An option contract is an agreement that gives the right to buy or sell at a predetermined price until a certain date. A large number of Bitcoin futures options contracts expire today. However, will they have a significant impact on the markets?

$780 million Bitcoin options expire today

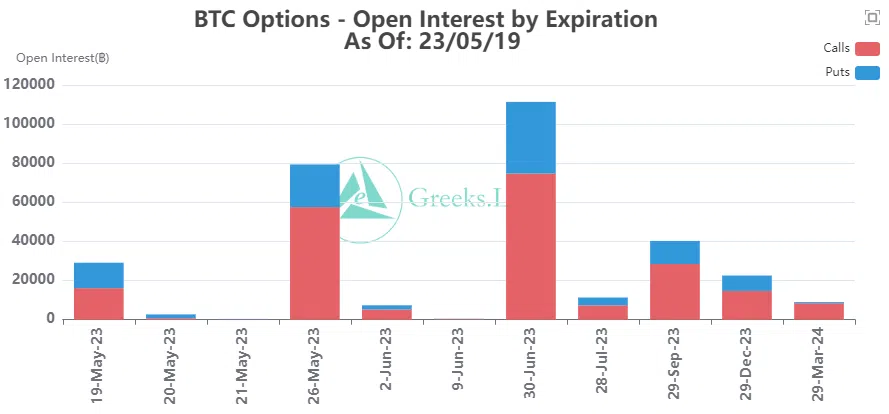

As GreeksLive reported, the notional value of these contracts is $780 million and the maximum pain point is $27,500. The maximum pain value is the price with the most open contracts. It is also the level at which the most loss will occur when the contract expires.

Also, the buy/sell ratio for this Bitcoin options group is 0.81. The sell/buy ratio is calculated by dividing the number of short contracts traded by the number of long contracts. A value below 1 is considered bullish. This is because more traders are buying long contracts than short contracts.

In addition, Deribit reports a total of 308,044 open positions. This amount represents the total number of open contracts that have not expired yet.

There are also about 169,000 Ethereum positions that are about to expire

Their notional value is $310 million and the maximum pain point is $1,800. The buy/sell ratio for ETH contracts is 0.96. This is a more neutral level compared to BTC.

GreeksLive, in its overview, said, “The grand total position data has been relatively stable. However, the rate of sell positions started to increase. Short traders are gradually gaining ground after a sustained sideways move,” he comments.

How is the Bitcoin price prior to expiring options?

Bitcoin price has moved down around 2% on the day. At the time of writing, it is trading in the $26,800 region. The leading crypto has been consolidating for the past few weeks since its 2023 peak at $31,000.

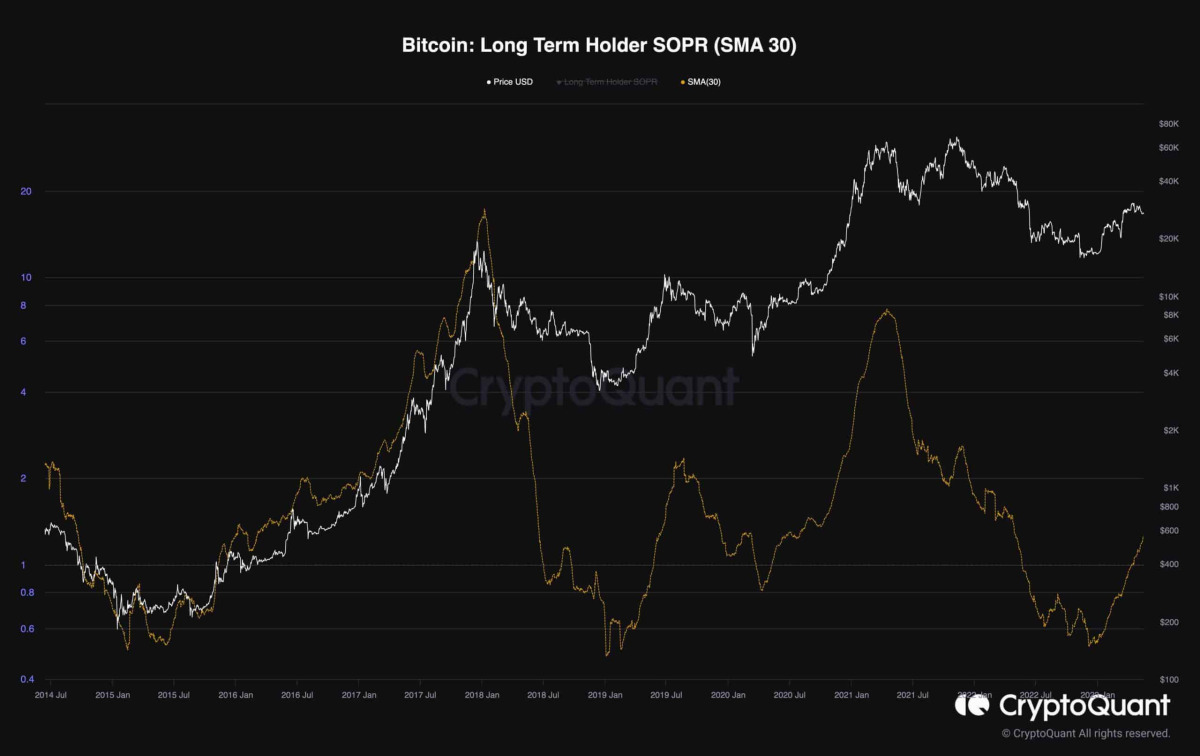

On the on-chain side, spending patterns of cryptocurrencies that have been inactive for more than 155 days often reveal significant trends in Bitcoin’s long-term prospects. The chart below clearly shows how the metric exceeds one value. This suggests that long-term owners are making profits. Such events typically occur in the early stages of Bitcoin’s bull runs.

It is important to emphasize that this indicator primarily reflects long-term cycles that typically take months or even years to reach extremes and do not reflect short-term fluctuations.

Meanwhile, cryptocoin.com As you follow, BTC miners sent 1,750 Bitcoins to Binance. This trend resulted in a significant drop in miners’ BTC reserves. According to LookOnChain’s report, meanwhile, the BTC price has lost more than 3% in about 5 hours.