The leading cryptocurrency Bitcoin (BTC) is in a better position for its $600 million options expiration on Friday. However, the bulls could reverse the situation if Bitcoin starts trading above the $18,000 level.

These levels are on the way for Bitcoin

$600 million weekly options expire today. Moreover, there are transactions of $20,000 and above. BTC has provided this level as a solid resistance zone since October 25. It also held on for almost two weeks. However, as a result of the liquidity crisis in FTX, withdrawals on its exchange were stopped. As a result, on November 8, fundamental predictions abruptly changed.

As we have reported as Kriptokoin.com; The events took the investors by surprise. More than $290 million of leverage buyers were liquidated in 48 hours afterwards.

In which direction will the BTC price move?

Bitcoin has quickly adapted to news ranging from $15,800 to $17,800 over the past seven days. Currently, investors fear that the contagion risks could force them to sell their cryptocurrency positions in other major companies. FTX was one of the key industry players. The exchange had a significant amount of cryptocurrencies. Therefore, it meant that other participants would also face significant losses.

BlockFi, for example, had a $400 million limit with FTX US. On November 15, collateralized return platform SALT announced significant losses from the FTX crisis. After that, it stopped withdrawals. Similar events were observed on the Japanese cryptocurrency exchange Liquid. Subsequently, the level of uncertainty in the entire market gradually increased. The expiration of November 18 options is particularly important. Because Bitcoin bears are likely to be able to secure $120 million in gains by pushing BTC below $16,500.

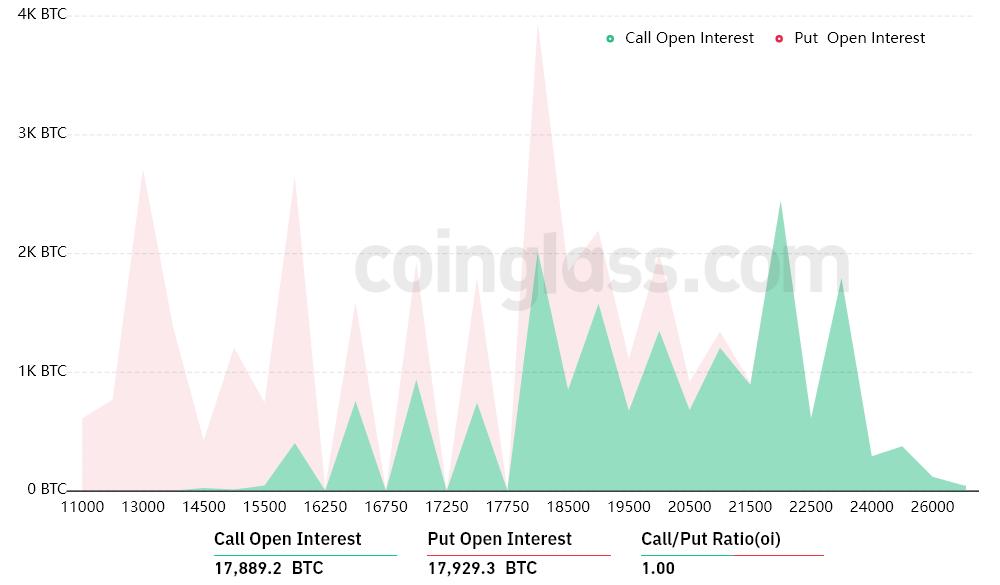

The open interest for the November 18 weekly option maturity is $600 million. However, the real figure will be lower if the bulls are overly optimistic.

Bitcoin price will drop if it fails to break this level

A bid-to-ask ratio of 1.00 represents the perfect balance between the $300 million open interest and the $300 million buy options. However, once Bitcoin lands near $16,500, most of the steps for the uptrend are likely to become worthless. According to analysts, only 10 percent of the buy options will be available if Bitcoin stays below $ 17,500. This difference is likely to push BTC to buy at $18,000 or $19k.

4 possible scenarios for BTC price

The bulls need a rally above $18,000 to take the lead. Below are the four most likely scenarios based on the current price action. Bitcoin options available for buy and sell levels vary depending on price. The imbalance in favor of both parties creates a theoretical gain as a result:

- It ranges from $15,500 to $16,500. 7,900 sales against 400 transactions. The net result is that the bears support $120 million.

- It is between the $16,500 and $17,500 price level. 1,700 calls and 6,100 sales transactions. The net result bears supporting $75 million.

- It ranges from $17,500 to $18,000. 2,500 searches and 5,000 sales. The net result is that the bears support $45 million.

- Between $18,000 and $18,500k. 4,500 searches and 3,100 sales. The net result is that the bulls support $25 million.

This forecast takes into account put options used on downtrends and specifically call options on neutral-bullish trades. However, oversimplification may overlook more complex investment strategies. For example, the investor can create a put option by effectively gaining positive exposure to Bitcoin above a certain price. Unfortunately, there is no easy way to predict this effect.

It shouldn’t be surprising if the BTC price drops below $16,000

Bitcoin bears need to push the price below $16,500 to make a profit of $120 million. The bulls, on the other hand, would need a 10 percent gain above $18,000 to reverse the price and gain $25 million in the best-case scenario. Bitcoin margin and options trading appear to show low confidence in reclaiming the $18,500 support. For Friday, the most likely outcome is for the bears.