Fresh money is entering cryptocurrencies as the stablecoin market is expanding for the first time in more than 18 months, highlighted by Tether’s USDT rising to an all-time high market cap of $89 billion.

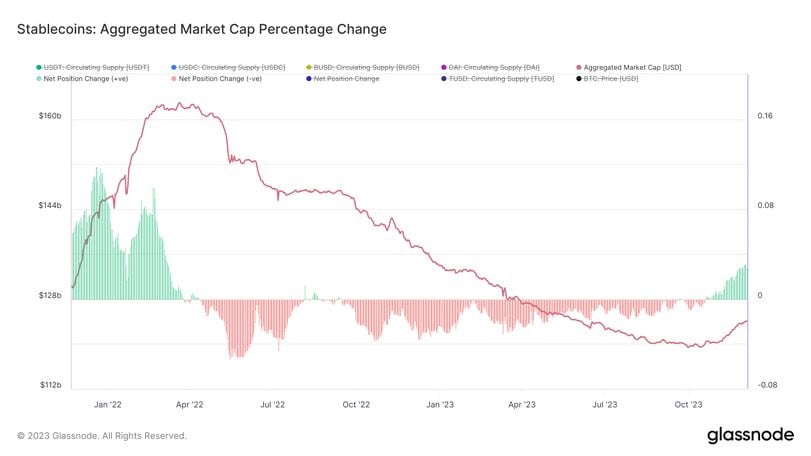

Glassnode data shows that the combined market capitalization of the largest stablecoins increased by almost $5 billion over the past month to $124 billion.

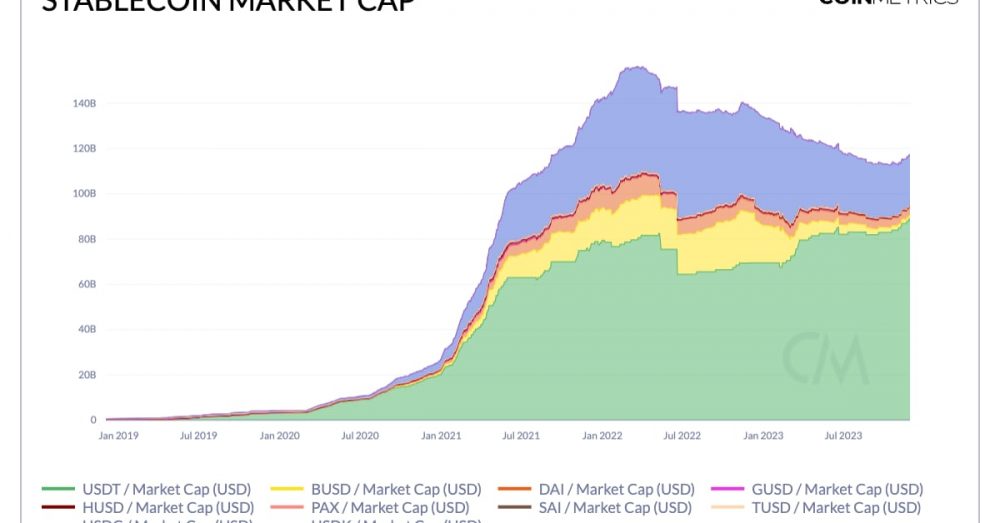

The expansion represents a major trend reversal from a sustained downtrend that started in May 2022, roughly coinciding with the beginning of the grueling crypto winter.

Stablecoin market cap saw growth for the first time in 18 months (Glassnode)

Stablecoins are token versions of cash, serving as a crucial plumbing of the crypto ecosystem, bridging traditional (fiat) money and blockchain-based digital asset markets and providing market participants with liquidity for trading and lending.

Thus, the trend reversal in the stablecoin market size is a bullish signal for the overall health of the recent crypto rally.

“This upward trend can be interpreted as a leading indicator of improving liquidity on-chain, suggesting an environment where more capital is available for deployment,” Tanay Ved, analyst at Coin Metrics, said in a market report Tuesday.

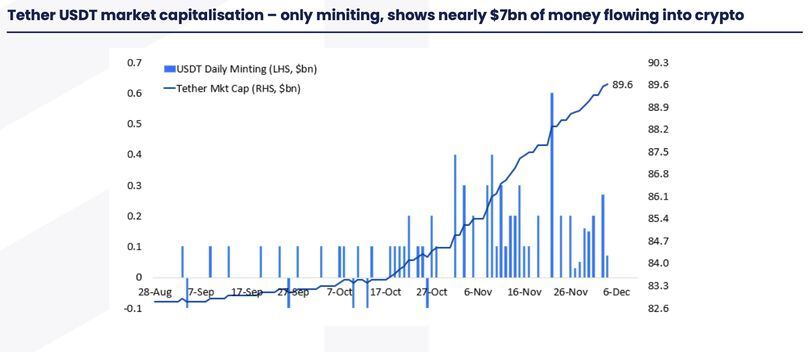

Tether supply rises to all-time highs

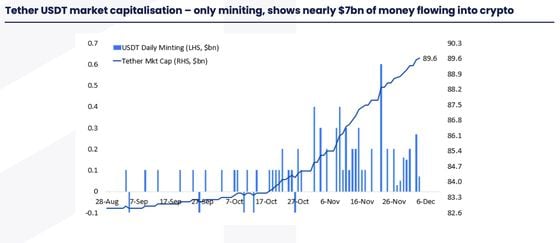

Most of the expansion comes from Tether (USDT), the largest stablecoin by market cap and mostly used on centralized exchanges and for transactions in the developing world. Its supply has increased by $7 billion since September, Matrixport noted in a Monday report, with minting picking up “in a meaningful way” since mid-October.

Tether USDT minting shows increased demand for the token since mid-October (Matrixport)

Actually, USDT’s market cap has grown has been growing through most of 2023 and is now nearing $90 billion, above its all-time high in 2022, CoinGecko data shows. But the contraction of competitors such as USDC and BUSD had offset USDT’s growth until recently.

“The trend seems to be up, which should be bullish for crypto assets as it signals growing investor interest,” said Noelle Acheson, analyst and author of the Crypto Is Macro Now newsletter.

“It’s still early as the total stablecoin market cap is still well below levels from earlier this year, when the outlook was arguably much worse than it is today,” she added.

We may earn a commission from partner links. Commissions do not affect our journalists’ opinions or evaluations. For more, see our Ethics Policy.