According to one bankruptcy professor, it’s too soon to know the severity of the damage from the FTX bankruptcy. An associate professor of finance awaits consolidation in the crypto market. A crypto expert is debating who is responsible for this collapse.

Crypto bankruptcies could follow FTX crash

FTX could drive some other companies into bankruptcy. The Wall Street Journal reported on Tuesday that crypto lender BlockFi is preparing for a possible filing. The firm paused withdrawals, stating that it could no longer run its business as usual due to its ‘substantial investment in FTX.

“As we continue to work towards recovery of all liabilities we owe to BlockFi, we expect a delay in recovery of liabilities owed to us by FTX as FTX has been working through the bankruptcy process,” BlockFi said. Crypto asset management firm Ikigai also said that the hedge fund will not be able to withdraw assets from FTX, where it holds a ‘vast majority’ of its total assets.

Unfortunately, I have some pretty bad news to share. Last week Ikigai was caught up in the FTX collapse. We had a large majority of the hedge fund’s total assets on FTX. By the time we went to withdraw Monday mrng, we got very little out. We’re now stuck alongside everyone else.

— Travis Kling (@Travis_Kling) November 14, 2022

So, additional crypto bankruptcies are unlikely to come as a surprise. Several companies have gone bankrupt before, including crypto hedge fund Three Arrows Capital and crypto lenders Celsius Network and Voyager Digital. Elvira Sojli, associate professor of finance at the University of New South Wales School of Banking and Finance, comments:

It’s possible that this wave of bankruptcies is the inevitable consolidation of a market that offers mostly the same thing.

Temple University Harold E. Kohn Professor of Law, Jonathan Lipson, says it is difficult to predict the fate of other cryptocurrency companies. Because, he notes, most of them are unregulated and not very transparent. Lipson notes, for example, that with investment bank Lehman Brothers going bankrupt in 2008, the Federal Reserve and other regulators were able to map transactional relationships to get a general idea of the financial fallout.

FTX crash is Lehman Brothers moment for crypto?

Many observers compare FTX to the September 2008 bankruptcy of Lehman. The mushroom cloud from the failure of the Wall Street bank has spread to the overall economy. Thus, it led to a worldwide contagion that triggered the Great Recession of 2008-2009. In this context, Jonathan Lipson makes the following statement:

Everyone felt it when Lehman fell. It will likely suffer from FTX’s bankruptcy. However, it is too early to know whether the debris will reach Lehman dimensions.

Both companies were innovative. Lehman has packaged complex financial tools for investors. In this way, he created a housing bubble, often inflated by subprime mortgages normally given to unsuitable homeowners. FTX has soared with the growing popularity of a financial asset that many don’t understand.

Lipson says Lehman is crucial to the financial economy. He also notes that the financial economy is also very important for the real economy. It is unknown if crypto plays a similar role, as its effect has not been tested so far. “We don’t know enough about FTX transactions to know if there will be similar ripple effects,” Lipson says.

“FTX’s collapse is more in line with Bernie Madoff’s Ponzi scheme”

Lipson points out that Lehman is a trillion-dollar bankruptcy, while FTX is billions. The firm’s bankruptcy filing lists an estimated $10 to $50 billion in assets with the same amount of liabilities. However, such figures in a bankruptcy petition are often placeholders and there are allegations of financial fraud.

James Giddens, a court-appointed trustee at Lehman, eventually reimbursed customers and creditors more than $115 billion, meeting 111,000 requests, and getting general unsecured creditors back 41 cents on the dollar. Unsecured creditors are unsecured creditors like customers. FTX initially claimed to have around 100,000 creditors, most of them customers. But on Tuesday, it brought the number to over a million, including former customers.

News reports have raised questions about FTX’s finances. The firm admitted in a court document that it filed for bankruptcy ‘due to the emergency’ while facing a ‘serious liquidity crisis’. Entwistle & Cappucci, the law firm investigating the FTX bankruptcy, said that “the Bernie Madoff Ponzi scheme bears an uncanny resemblance to the misuse of client funds at FTX.” The firm, which specializes in complex fraud and bankruptcy cases, released the following statement:

In a normal bankruptcy situation, important details about the assets and financial situation of the bankrupt institutions appear in the ‘First Day Applications’. It is extremely unusual for sophisticated organizations like FTX and Alameda to file a simple bankruptcy petition.

