Former SEC official John Reed Stark is urging US financial regulators to ban this altcoin project.

John Reed Stark has targeted this altcoin giant

Former SEC official urged the US to ban Tether (USDT). He touted the company as a fragile structure that could cause a catastrophe. In his May 9 Twitter post, he addressed different issues surrounding Tether accordingly.

According to Stark, his experience and work with markets and financial statements in recent years indicates that Tether could be the next domino…

IMHO, Tether is a Mammoth House of Cards.

Having studied markets and financial statements for 35 years, including during my 18 years as an attorney in the SEC Enforcement Division, IMHO, Tether, could be the next domino to fall. https://t.co/38SFD2fsRk

Tether, the first… pic.twitter.com/fOy3pzImbS

— John Reed Stark (@JohnReedStark) May 9, 2023

Tether takes advantage of regulatory loophole

Stark noted that Tether operates without any regulatory restrictions as it has no legal framework guiding its operations in the US. According to him, the fact that Tether users had to deal with “condescending and ineffective public relations bullshit and fuss” was a significant danger sign.

“Tether’s core business, the core of everything Tether does, depends solely on Tether’s financial reserves. “However, these reserves remain unchecked, unconfirmed and therefore suspect.”

Issues about Tether reserves

Stark criticizes Tether’s proof of reserve, saying it cannot replace an audit. Accordingly, while audits are designed to look for potential risks, evidence of reserve only examines whether the data presented is currently correct.

“Proof of reserve is not the same as audit under any circumstances. “This type of ‘unverified snapshot’ will never pass any regulation.”

https://twitter.com/Tether_to/status/165629999036757672

Meanwhile, Tether released its latest report today showing a profit of $1.5 billion in the first quarter of the year. “If Tether’s internal controls are so lacking that its financial reserves cannot be instantly accounted for down to the penny, that says a lot about Tether’s reliability and credibility,” Stark says.

Tether reports holding BTC and altcoins

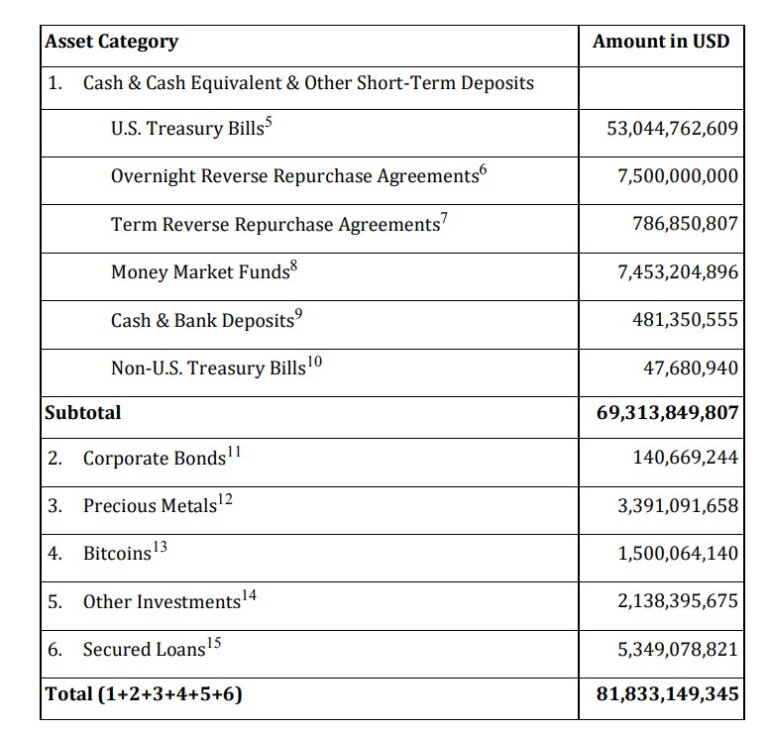

The stablecoin company reported that it holds $1.5 billion worth of Bitcoin (BTC) in its reserves. He said that this equals 2% of their total reserves. The company also announced that it holds $3.39 billion in precious metals such as gold. This corresponds to 4% of its total reserves.

According to the report, Tether’s total consolidated assets at the end of the first quarter of 2023 were $81.8 billion, mostly in US Treasury Bills. It reported that its total liabilities as of May 9, 2023 were $79.39 billion. Of that, $79.37 billion was related to its own token, USDT.

In addition, the company was no longer legally required to provide attestation of reserves. Therefore, Tether company no longer has to prove its reserves again if it wants to. Which means it could leave more questions about its reserves.

Ban calls

The Canadian province of Ontario has banned crypto platforms from offering USDT. He also urged the United States to take a similar step. Earlier this year, Crypto.com delisted USDT for Canadians due to compliance with regulatory requests. However, Tether is struggling with questions regarding its reserves and operations. However, USDT is still the largest stablecoin in the market. It currently has a market cap of $82.5 billion and a 24-hour volume of $24.17 billion.