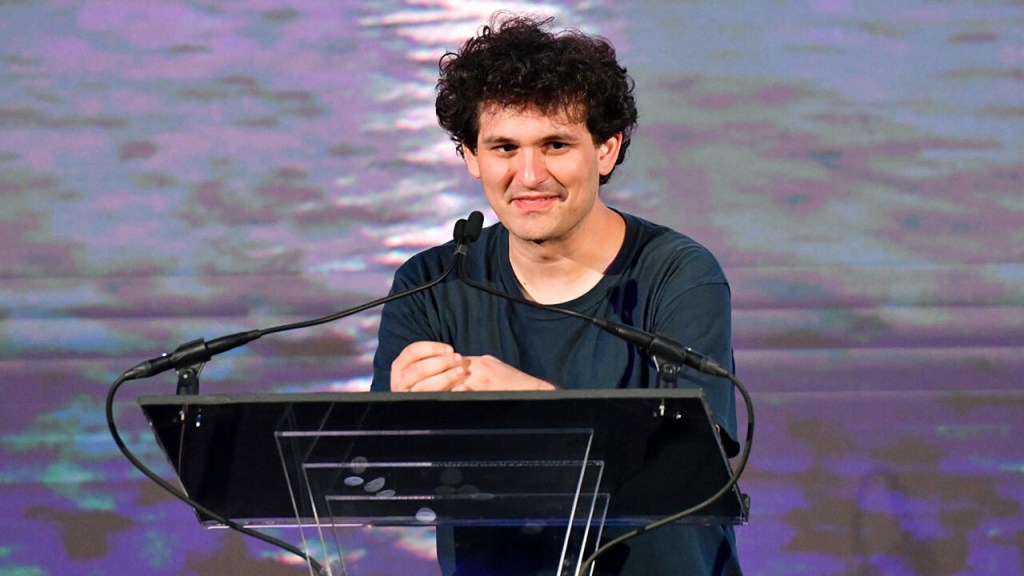

FTX founder Sam Bankman-Fried is demanding the return of his cryptocurrencies. In their new statement, he suggested that FTX assets were detained without being associated with any unauthorized transactions.

Former FTX CEO claims stock market assets back

In the ongoing FTX lawsuit, Sam Bankman’s lawyers claimed that his former company FTX should have access to assets and cryptocurrencies owned by him. Lawyers argue that there is no evidence that SBF was previously involved in any suspected illegal activity. Bankman-Fried, who resigned as FTX CEO on November 11, 2022, was released on bail after being prosecuted for electronic fraud and money laundering charges. The stock market caused a loss of $ 9 billion with its bankruptcy in the week that began on November 7.

1/ Our data suggests that FTX’s demise hasn’t been crypto investors’ biggest issue this year. Both the depegging of Terra’s UST token & the collapse weeks later of Celsius & Three Arrows Capital (3AC) drove much bigger realized losses. 👉 https://t.co/tWpX9qjY6o pic.twitter.com/TI2eJSVXaW

— Chainalysis (@chainalysis) December 14, 2022

SBF claims assets of FTX

SBF’s $250 million bail release agreement included a ban on FTX and all of the assets held by its sister company, Alameda Research. This deal also includes cryptocurrencies purchased with FTX or Alameda funds.

On January 28, Mark Cohen, one of the SBF’s attorneys, sent a letter to the court, assuming that nearly three weeks had passed since the preparatory conference and that the Government investigation had confirmed what the SBF had been saying all along. The attorney also told Judge Lewis Kaplan of the Southern District Court for the Southern District of New York that the bail requirement imposed at the conference should be withdrawn because the only reason presented for obtaining this requirement has not been proven.

Who are Sam Bankman-ex-Fried’s friends?

Additionally, in a document filed Jan. 27, the U.S. Department of Justice stated that Bankman-Fried sought to contact one of his witnesses in the case, Ryne Miller, FTX’s General Counsel. The Ministry of Justice then requested that this communication be banned. Cohen says he agrees with this restriction, but needs to be able to communicate with some former employees, such as Bankman-Fried’s therapist, George Lerner. Cohen also said:

Requiring Bankman-Fried to include his lawyer in every communication with a former or new FTX employee unnecessarily strains his resources and harms his ability to defend this case.

The December 14 report found that the May decline of Terra USD (UST) peaked weekly losses at $20.5 billion, followed by the June crash of Three Arrows Capital and Celsius, with weekly losses peaking at $33 billion. In contrast, weekly losses during the FTX saga peaked at $9 billion in the week starting Nov.

Now SBF and its attorneys are claiming the founder’s FTX assets back, arguing that no unauthorized transactions have been detected. cryptocoin.comSince the bankruptcy in November, which we quoted as our company, the only price paid by SBF has been a $250 million bail.