A fractal analysis of XRP’s recent candlestick and price momentum patterns shows that a sharp market correction is still on the table. According to historical data, XRP price has lost 60% of its value in a similar situation before.

XRP price could see these levels by September

The partial Ripple victory of July 13 triggered a 90% rally in XRP price. The double-digit rally may have reached the point of exhaustion right now, reflecting trends elsewhere in the crypto market.

Notably, certain XRP market signals preceded a 65% price drop in Q2 2021. These are now flashing again, as shown below, i.e. the multi-year descending trendline resistance and the RSI in the “overbought” zone.

The descending trendline resistance (marked as “upper trendline resistance” on the chart above) has limited XRP’s upward movement since January 2018. This price ceiling is assisted by another horizontal trend line resistance (purple) near $0.93.

Overall, the combination of resistance coupled with the overbought RSI now increases the risks of market correction for XRP. In this case, XRP price will likely drop towards the lower trendline support of around $0.52, down about 40% from current price levels by September.

The drop reinforces a potential rally effect

On the other hand, the downside target looks closer with XRP’s 50-week EMA (50-week EMA; red wave). This increases the probability of a bounce around this level. Also, the wave support was the local low during the price drop in Q2 2021. As of July 20, the XRP price has increased by 70% month to date. It outstripped the broader crypto market, which rose only 5% over the same period.

XRP investors remain optimistic

Ripple investors remain optimistic about the future of the price despite last week’s rally. XRP price fell 20% from its weekly high after the rally. Meanwhile, it dropped to $0.76.

This result keeps short-term profit-taking at bay as most of the gains remain. In other words, XRP investors are optimistic about more potential gains ahead.

While the downside seems to be limited, XRP investors should consider other possibilities as well. The RSI was technically still overbought at this time. The chances of making a profit are therefore quite high, especially if downside market conditions arise.

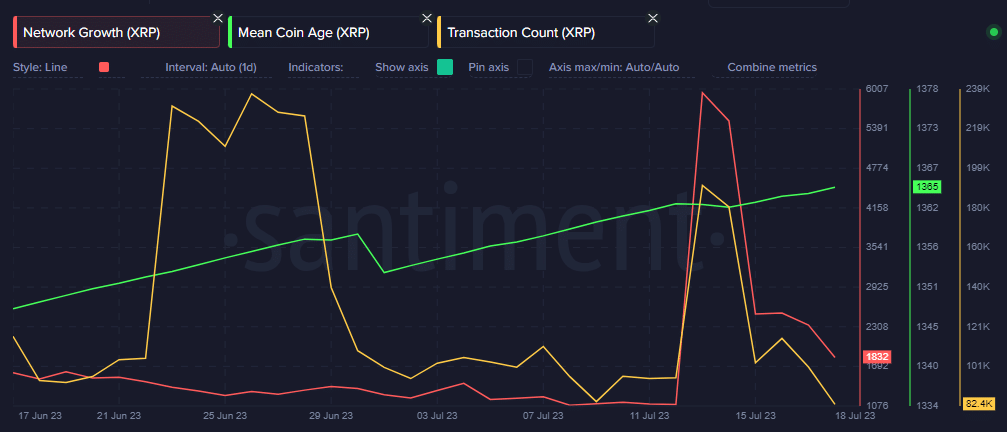

On-chain performance so far indicates a slowdown in network growth and transaction count. This was confirmation that last week’s excitement was over.

Meanwhile, cryptocoin.comAs you follow, some analysts continue to keep expectations high.