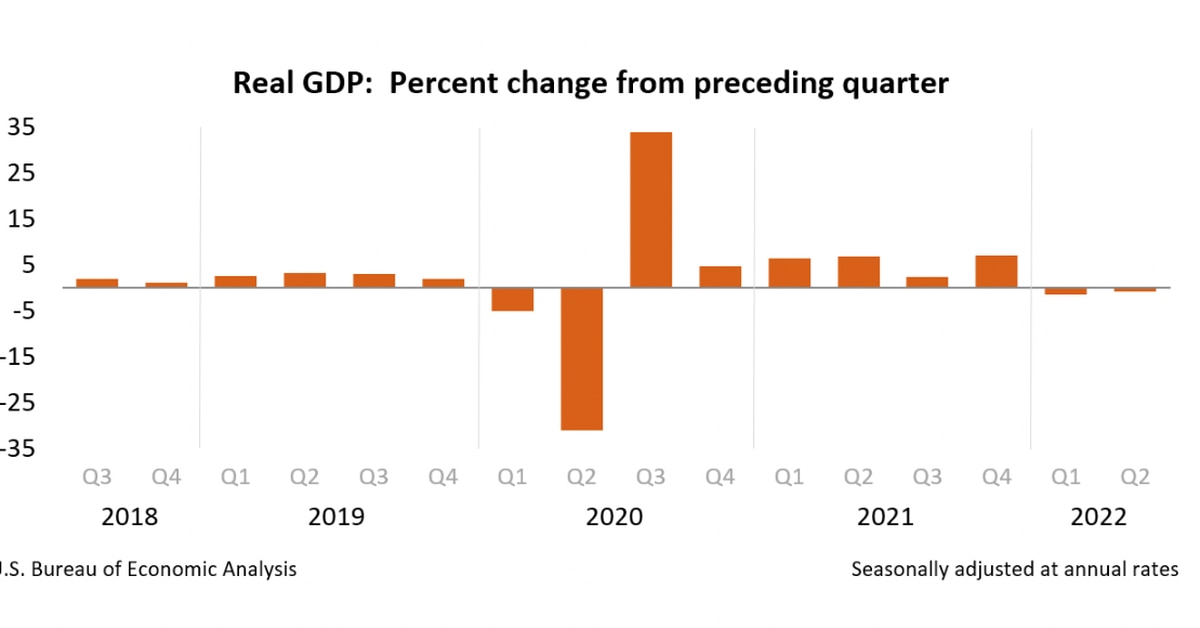

Gross domestic product (GDP) declined at an annualized pace of 0.9% in the second quarter, marking two consecutive quarters of economic contraction.

While the report on Thursday morning was worse than economist forecasts of a 0.5% contraction, it was slightly better than “whisper” expectations for a decline of 1% or more. The Atlanta Fed’s GDPNow tracker, for instance, predicted a negative 1.2% print for Q2.

Bitcoin (BTC), which rose sharply over the past 18 hours in wake of yesterday’s downgrade of the economy by the U.S. Federal Reserve, slipped $200 following the GDP number and now trades at $22,800.

This morning’s GDP report cited “decreases in private inventory investment, residential fixed investment, federal government spending, state and local government spending, and nonresidential fixed investment that were partly offset by increases in exports and personal consumption expenditures,” as the main driver for negative GDP.

Today’s number follows an unexpected decline in economic activity of 1.6% in the first quarter, which fueled recession fears over the past three months. One widely used definition for a recession is when GDP contracts over two consecutive quarters.

However, many economists – and even Federal Reserve Chair Jerome Powell at a press conference on Wednesday – have refrained from calling a recession because other factors, like the labor market which still adds 372,000 jobs per month, show signs of a strong economy. Both the government and the Fed defer to the National Bureau of Economic Research (NBER) to declare a recession, which takes into account employment, personal income, and industrial production, in addition to GDP growth.

“I do not think the U.S. is currently in a recession and the reason is there are too many areas of the economy that are performing too well,” Powell said during a press conference on Wednesday. “You tend to take first GDP reports with a grain of salt,” he added.

Central bankers on Wednesday hiked interest rates by another 0.75 percentage points, or 75 basis points, in an effort to slow the economy and curb four-decade high inflation. Traders took the statement by the Federal Open Market Committee (FOMC) which sets monetary policy dovish, with markets jumping after the announcement.

Bitcoin (BTC) saw its biggest single-day gain in six week, jumping 8% on Wednesday to $23,416. Ethereum (ETH) was up almost 12%, trading slightly above the $1600 mark.

Even if the economy isn’t currently in a recession, raising interest rates for the fourth consecutive month could certainly lead to one, and Powell has repeatedly said that a recession is “a possibility.”

“The Fed can’t say, we’re trying to push the economy into a recession, but in my opinion they are, because that’s the only thing that’s going to slow down prices,” said Bob Iaccino, chief strategist at Path Trading Partners and co-portfolio manager at Stock Think Tank, said.

“They have no control over Russia, which is part of the inflation problem. They have no control over the supply chain, which is part of the inflation problem. The only thing they can try and do is slow demand,” he said.