Bitcoin (BTC) bottomed out at $17,708.62 on June 18, before hitting $21,000 this week. According to Glassnode data, even investors who buy BTC at $ 69,000 preferred to sell at this level. Here is the report and details…

Long-term Bitcoin investors are finally giving up

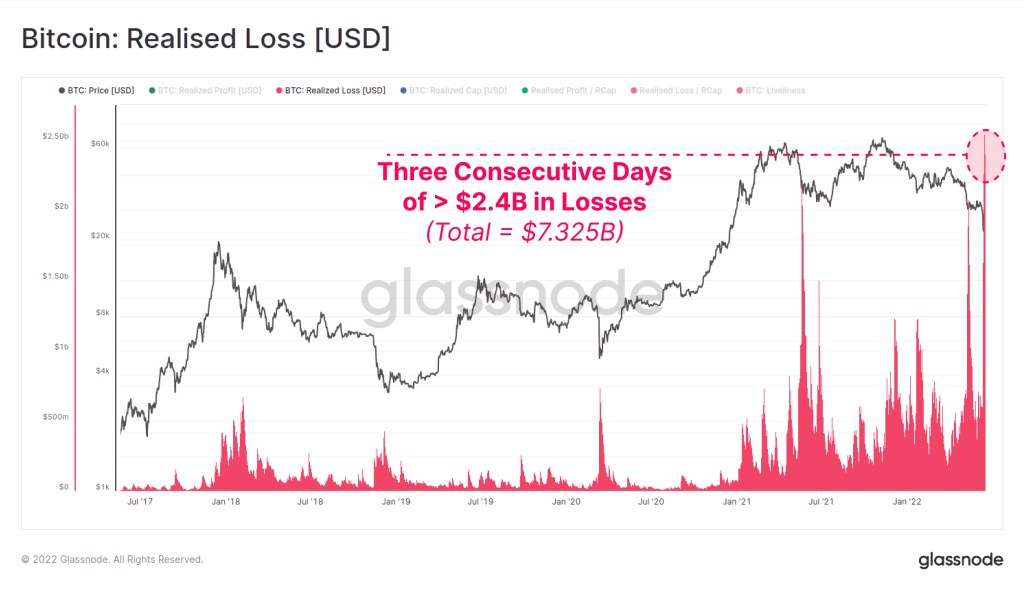

The market experienced another major bloodbath week as Bitcoin plunged below $18,000 for the first time. Major liquidations have taken place, with long-term Bitcoin investors giving up. Glassnode data shows that $2.42 billion worth of Bitcoin has been liquidated every day for the past three consecutive days. The firm noted the following in a recent tweet:

The last three consecutive days has been the largest dollar-denominated Loss in Bitcoin history. Over $7.325 billion in BTC loss has been locked in by investors spending the cryptocurrencies piling up at higher prices.

Also, in the last three days, more than 555 thousand Bitcoins have changed hands in the price range of 18,000-23,000 dollars. Interestingly, long-term investors who have been holding BTC for over a year and accumulating Bitcoin in the first half of 2021 or before are starting to panic. Meanwhile, it flooded the exchanges with 20,000 to 36,000 BTC every day.

