Analysts argue that Solana (SOL) could emulate Ethereum’s impressive recovery after the 2018 bear market. Solana (SOL) is still likely to drop in the near term. However, according to analysts, it is possible for SOL to increase by 5,000% if it follows in the footsteps of its rival leading altcoin Ethereum.

Leading altcoin Ethereum 2018 fractal on Solana

According to experts, SOL risks falling to $15 with the expectation that it will behave like Ethereum (ETH) during the market crash in 2018. ETH in particular has corrected 95% from its high of $1,529 earlier that year. cryptocoin.com Then, in December 2018, it dropped to about $79. Then it experienced a long recovery, increasing by about 6,000% over the next four years. Thus, in November 2022, it reached a record level of approximately $4,950.

ETH three-day price chart / Source: TradingView

ETH three-day price chart / Source: TradingViewSolana, which rivals Ethereum for its top spot in the smart contracts industry, has dropped over 85% after peaking at around $267 in November 2021. This causes the token to drop another 10% along with the room when measured from that record.

Popular analyst PostyXBT says SOL could drop to $15. Thus, he states that Ethereum can reflect the bear cycle in 2018. Moreover, SOL claims that it could push its price above $750 with an Ethereum-like recovery in the coming years.

$ETH did a ~60x from the 2018 lows despite many people calling for it to hit zero…

If $SOL drops to $15 I think a ~50x is on the cards whilst people call for it to nuke to zero.

For those who question the functionality issues and outages, remember that hype always wins.

— Posty (@PostyXBT) July 11, 2022

Meanwhile, another popular analyst, Spencer Noon, thinks along the same lines, although he does not share a clear upside target. Noon says Solana went through a ‘disappointment’ phase that plagued the Ethereum market in 2018. He also states that he will overcome the difficulties at the end of the project. The analyst makes the following assessment for the altcoin:

Solana has a vibrant developer ecosystem. Interruption problems can be solved. This will be evident in retrospect.

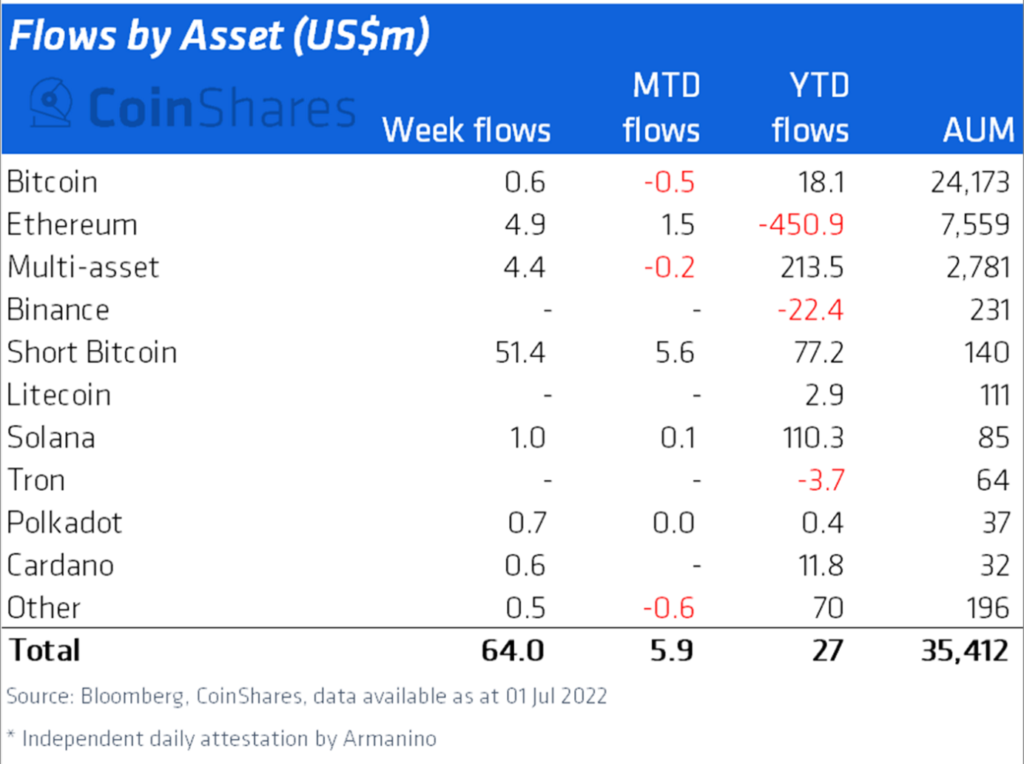

Solana funds pulled in $110M in 2022

According to a recent CoinShares report, as of July 1, $450.9 million has come out of Ethereum funds. By comparison, Solana-based mutual funds saw over $110 million in inflows in 2022.

