Uncertainty is mounting around Bitcoin (BTC) and Ethereum (ETH) ahead of this week’s FOMC. BTC and ETH fell on Monday ahead of a busy week in the global financial and crypto markets. Meanwhile, earnings reports of America’s top five technology companies will come this week. According to analysts, these reports, along with other reports, are likely to affect crypto prices in the coming days.

How will Bitcoin and Ethereum investors react to the Fed decision?

Volatility has hit the cryptocurrency market as speculation mounts around a series of highly anticipated meetings this week. Of particular importance to crypto market participants, however, is the FOMC on Wednesday, July 27. cryptocoin.com As you follow, US inflation reached its highest level in 40 years with 9.1% last month. Markets expect the Fed to raise interest rates by another 75 basis points to curb inflation. Analysts evaluate the impact on the market as follows:

It is possible that an interest rate hike will encourage some crypto investors to sell their holdings. High interest rate environments tend to negatively affect risky assets. Therefore, investors are likely to prefer to take profits.

How will US growth data and corporate balance sheets affect crypto?

US GDP data for the second quarter of the year will also arrive this Thursday. This is also likely to raise more fears around the possibility of a recession in the US. The economy contracted by 1.6% in the first quarter. This week’s data is expected to grow 0.5% in the second quarter. However, if growth is slower than expected or another pullback, it’s likely to be seen as another sign that the US has entered a recession.

Also this week, earnings reports from Apple, Microsoft, Alphabet, Amazon and Meta are due. These reports will also be an indicator of the health of the US economy. According to analysts, it could potentially lead to volatility in the global and crypto markets.

Bitcoin (BTC) technical view

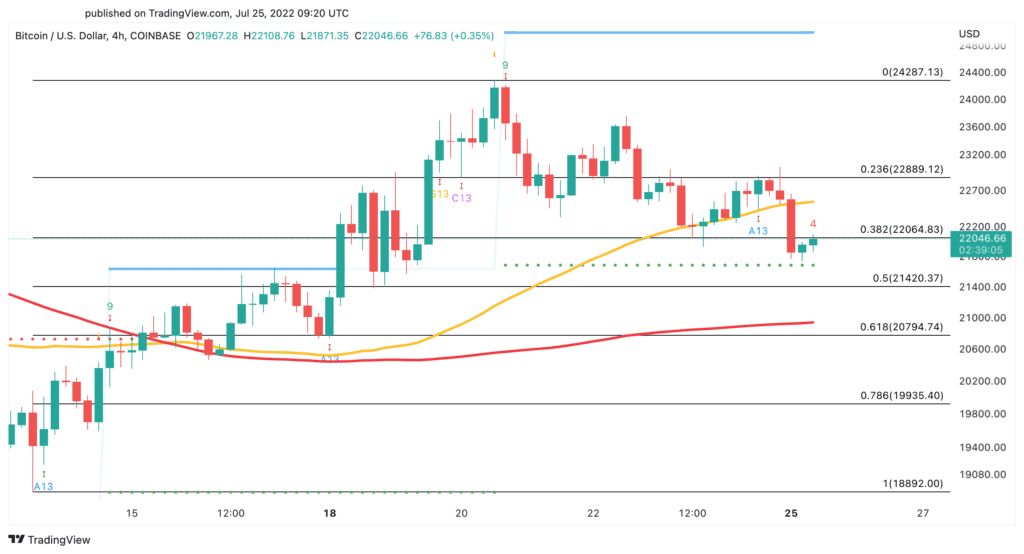

Ahead of one of the busiest weeks for crypto of summer, Bitcoin is down 3.7% at press time. The leading cryptocurrency fell from $ 22,580 to $ 21,750. Analysts picture the technical outlook of Bitcoin as follows. On the four-hour chart, Bitcoin’s recent activity marks a crucial price point. The Tom DeMark (TD) Sequential indicator shows the support trendline at $21,700. Bitcoin needs to be protected here to avoid further losses. If bitcoin fails to sustain this level, it is likely to see a drop to the 200 hourly moving average near $20,800.

Bitcoin will likely have to cut the 50 hourly moving average at $22,700 to have a chance to push higher. Overcoming this key resistance level will give it the strength to retest the July 20 high of $24,290.

BTC four-hour chart / Source: TradingView

BTC four-hour chart / Source: TradingViewEthereum (ETH) technical view

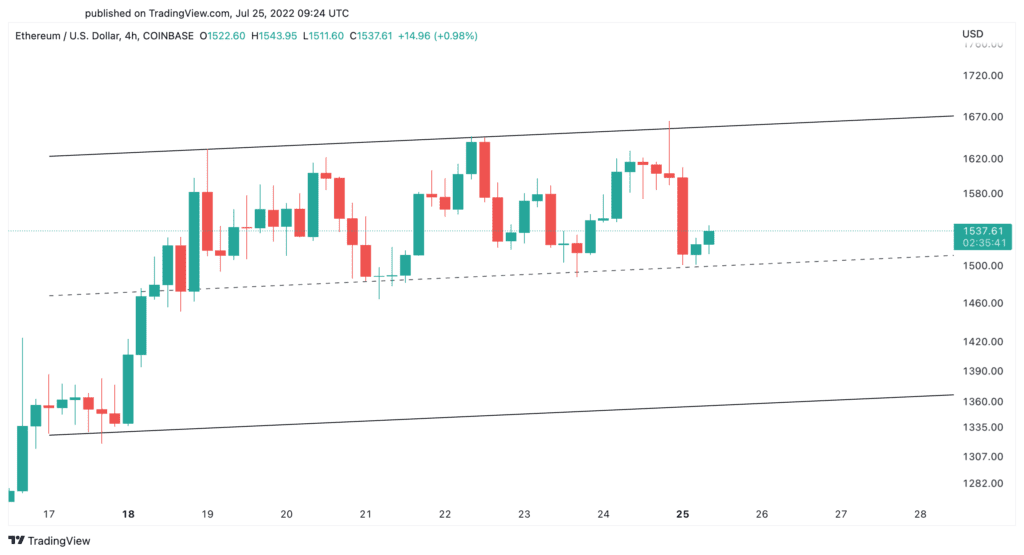

Analysts make the following assessments for the leading altcoin. Ethereum also started the week in the red. It has lost more than 100 points in market value. The sudden drop pushed ETH to the lower border of a parallel channel from $1,500, where prices consolidated last week. This key support area needs to be valid to avoid triggering a pullback to $1,360.

ETH four-hour chart / Source: TradingView

ETH four-hour chart / Source: TradingViewBased on the recent price action, Ethereum will need to print a four-hour candlestick above $1,670 to continue further. If successful, there will be higher chances of a break towards $1,850.