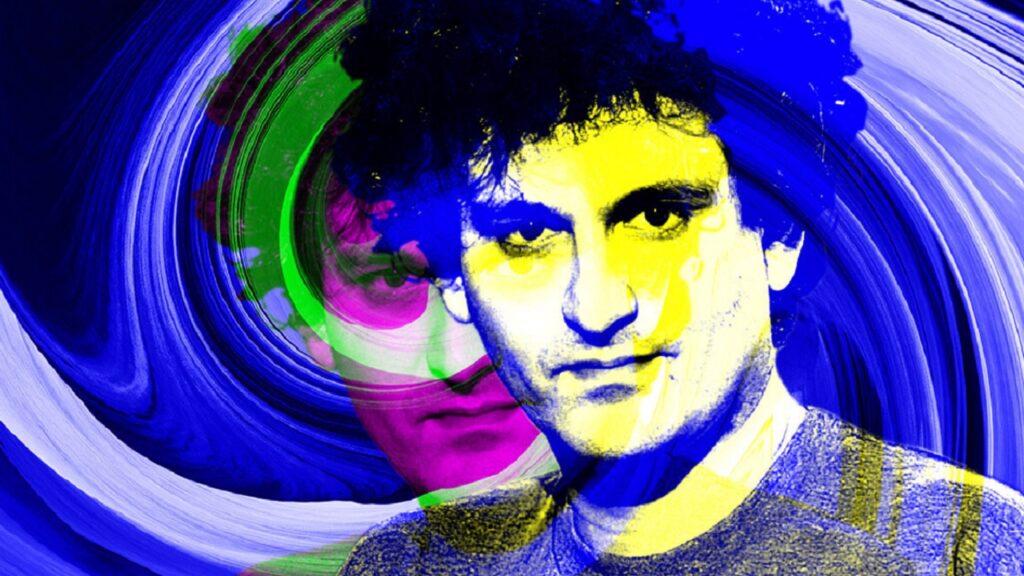

Who is really responsible for the FTX crypto crash?

According to Reuters sources, at least $1 billion in client funds were lost from the crashing crypto exchange FTX. Sources also said that SBF transferred $10 billion in client funds from FTX to Alameda Research.

Lipson believes FTX and Lehman will ultimately be viewed differently, in part because of the innovation of crypto and Lehman being a tightly regulated and publicly traded investment bank, whereas FTX is largely unregulated, meaning it is responsible for taking more risks for clients’ investments. He said it means.

Who is really to blame for FTX’s downfall?

FTX and its subsidiaries went bankrupt due to balance sheet instability and exchange withdrawals. As of Friday morning, FTX has filed for bankruptcy for 134 organizations. However cryptocoin.com As you follow, the allegations that the FTX exchange was hacked on Friday night came to the fore. In this attack, more than $1 billion in customer funds were reportedly transferred to private accounts or crypto wallets. Also, there were rumors that FTX executives had fled the Bahamas. Crypto expert Brad Myers calls those responsible for the FTX collapse and comes to the following conclusions.

Investors in venture capitals and cryptocurrencies are to blame. These parties either did not have the power to provide legitimate due diligence or there was a miscommunication with Bankman-Fried. Financial destruction of this magnitude should not have been possible with so many high-profile and intelligent investors involved.

More broadly, venture capital investing in cryptocurrency has ballooned. From less than $1 billion in 2017 to $33 billion in 2021. Unfortunately, these investors have worked in narrow circles to create excitement, buzz and marketing around businesses to attract new entrants while raising the valuations of their own cryptocurrencies.

There are governance controls over their tokens that are often unknown to individual investors. These crypto CEOs have the ability to generate more tokens if they want, or change the protocol rules at any time. These are unregistered securities traded on exchanges that venture capitalists can cash out. This is a goddamn IPO with no regulation. All these venture-backed tokens are worth zero. Worse still, many of the same VCs funded exchanges where these worthless tokens were traded. In other words, VCs helped build the casino. He designed the games, secured his chips and became active participants.

Regulators have allowed this common behavior to evolve. Gensler has done a terrible job trying to protect individual investors in the crypto space to the point where it seems deliberate.