Net in/out of crypto funds by assets / Source: CoinShares

Net in/out of crypto funds by assets / Source: CoinSharesFund inflows are emerging as Solana’s market cap slowly moves towards Ethereum after its launch in March 2020. According to data tracked by TradingView, the Ethereum/Solana market cap ratio is currently around 32.5% versus its December 2020 peak of 525.3.

ETH/ SOL market cap ratio / Source: TradingView

According to experts, the measurements point to a trend that may continue in the coming years. This indicates a strong capital shift to the Solana ecosystem.

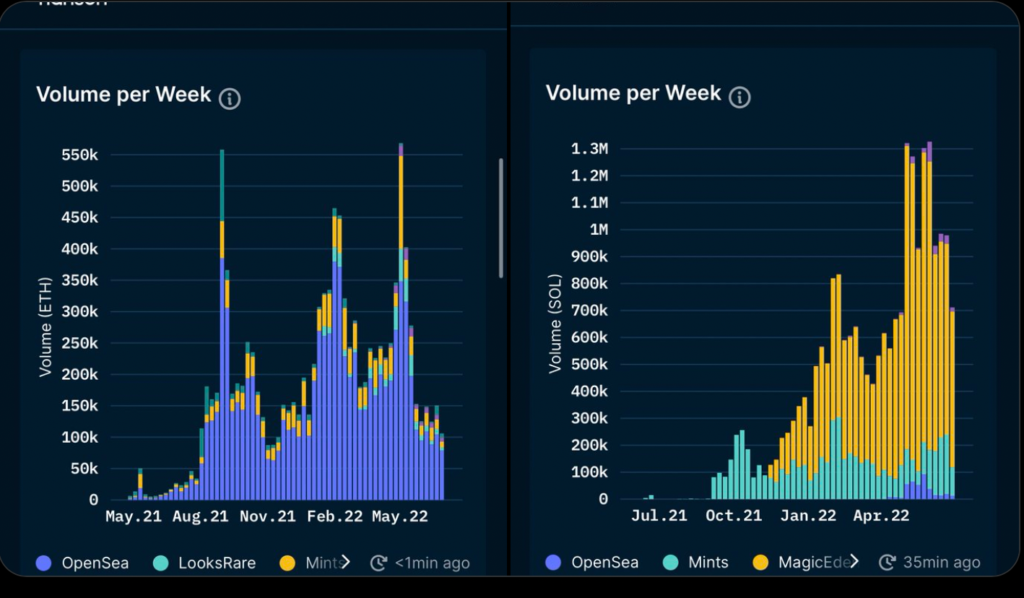

NFT volume of altcoin project

Solana poses a serious challenge for Ethereum based on other key metrics. For example, according to Nansen, Solana’s weekly volumes in the major Non Fungible Token (NFT) markets, including OpenSea and MagicEden, are in a sustained uptrend. That said, Ethereum has dwindled in recent months.

Ethereum NFT volume (left) with Solana (right) / Source: Nansen

Solana fees give advantage over Ethereum

Additionally, according to the latest weekly report from Arcane Research, more affordable fees are the main reason why NFT volumes on Solana Blockchain are increasing compared to Ethereum. The report includes the following assessment:

The speed of the Ethereum Blockchain network decreased as transaction costs increased. This has led to the Solana-based NFT marketplaces gaining momentum. The average transaction fee on Ethereum was $6.5 in June, as opposed to the few cents users currently pay for block space on Solana.

Meanwhile, similar to NFT volume, the amount of gas fees paid has also seen a strong uptrend. However, it has experienced a smaller decline from its peak since the summer of 2021.

Daily Gas Paid Ethereum vs Solana$ETH $SOL pic.twitter.com/FJTibaEkVG

— Whis (@whisz7) July 11, 2022