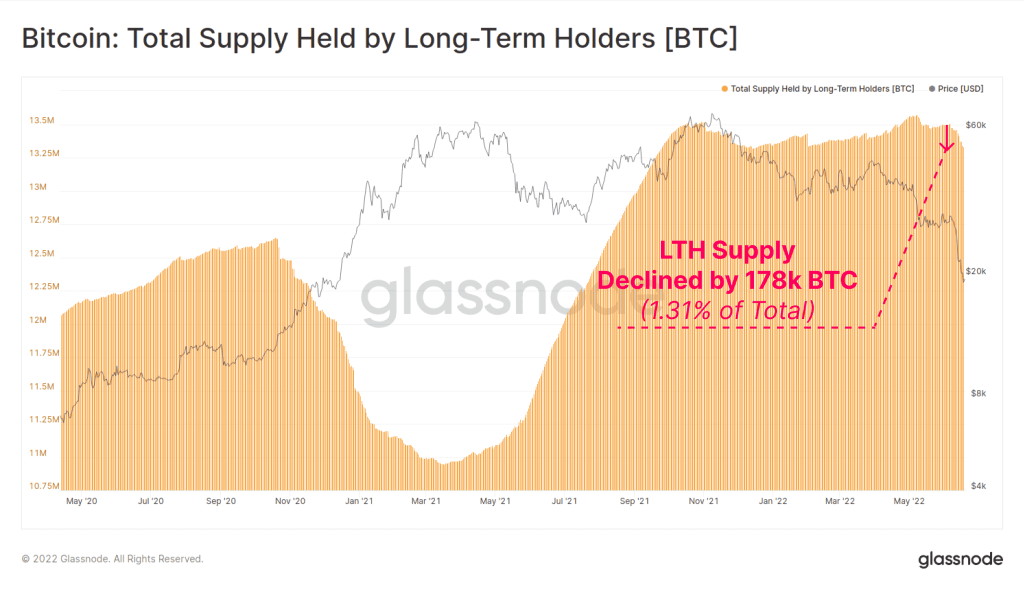

Long-term BTC traders’ balances are falling

Glassnode data shows that long-term investors have sold more than 178,000 BTC after the price dropped below $23,000. This amount represents 1.31% of the total assets of long-term investors. It also brings the total LTH (Long Term Investor Supply Shock) balance to September 2021 levels.

Glassnode also talks about the signs of massive capitulation taking place. One report writes:

When we investigate the profit and loss of long-term investors sending coins to the exchanges, we can see that a deep capitulation has taken place. He even bought several Bitcoin LTHs for $69k. He then sold it for $18,000 with a 75% loss. Total LTH is losing 0.0125% of its daily Market Cap.

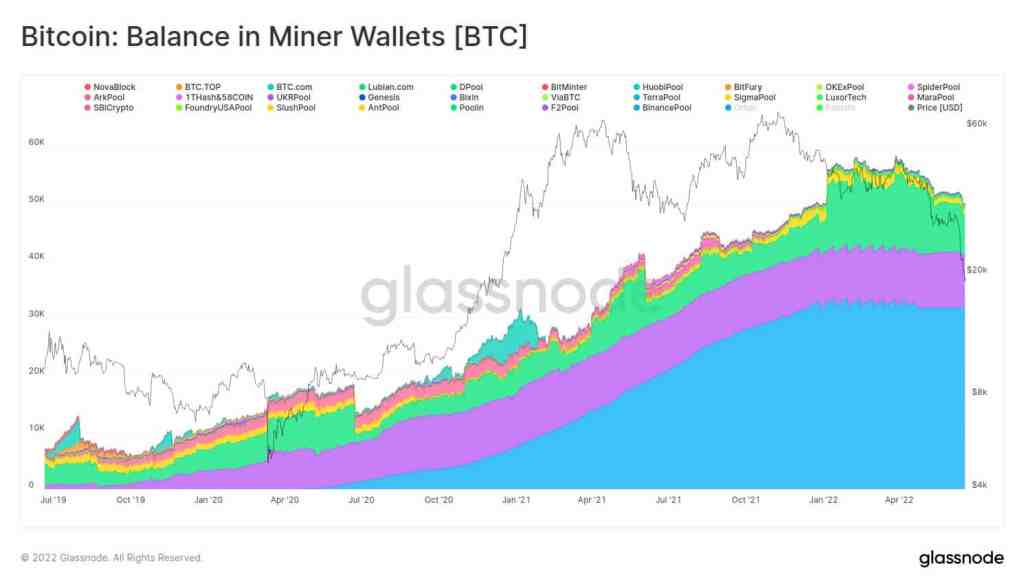

Besides that, Glassnode takes a look at how Bitcoin miners are also reacting to the drop. He adds that miners are under stress with their balances that have stagnated since the 2019-2021 accumulation period. cryptocoin.com As we reported, last week, BTC miners spent $9,000 from their treasury. They still hold over 50,000 BTC. The Bitcoin hash rate has also dropped 10% from the ATH level.

Besides long-term investors, short-term investors also saw huge losses. Glassnode explains:

Judging the damage, almost all wallets, from small whales to giant whales, are now in worse shape than in March 2020. Looking at this, we can see that they have huge unrealized losses.

Glassnode explains that only 49% of total Bitcoins were in profit as the BTC price dropped below $18,000.