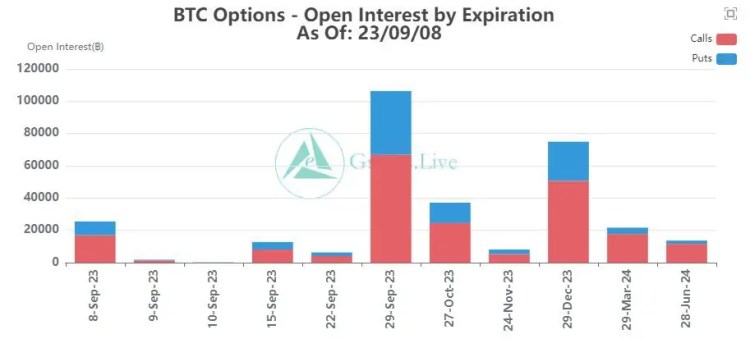

Friday is the expiration date for Bitcoin options contracts, and a lot of contracts are closing this week. Will these have any impact on the lackluster BTC price? Analysts answer…

Today is the last day of $640 million worth of Bitcoin options

According to reports, the most critical level of the option contract group is at $26,500. This is quite close to the current BTC price. The maximum pain point is the price level with the most open contracts and at which the biggest loss will occur when they expire. Bitcoin is currently trading slightly below this level at $25,800.

The sell/buy ratio of contracts that expire today is 0.51. This shows that twice as many long contracts are sold as short positions. Greeks Live noted that Bitcoin and ETH have had extremely low intraday volatility for most of this week. “Recently, there has been a small fluctuation towards the point of maximum pain near the time of birth. This is the exact opposite of last week,” he added.

The analysts added that the lack of volatility “resulted in a more stable position structure this week.” It currently has low daily option implied volatility and a relatively stable long term option IV. (IV is a measure of expected future volatility from expiring derivative contracts). According to Greeks Live’s report:

Put options are more expensive and the low liquidity market needs to guard against declines, but the probability of a collapse in whale positions is not high.

Last day for Ethereum contracts

In addition to the BTC contract expiring, 138,000 Ethereum contracts will also expire today. Their notional value is $220 million and the maximum pain point is $1,650. The put/call ratio for ETH options is 0.86. This signals more balance between long and short positions.

What is the price of Bitcoin?

Bitcoin price had a minor rally this Friday. It is currently trading at $25,826.16, up 0.5% on the intraday. This price is the highest BTC has seen since the end of August. However, BTC still remains in a certain range.

On September 7, Bitcoin showed a bullish trend when viewed on the daily timeframe at the close of the transaction. The chart revealed that BTC completed the trade by surpassing $26,000 with a price increase of over 2%. This was a notable event, along with the more than 6% price increase on August 29, as it had been weeks since Bitcoin had experienced an increase of this magnitude. Additionally, it broke the $26,000 price barrier for the first time in more than a week.

As of the moment this article was written, Bitcoin continued its upward momentum. It was trading at around $26,300, albeit with gains of less than 1 percent. Moreover, this slight price increase pushed it above the neutral line on the Relative Strength Index (RSI). cryptocoin.comYou can take a look at the current analyst predictions we provide in this article.