In the economic calendar of the week, the markets will put the Consumer Price Index (CPI) and Producer Price Index (PPI) data from the USA on the agenda, while SEC Chairman Gary Gensler will testify at the Senate Banking Committee on September 12.

After the summary judgment in the XRP case and the victory in the Grayscale spot Bitcoin ETF case, we will see how SEC Chairman Gensler will follow his anti-crypto stance. Another important development on the macro side will be the interest rate decision in the Euro Zone.

Highlights of the week

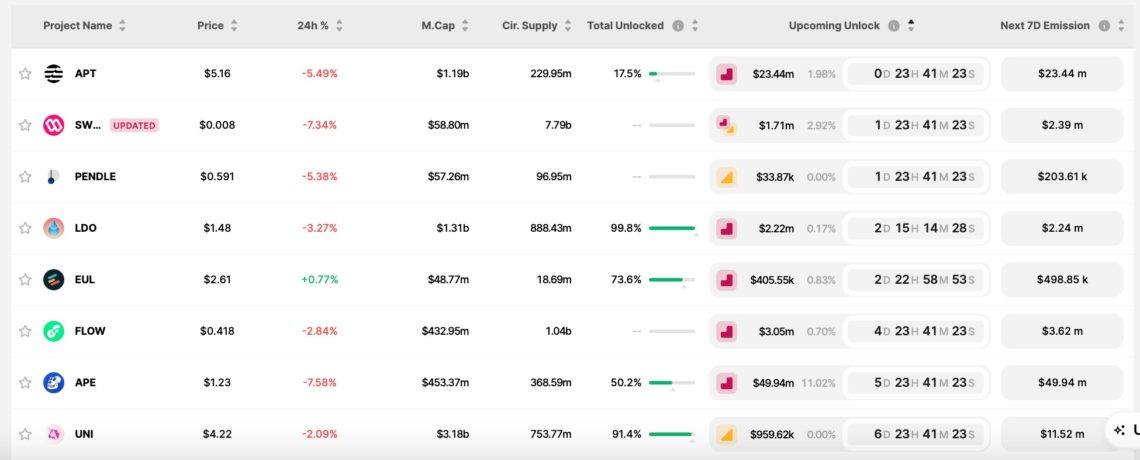

The most important development in the cryptocurrency market this week will undoubtedly be FTX, which is preparing to liquidate its altcoin reserves on September 13 in case of court approval. Liquidating a $3.4 billion asset would create huge selling pressure in the cryptocurrency market.

Let’s look at the distribution of assets:

Solana: $685 million (locked)

FTT: $529 million

BTC: $268 million

ETH: 90 million dollars

APT: $67 million

DOGE: $42 million

MATIC: $39 million

BIT: $35 million

TONS: $31 million

XRP: $29 million

Let’s take a look at the key expansions of the week:

Economic Calendar

Monday, September 11

Türkiye – Unemployment Rate (Monthly) – 10.00

Tuesday, September 12

BinanceUS will delist OMG Network (OMG).

SEC Chairman Gary Gensler will testify at the convention.

Wednesday, September 13

USA – Consumer Price Index (CPI) (Annual) Expectation: 3.6 percent Previous: 3.2 percent – 15.30

FTX will go to court to get approval to liquidate its crypto assets.

Thursday, September 14

Euro Zone – Interest Rate Decision – 15.15

USA – Applications for Unemployment Benefits Expected: 226k – Previous: 216K 15.30

USA – Producer Price Index (PPI) Expectation: 0.4 percent Previous: 0.3 percent 15.30

Bitcoin Technical Analysis

In a week where volumes decreased significantly, Bitcoin continues its horizontal movement between $ 25,800 – $ 26,800. Unless the candle closes above the 26,800 levels indicated by the blue line on the daily chart, it will not be possible to advance to its next stop, $28,300. For a possible downward movement, it should not lose the levels of $ 25,560 – $ 25,720, which I indicated with the green box. If the region is lost, it may move towards the lower levels of $21,900 – $23,550.