Scott Minerd, global chief investment officer of Guggenheim Partners, shared his comments on Bitcoin (BTC), the largest cryptocurrency by market cap. In a recent interview with Bloomberg, he predicted that Bitcoin would continue to decline further. Here are the details…

Minerd likened the current state of Bitcoin (BTC) to the dot-com bubble

Guggenheim’s Scott Minerd talked about some of the less heartwarming comments about Bitcoin. According to Minerd, “the air will deflate even more” and, just as with the collapse of the internet bubble, we will determine who is the winner and who is the loser. “I don’t think we’ve completely cleaned the system yet,” Minerd said. From a trader’s perspective, it makes sense to take advantage of the opportunity to see higher prices in the near term, according to Minerd. But as an investor, he thinks cryptocurrencies are under pressure from a “regulatory perspective.” He also noted that there is no real corporate money to back this up.

Meanwhile, cryptocoin.com As we reported, Bitcoin experienced a sharp rally on Wednesday after the US Fed decided to go with a 75 basis point gain. The cryptocurrency had dropped as much as 14 percent until the central bank’s announcement. It then rose as high as $23,452. Speaking of the recent rally, Minerd noted that it may not be as hawkish as the Fed has shown. At the same time, he argues against the claims of Fed Chairman Jerome Powell that it’s really hard to say that the US is not in a recession. Minerd predicted that the $8,000 level could become Bitcoin’s “ultimate bottom.” However, it should be taken into account that the investor has made some incorrect price predictions in the past.

Is BTC capitulation over?

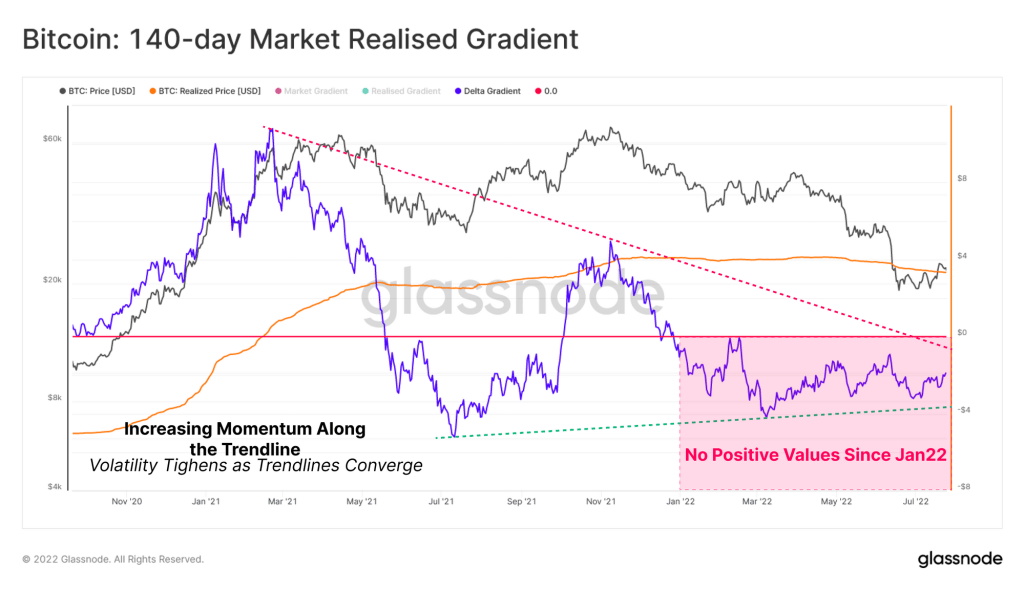

Meanwhile, major cryptocurrency data analytics platform Glassnode shared new data for BTC. In a new analysis, Glassnode examines the Market Realized Gradient Oscillator (MGRO) on 14-day, 28-day and 140-day timeframes. Recent analysis shows that Bitcoin has been in a bear market for months. The 140-day MRGO has seen consistently lower highs since March 2021. It did not register a positive value in 2022. This highlights that the macro bearish market dynamic has probably been in effect for the past 15 months.

The current extended negative value regime is an indicator of consistently negative price performance in 2022. At this stage, the bears remain in favor. The underlying trend suggests a potentially longer-term recovery is in place. It continues to rise slowly, but indicates that additional time and recovery time may be required. MGRO compares market momentum with capital inflows based on the rate of change between market price and actual price. A positive MGRO value indicates bullish momentum, and a negative MGRO value indicates bearish momentum.