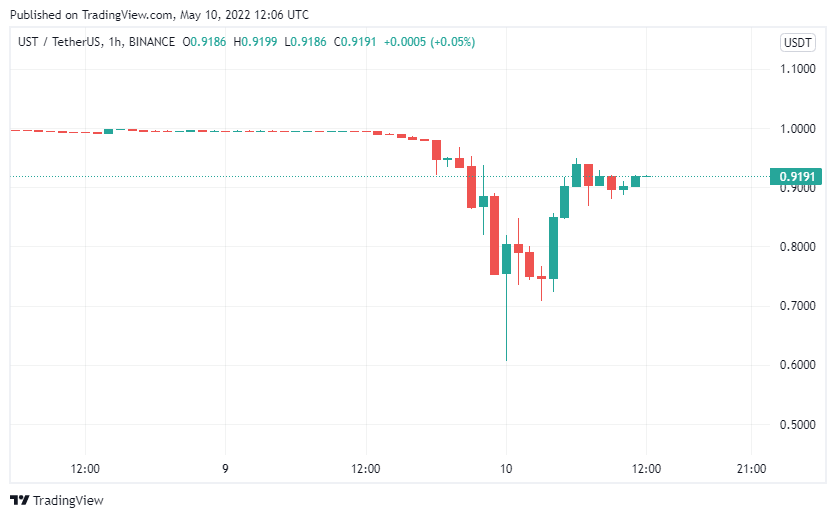

The massive sell-off was exacerbated by the explosion of Terra, one of the hottest Blockchain projects. After the flagship UST stablecoin lost stability and fell below $0.70, LUNA crashed more than 60%.

As a result of the highly volatile price movements and turbulent market, Terra Luna Foundation Guard (LFG) increased the wallet balance from 70,000 BTC ( $2.23 billion) to 0 BTC.

Thus, the biggest one-day drop for any major cryptocurrency project since XRP, which lost more than half its value due to the SEC lawsuit in December 2020. After Binance suspended withdrawals and the Luna Foundation Guard (LFG) distributed all Bitcoin reserves, the price of stablecoin UST managed to climb above $0.9 again.

Yet these unprecedented measures have failed to push the UST back to $1, and many argue that the largest decentralized stablecoin has been a massive failure.

Meanwhile, Tether (UST) capitalized on extreme volatility to exceed $160 billion in daily trading volume.