Exchange giant FTX is in the lead to buy the assets of Voyager Digital, the cryptocurrency lender whose bankruptcy filing deepened this year’s industry crisis, but higher offers could still come in in the days ahead, according to a person familiar with the matter.

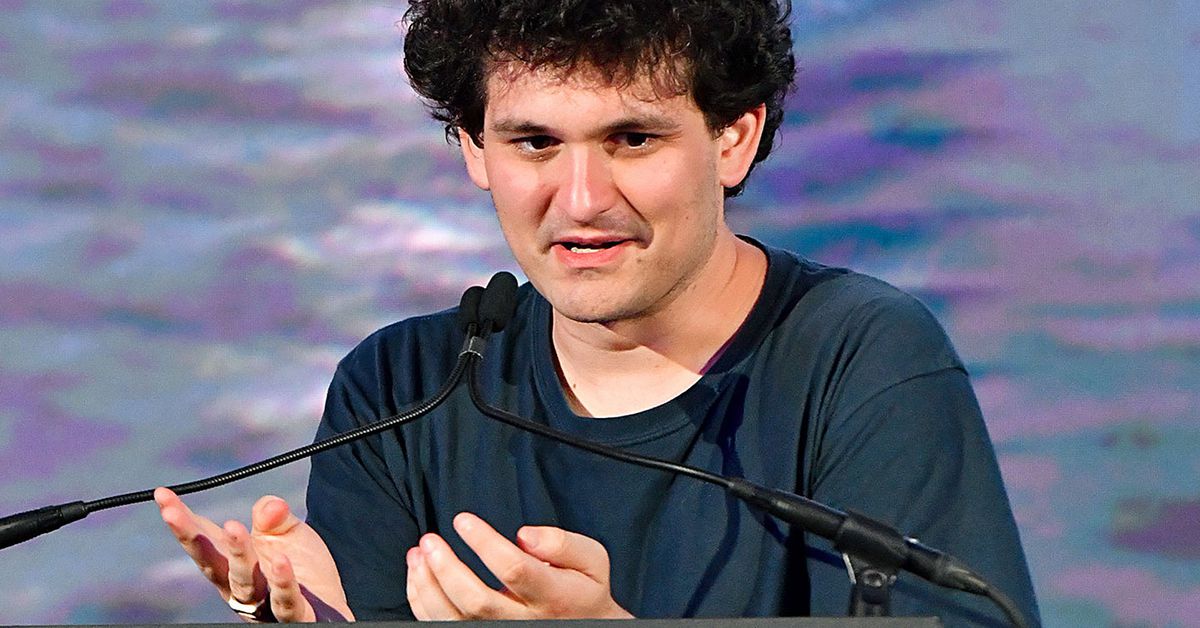

An auction was held this week through bankruptcy court for Voyager’s assets. At the final stage it was a battle between billionaire Sam Bankman-Fried’s FTX exchange and Wave Financial, a digital-asset investment firm, according to the person.

FTX’s bid was higher, the person added. It’s unclear how much FTX agreed to pay.

FTX didn’t immediately respond to a request for comment. A Wave representative declined to comment.

Read more: Behind Voyager’s Fall: Crypto Broker Acted Like a Bank, Went Bankrupt

CoinDesk reported on Aug. 25 that FTX and Binance were in the hunt to acquire Voyager. FTX had made an offer for Voyager that was rejected in July as a “low-ball bid.” The presence of Wave among bidders hadn’t previously been revealed. Earlier this week, CoinDesk reported that FTX is raising capital in parallel with a potential acquisition.

A deal for Voyager could bring a relatively tidy end to one of the most harrowing tales from a terrible year for crypto.

After crypto prices sank, Voyager in early July barred customers from withdrawing their money. Its clients then became company creditors in bankruptcy court, forced to get in line with sophisticated restructuring lawyers and financiers as novice participants in a potentially laborious process to get their funds back. Unlike a conventional bank, Voyager’s failure didn’t trigger government-backed deposit insurance that makes most bank customers whole – which apparently surprised some Voyager users.

A purchase wouldn’t end Voyager’s Chapter 11 case. U.S. bankruptcy law, however, gives leeway to sell assets so troubled companies can maximize how much money they can recover to pay their creditors.