Over the last 30 days, the Bitcoin price (BTC) has remained largely sideways. During this period, there were important developments such as spot Bitcoin ETFs and crypto lawsuits such as Grayscale. However, Glassnode analysis reveals that the current BTC price pattern shows inherent strength in terms of the cycle.

On-chain data gives signs of revival for Bitcoin

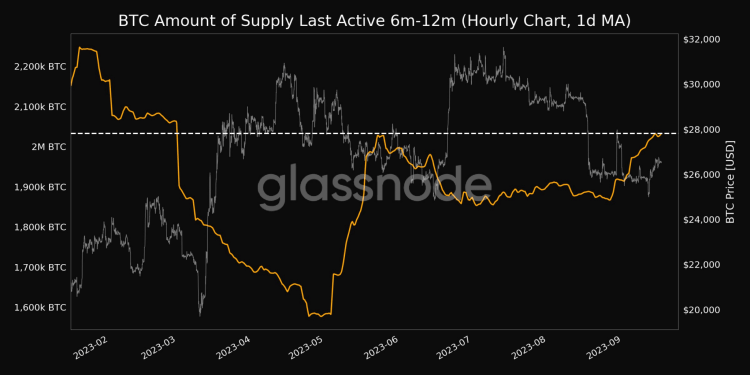

According to Glassnode, the last active supply over the last 6 months to 1 year has now reached a 6-month high relative to the 1-day moving average. Interestingly, the recent surge in active supply for Bitcoin began when Grayscale won a lawsuit against the SEC to convert the Grayscale Bitcoin Trust into a spot Bitcoin ETF.

This indicator is usually associated with an increase in active volume either in a bull market scenario or a selling environment.

Grayscale’s victory came at a time when a historic decision was made about XRP. cryptokoin.com As we reported, the SEC-Ripple case, which has been going on since late 2020, was ruled in favor of XRP. During this time, major financial institutions such as Blackrock also filed applications with the SEC seeking approval for a spot Bitcoin ETF. While investor sentiment remains positive, it is unclear whether the U.S. macroeconomic environment can sustain this momentum.

Expectations in the Bitcoin market before the FED meeting

The SEC’s Federal Open Market Committee (FOMC) meeting will take place on September 19-20, 2023. According to the CME FedWatch Tool, participants think the Fed will keep interest rates steady in the range of 525-550 basis points. The Fed’s aggressive interest rate increase measures over the last two years have caused high volatility in Bitcoin. However, from the beginning of 2023, this trend has slowed down, thanks to optimistic expectations regarding monetary policy.

Surprise Bitcoin rally prediction from Glassnode founders

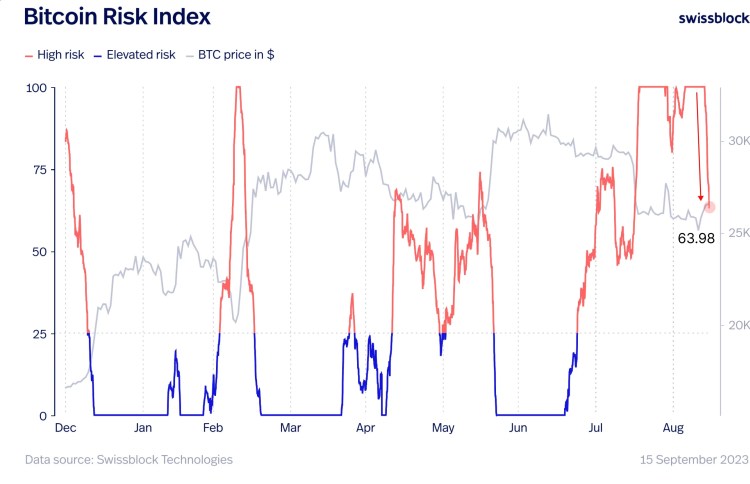

Glassnode founders Jan Happel and Yann Allemann state that Bitcoin is preparing for a big rise despite higher-than-expected inflation data coming last week. Analysts note that Bitcoin has regained the $26,000 support level. It also says that BTC’s Risk Signal has dropped significantly. Here’s what Glassnode’s founders say about Bitcoin’s current outlook:

The 0.6% increase in the US Consumer Price Index (CPI) was expected to stir the BTC price, and it did. Having reclaimed support above $26,000, BTC is now awaiting a break above $27,000, potentially breaking out of a multi-week range.

Risk Signal’s rapid decline towards the 60s indicates this change in attitude. Profit-booking pressure may appear near $27,400 and $28,200, but this climb seems poised as a step before breaking the psychological barrier of $30,000.

Is the direction up for Bitcoin?

Last week, the U.S. Bureau of Labor Statistics announced that the Consumer Price Index (CPI) increased from 0.2% to 0.6% from July to August. Glassnode founders suggest that Bitcoin is preparing for a major rise and could reach $150,000.

As a result, Bitcoin price action has shown sideways volatility despite significant improvements. However, according to Glassnode data, the market is poised to rise.