Various allegations are coming to light for the cryptocurrency lending platform Genesis. Data shows that Genesis received billions of FTT tokens last year from bankrupt crypto companies Alameda Research and FTX. So, what other cryptocurrencies does Genesis have? Here are the details…

Genesis portfolio includes FTT

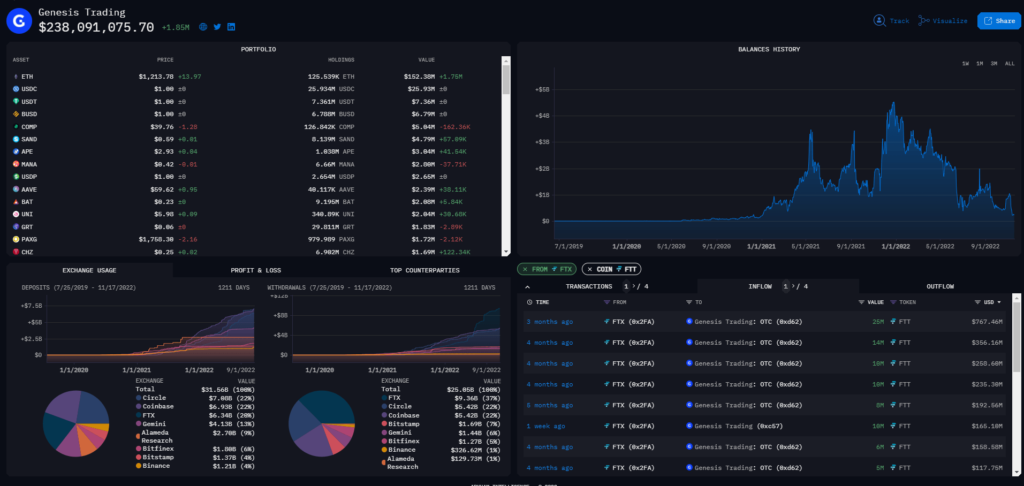

Genesis received $932.56 million worth of FTT tokens from FTX in the past three months. In the same period, it received another $141.1 million worth of FTT from Alameda Research. The crypto lending platform recently stopped all customer withdrawals due to the collapse of FTX. The company stated that the incident resulted in “abnormal withdrawal requests” that exceeded its liquidity. Meanwhile, reports emerged that the lender was unable to obtain $1 billion in emergency loans from investors following the collapse.

Meanwhile, the extent of FTX’s Genesis business collapse speaks volumes given the value of its trading assets. At its peak, Genesis trading assets were almost $5 billion. As of now, the firm’s business assets are worth approximately $238 million, according to Arkham Intelligence. Genesis is under the umbrella of the Digital Currency Group. It is among the various platforms that DCG has invested in in the payments category.

DCG’s investments/platforms include platforms such as Grayscale, Circle, Ripio, Wyre, Fireblocks, LUNO, Avanti. Apart from that, it has invested in layer-1 projects such as Polygon, Ripple, Acala, HEdera.

Genesis processes large amounts of payments

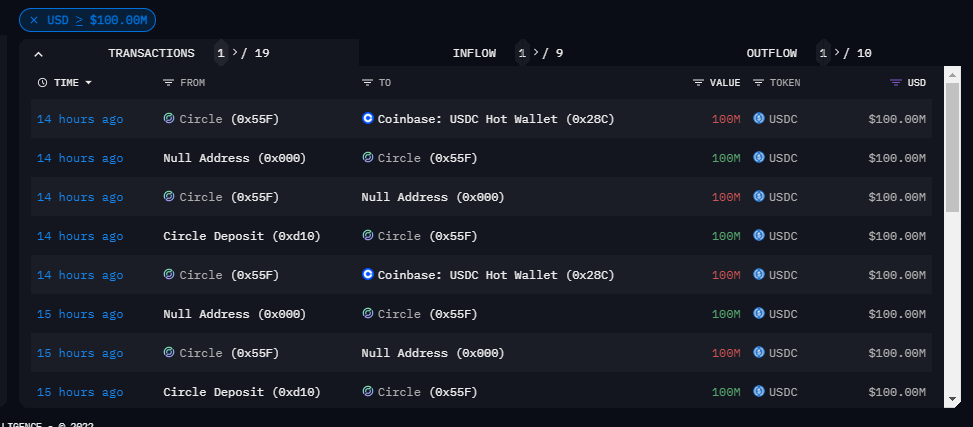

On November 16, an address tagged Genesis made its biggest transactions. Arkham Intelligence tweeted on November 18. According to the tweet, over $100 million USDCoin (USDC) has been transferred to the company’s over-the-counter (OTC) address. This address later invested 105 million USDC in Circle. Arkham said this is likely a large client pulled from the Genesis OTC platform.

Meanwhile, Circle is also seeing massive USDC redemptions for fiat as it burns millions of USDC. Arkham Intelligence said that USDC is burned when USD is redeemed as fiat. The data shows that the stablecoin issuer has burned $100 million twice in the last 24 hours.

There are allegations of bankruptcy

On the other hand, according to Bloomberg’s claims, the company could not raise enough funds to fix the liquidity squeeze. Therefore, without additional funds, it potentially faces bankruptcy. The company is said to be seeking a $1 billion cash injection into the business after it stopped withdrawals on its lending product last week. However, a Genesis spokesperson stated that bankruptcy is not an option.

But fears of a possible Genesis bankruptcy could now spread to its parent company, Digital Currency Group. Genesis accounts for a large percentage of its holdings with Grayscale, which is also in the limelight as it fails to produce proof of reserve.